Get the free simple promissory note no interest form

Show details

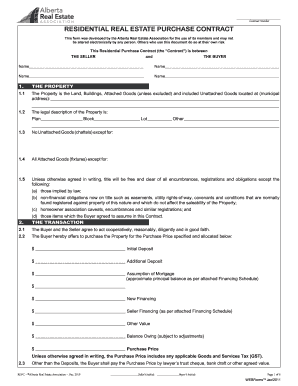

SAMPLE PROMISSORY NOTE Company letterhead with address Date Non-interest Bearing Demand Promissory Note $ name of successful bidder promises to pay to the Receiver General for dollars Canada, on demand,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your simple promissory note no form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your simple promissory note no form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit simple promissory note no interest online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit no interest letter example form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

How to fill out simple promissory note no

How to fill out a simple promissory note:

01

Start by inserting the date on the top right corner of the document. This is the date when the promissory note is created.

02

Next, enter the names and addresses of both the borrower (the person who will repay the loan) and the lender (the person who will receive the loan repayment) on the left side of the document.

03

Specify the principal amount of the loan. Write the exact amount that the borrower is borrowing from the lender.

04

Outline the terms of repayment. This includes specifying the interest rate (if applicable), the frequency of payments, and the due dates for each payment.

05

Include any additional terms or conditions that both parties agree upon. This may include late payment fees, penalties, or any other specific terms relevant to the loan.

06

The promissory note should also include signatures from both the borrower and the lender. This signifies their agreement to the terms outlined in the document.

Who needs a simple promissory note:

01

Individuals lending money to friends, family, or acquaintances who want a formal agreement in place to protect their interests.

02

Businesses or individuals providing loans to employees for employee benefits, such as educational expenses or relocation costs.

03

Financial institutions or moneylenders who want a legally binding document to ensure repayment of loans.

In summary, to fill out a simple promissory note, one must include the date, borrower and lender information, loan amount, repayment terms, additional conditions, and signatures. Simple promissory notes may be needed by individuals, businesses, or financial institutions depending on their specific needs and loan arrangements.

Fill non interest bearing note template : Try Risk Free

People Also Ask about simple promissory note no interest

What is needed to make a promissory note legal?

Is promissory note simple interest?

What is the sample wording for promissory note?

How do you make a simple promissory note?

Can you write your own promissory note?

Can a promissory note have no interest?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What information must be reported on simple promissory note no?

A simple promissory note should contain the following information:

- The names of the parties involved (the lender and the borrower)

- The amount of money being loaned

- The interest rate (if applicable)

- The date of the loan

- The due date for repayment

- Any other terms and conditions of the loan.

When is the deadline to file simple promissory note no in 2023?

The deadline to file a simple promissory note in 2023 would depend on the specific details of the promissory note. Generally, the deadline to file a promissory note is set by the terms of the note itself.

What is the penalty for the late filing of simple promissory note no?

The penalty for late filing of a simple promissory note varies depending on the state in which it was issued. Generally, the penalty for late filing can range from late fees and interest on the amount owed to full repayment of all debt. It is important to consult the laws of the state where the note was issued to determine the exact penalties for late filing.

What is simple promissory note no?

A simple promissory note is a written agreement between two parties, commonly referred to as the borrower and the lender. It states that the borrower promises to repay a specific amount of money to the lender within a given time frame, along with any applicable interest. The "promissory note number" is a unique identifier assigned to each promissory note for tracking and reference purposes.

Who is required to file simple promissory note no?

The person or entity who is providing the loan is typically required to file a simple promissory note. This could be an individual, a company, a financial institution, or any other party lending money to another person or entity. The borrower does not usually file the promissory note, as it primarily serves as a legal document outlining the terms and conditions of the loan agreement.

How to fill out simple promissory note no?

To fill out a simple promissory note, follow these steps:

1. Begin by writing the date at the top of the document.

2. Create a title for the promissory note such as "Promissory Note" or "Loan Agreement."

3. Write the full legal names of both the borrower (the person borrowing the money) and the lender (the person or entity lending the money).

4. Specify the principal amount of money being loaned. Write both the numeric amount and the amount in words to avoid any confusion.

5. State the interest rate, if any, that will be charged on the loan. If no interest is being charged, you can state that the loan is interest-free.

6. Indicate the repayment terms including the number of installments, amount of each installment, and frequency of payments (e.g., monthly, quarterly).

7. Outline any late payment fees or penalties that will be incurred if the borrower fails to make timely payments.

8. Include a provision regarding the consequences of default. Describe what actions will be taken in the event the borrower fails to repay the loan, such as pursuing legal action or taking possession of collateral.

9. Include a statement regarding the governing law, which specifies the jurisdiction that will govern the agreement in case of any legal disputes.

10. Add a section for both the borrower and lender to sign and date the promissory note. This section should also include their printed names and addresses.

11. If desired, you can include additional provisions like the collateral being used to secure the loan or any specific terms and conditions agreed upon between the borrower and lender.

Remember that a promissory note is a legally binding document, so it is recommended to consult with an attorney or legal professional to ensure all necessary elements are present and that the document complies with applicable laws in your jurisdiction.

What is the purpose of simple promissory note no?

The purpose of a simple promissory note is to document a loan agreement between two parties. It outlines the terms and conditions of the loan, including the amount borrowed, repayment schedule, interest rate (if applicable), and any other relevant details. It serves as a legal binding contract, protecting both the borrower and lender and ensuring that the loan is repaid within the agreed-upon terms.

How do I edit simple promissory note no interest online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your no interest letter example form and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit non interest bearing promissory note example in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing promissory note template alberta and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I edit sample of promissory note for loan on an iOS device?

You certainly can. You can quickly edit, distribute, and sign promissory note template ontario form on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Fill out your simple promissory note no online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non Interest Bearing Promissory Note Example is not the form you're looking for?Search for another form here.

Keywords relevant to promissory note without interest form

Related to promissory note no interest

If you believe that this page should be taken down, please follow our DMCA take down process

here

.