. . . . . . . . . . 3 Application. Any entity that does more than 50,000 in business annually in and for the State of Oregon must complete this form. Any person doing business in the State of Oregon must complete the form. . . . . . . . . 2

2.3.1.4.4.9.11 (10-01-2014) General Information About the Filing Party. To help the Department understand the type of information needed by the filing party(s) involved, a list of some typical data elements is summarized in Table 2 below. This list is intended as a quick reference only and does not constitute a full list of information required on the form. In addition, the Table does not define certain terms or provide any definitions. These terms are defined in Sections 12.3, 13.6, 14.6, 15.1, 15.2, and 16.7, at the state or local level.

2.3.1.4.4.8.5 Table 2 Descriptions

The following table lists the most frequently required information for the Department to know if it is filing a Form 1120-IC-DISC claim:

Item Explanation File number The filing party's name; the filing party's Oregon number (if any) and the filing party's local number (if the filing party is filing on behalf of another entity other than a sole proprietorship, general partnership, or unincorporated association); The filing party's date of election to file with the Department or the date the Department may accept the filing party's filing; Taxpayer identification number of the filing party; Employer identification number of the filing party; Employer identification number of the filing party's foreign subsidiary (unless there are no foreign subsidiaries); Employment information of the filing party with date of last complete year of employment; Number of employees employed on the last complete year of employment.

IRS Instructions 1120-IC-DISC 2011 free printable template

Show details

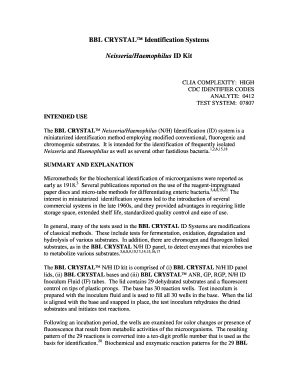

Instructions for Form 1120-IC-DISC Department of the Treasury Internal Revenue Service (Rev. December 2011) Interest Charge Domestic International Sales Corporation Return Section references are to

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign

Edit your 1120 ic disc instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1120 ic disc instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 1120 ic disc instructions online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 1120 ic disc instructions. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

IRS Instructions 1120-IC-DISC Form Versions

Version

Form Popularity

Fillable & printabley

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 1120 ic disc instructions?

The 1120 IC-DISC instructions provide guidance on how to fill out and file Form 1120 IC-DISC, which is used by a Domestic International Sales Corporation (IC-DISC) to report its income, deductions, and other relevant information to the Internal Revenue Service (IRS).

Who is required to file 1120 ic disc instructions?

Any Domestic International Sales Corporation (IC-DISC) that meets the filing requirements specified by the IRS is required to file Form 1120 IC-DISC and follow the associated instructions.

How to fill out 1120 ic disc instructions?

The instructions for Form 1120 IC-DISC explain how to complete each section of the form and provide specific guidance on reporting income, deductions, credits, and other relevant information. The instructions also outline the necessary schedules and attachments that may be required based on the IC-DISC's operations and transactions.

What is the purpose of 1120 ic disc instructions?

The purpose of the 1120 IC-DISC instructions is to assist Domestic International Sales Corporations (IC-DISCs) in accurately reporting their income, deductions, and other relevant information to the IRS. The instructions provide guidance on how to comply with tax laws and regulations related to IC-DISCs.

What information must be reported on 1120 ic disc instructions?

The information that must be reported on Form 1120 IC-DISC includes the IC-DISC's gross receipts, cost of goods sold, operating expenses, dividends paid, interest income, and other income or deductions. Additionally, the form requires the IC-DISC to provide details about qualifying transactions and shareholders.

When is the deadline to file 1120 ic disc instructions in 2023?

The deadline to file Form 1120 IC-DISC for the tax year 2023 is typically the 15th day of the 9th month after the end of the IC-DISC's tax year. However, it is recommended to consult the IRS website or official publications for the exact deadline. Filing extensions may be available under certain circumstances.

What is the penalty for the late filing of 1120 ic disc instructions?

The penalty for the late filing of Form 1120 IC-DISC is typically based on a percentage of the unpaid tax amount. The specific penalty rate may vary depending on the number of days past the deadline and the IC-DISC's prior compliance history. It is advised to review the IRS guidelines or consult a tax professional for accurate penalty information.

How do I modify my 1120 ic disc instructions in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your 1120 ic disc instructions along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I get 1120 ic disc instructions?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific 1120 ic disc instructions and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an electronic signature for signing my 1120 ic disc instructions in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your 1120 ic disc instructions right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Fill out your 1120 ic disc instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.