HI N-288B 2012 free printable template

Show details

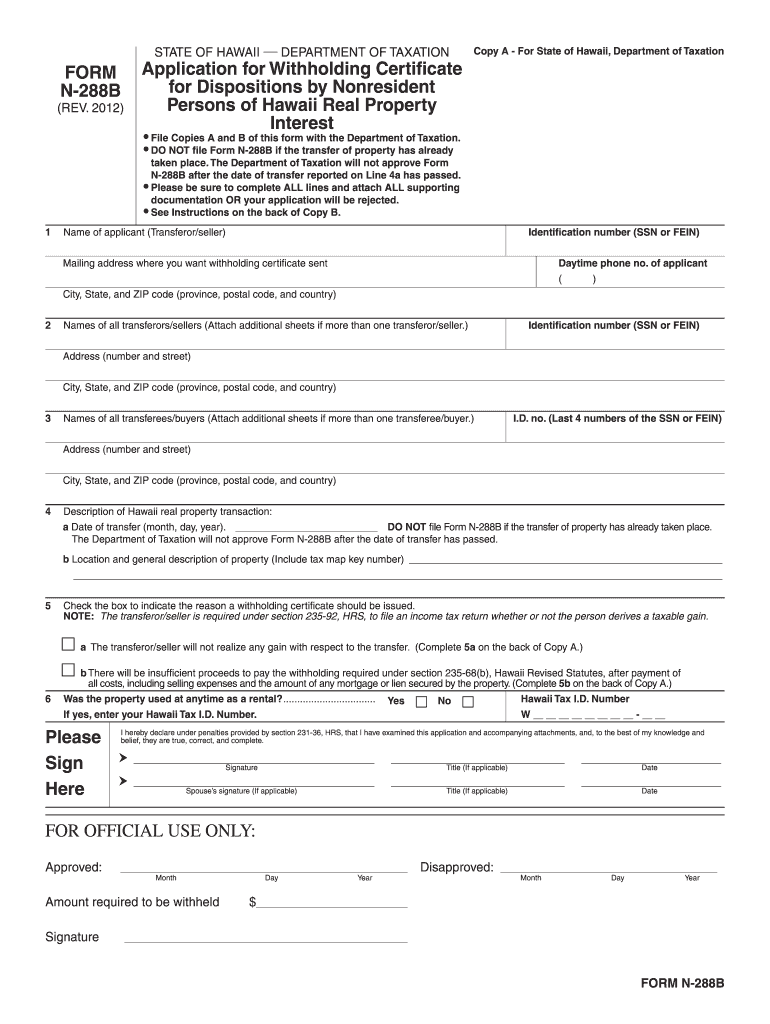

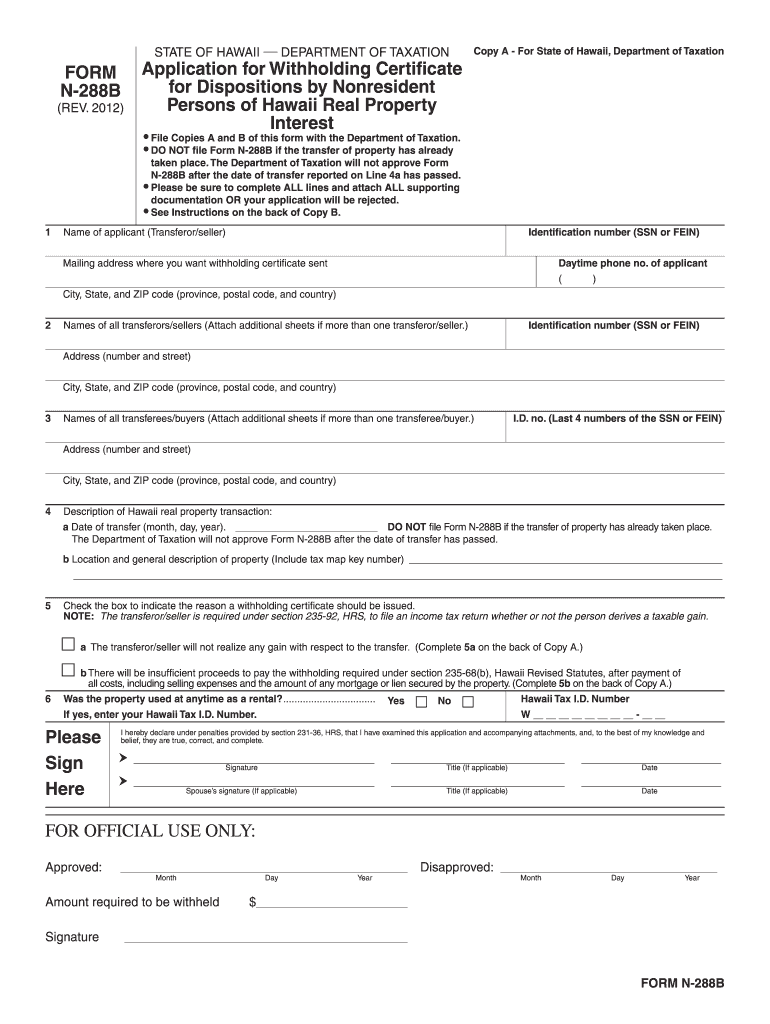

Clear Form STATE OF HAWAII DEPARTMENT OF TAXATION FORM N-288B (REV. 2012) Copy A For State of Hawaii, Department of Taxation Application for Withholding Certificate for Dispositions by Nonresident

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign HI N-288B

Edit your HI N-288B form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your HI N-288B form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing HI N-288B online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit HI N-288B. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI N-288B Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out HI N-288B

How to fill out HI N-288B

01

Obtain the HI N-288B form from the appropriate government website or office.

02

Read the instructions provided on the form carefully to understand the requirements.

03

Fill in your personal information in the designated sections, including your name, address, and contact details.

04

Provide any required supporting documentation as outlined in the instructions.

05

Review your completed form for accuracy and completeness before submission.

06

Submit the form to the designated agency, either through mail or in person, as specified in the instructions.

Who needs HI N-288B?

01

Individuals who are seeking certain benefits or services related to their residency or status.

02

People required by law to report specific information to the government.

03

Applicants for certifications or licenses that necessitate the use of the HI N-288B form.

Fill

form

: Try Risk Free

People Also Ask about

What is form N 163 in Hawaii?

Purpose of Form Use Form N-163 to figure and claim the fuel tax credit for commercial fishers under sections 235-110.6, HRS, and 18-235- 110.6, Hawaii Administrative Rules.

How do I get my Hawaii state tax form?

To request a form by mail or fax, you may call our Taxpayer Services Form Request Line at 808-587-4242 or toll-free 1-800-222-3229.

How do I avoid paying HARPTA?

File a Form N-288B (with Form N-103 included if applicable) in a timely manner prior to closing to avoid HARPTA withholding altogether if you qualify. Or, maybe you qualify for an N-289 exemption? Alternatively, you may need to file a Form N-288C to get your money back… if you don't qualify for an exemption.

