Get the free publication 1854 form

Show details

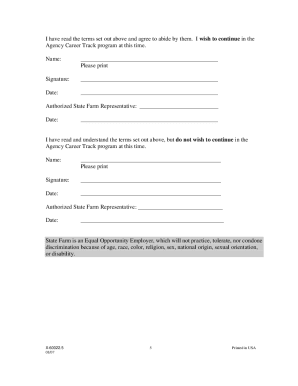

Certification Publication 1854 Rev. 1-1999 Catalog No. 21563Q For joint income tax liabilities both husband and wife should sign the statement. How to prepare a Collection Information Statement Form 433-A Complete all blocks except shaded areas. Write N/A Not Applicable in those blocks that do not apply to you. If you don t complete the form we won t be able to help determine the best method for you to pay the amount due. The areas explained below are the ones we have found to be the most...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your publication 1854 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your publication 1854 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing publication 1854 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit publication 1854. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

How to fill out publication 1854 form

To fill out publication 1854, follow these steps:

01

Begin by gathering all the necessary information and data required for the publication.

02

Make sure to review any guidelines or instructions provided for filling out the publication accurately.

03

Start with the first section and provide all the required details according to the guidelines.

04

Continue filling out each section in the order specified, ensuring that you provide accurate and relevant information.

05

Double-check all the information provided to avoid any errors or omissions.

06

Once you have completed filling out all the required sections, review the entire publication to ensure its completeness and correctness.

07

Finally, submit the filled publication according to the required submission process or guidelines.

7.1

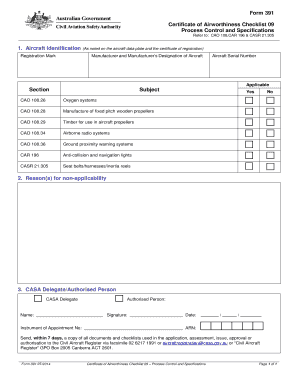

Publication 1854 is generally needed by individuals or organizations who are required to provide specific information or data in a standardized format. Some possible examples of who may need publication 1854 include:

08

Government agencies or departments that require certain information to be collected and reported.

09

Research institutions or academic organizations that need to document and publish their findings or results.

10

Companies or businesses that need to comply with certain regulations or reporting requirements.

11

Individuals applying for licenses or permits that necessitate the completion of publication 1854.

12

Non-profit organizations or foundations that are required to disclose certain information to the public or governing bodies.

Overall, anyone who is required to provide information in the specific format outlined in publication 1854 would need to fill it out.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

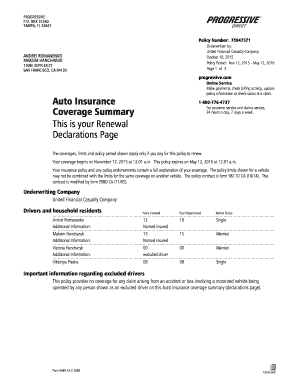

What is publication 1854?

Publication 1854 is an IRS publication that provides tax information for small businesses and self-employed individuals. It includes information on topics such as filing requirements, deductions, credits, and other tax-related matters.

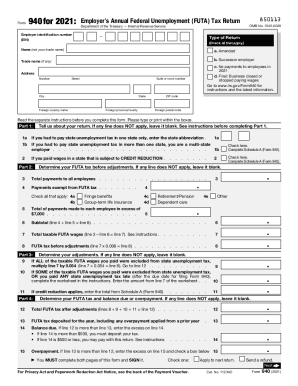

Who is required to file publication 1854?

Publication 1854 is required to be filed by employers who are subject to the Affordable Care Act's (ACA) employer shared responsibility provisions.

How to fill out publication 1854?

The Publication 1854 is an IRS form that businesses must use to report their taxable income and deductions. The form consists of several sections that must be filled out in order to properly report the company’s taxable income and deductions.

To fill out the form, start by gathering all the necessary information, such as income and expense statements, tax documents, and other financial reports. Once you have all the information, fill out the first section of the form, which includes the company’s name, address, and employer identification number.

The second section of the form requires you to enter the company’s gross income and deductions. This includes all sources of income, such as sales, services, investments, and interest income. You must also enter all applicable deductions, including business expenses, charitable contributions, and any taxes paid.

The third section requires you to enter any credits or other adjustments that apply to the company’s taxable income. This includes credits for research and development, energy efficiency improvements, and any other applicable credits.

Once you’ve completed all the sections, you can calculate the company’s total taxable income and submit the form to the IRS.

What is the purpose of publication 1854?

Publication 1854 is the Internal Revenue Service's guide to the self-employment tax. It provides information on how to calculate self-employment taxes and how to report them to the IRS. It also explains how to claim the Self-Employment Tax Deduction and how to figure the tax for household employees.

What information must be reported on publication 1854?

Publication 1854, Taxpayer Education—A Guide for 501(c)(3) Public Charities, provides information about the requirements 501(c)(3) public charities must meet to maintain their tax-exempt status. It includes information on topics such as filing requirements, allowable activities, lobbying and political activities, endowment funds, and unrelated business income tax. It also provides guidance on the reporting requirements for Form 990, Return of Organization Exempt from Income Tax, and Form 990-T, Exempt Organization Business Income Tax Return.

When is the deadline to file publication 1854 in 2023?

The deadline to file Publication 1854 for 2023 is April 15, 2024.

What is the penalty for the late filing of publication 1854?

The penalty for late filing of Publication 1854 is a $50 penalty for each month or fraction of a month that the filing is late, up to a maximum of $500.

How can I send publication 1854 to be eSigned by others?

When your publication 1854 is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an electronic signature for the publication 1854 in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your publication 1854 in minutes.

How do I edit publication 1854 straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing publication 1854, you need to install and log in to the app.

Fill out your publication 1854 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.