What form do I use for Hawaii estimated taxes?

1040ES. Estimated Tax for Individuals. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, or alimony).

What is the withholding for non resident in Hawaii?

A 7.25% withholding obligation is generally imposed on the transferee/buyer when a Hawaii real property interest is acquired from a nonresident person.

What is Hawaii tax form N 15?

Form N-15 is filed by nonresident individuals who have Hawaii tax liability and by individuals who are Hawaii residents for only part of the tax year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find HI N-288B?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific HI N-288B and other forms. Find the template you need and change it using powerful tools.

Can I create an electronic signature for the HI N-288B in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your HI N-288B in minutes.

How do I complete HI N-288B on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your HI N-288B, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is HI N-288B?

HI N-288B is a specific form used for reporting certain types of income or information for tax purposes, particularly in the context of health insurance or related benefits.

Who is required to file HI N-288B?

Individuals or entities that are involved in health insurance transactions or are required to report specific financial information regarding health-related benefits or income typically need to file HI N-288B.

How to fill out HI N-288B?

To fill out HI N-288B, one should gather the necessary information required by the form, follow the provided instructions carefully, and ensure that all sections are completed accurately. Additional documentation may be required to support the entries made on the form.

What is the purpose of HI N-288B?

The purpose of HI N-288B is to collect and report accurate information for tax processing, compliance, and to determine eligibility for certain health benefits or insurance coverages.

What information must be reported on HI N-288B?

Information typically reported on HI N-288B may include personal identification data, income details, types of health benefits received, and any other relevant financial information as specified in the form's instructions.

Fill out your HI N-288B online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

HI N-288b is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.