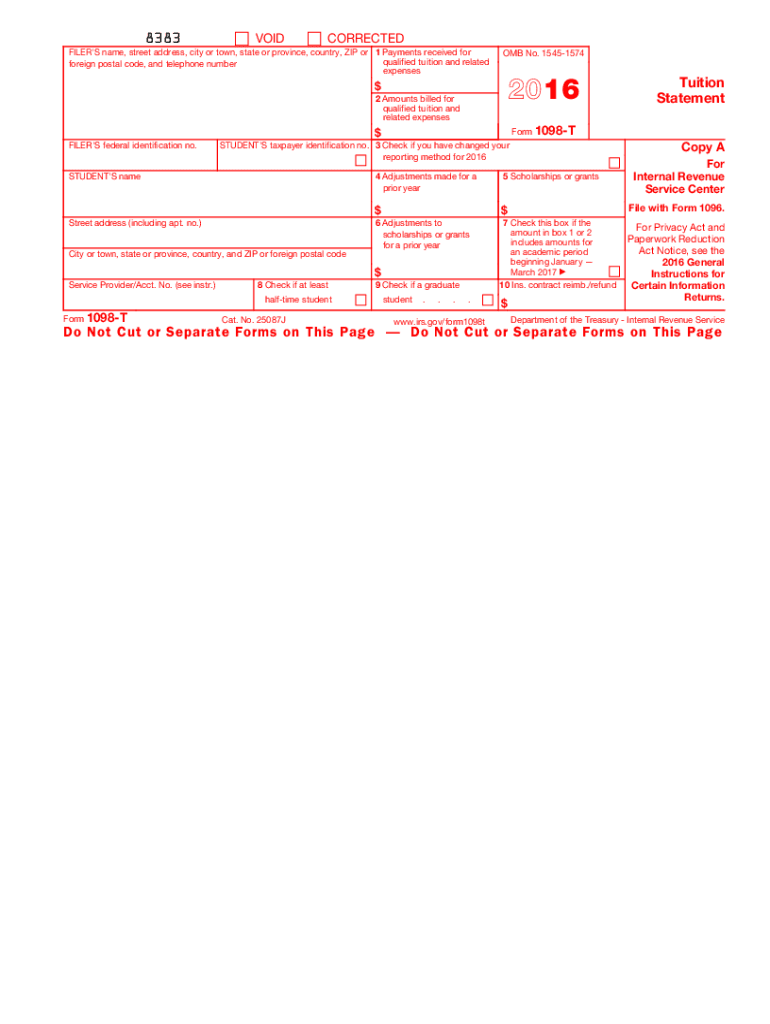

Who needs to file the 1098-T form?

This form must be filed by the eligible educational institutions for each enrolled student for whom a reportable transaction is made. Taxpayers who paid tuition and qualified related expenses should receive a copy of the Form 1098-T (Copy B) from the educational institution. Information from the Form 1098-T is reported on the student’s tax return, or the tax return of the person who paid the tuition and other qualified related expenses.

What is the purpose of the 1098-T form?

The educational institution uses this form to report tuition payments and other qualified related expenses for enrolled students to the IRS. This form allows the student or the person who paid the tuition and other qualified related expenses, to claim a deduction for those payments.

Is the Form 1098 T accompanied by other forms?

This form is attached to the IRS form 1096. If students have received a student loan, the Form 1098-T should be accompanied by the Form 1098-E, which is used to report student loan interest paid. In some cases, students may also qualify for educations credits, such as the American Opportunity Credit or the Lifetime Learning Credit. If this is the case, the Form 8863 is also completed and attached to the tax return (Form 1040).

When is the Form 1098-T due?

The Form 1098 T must be filed by the institution for each new student within 30 days after the first day of the academic period. The taxpayer has to file this form with the IRS by the 31st of January 2017 or 31st of March in case of e-filing.

What information should be provided in the Form 1098-T?

The filler has to indicate his/her name, address, federal identification number, the paid sum of money, name and address of the student, and check appropriate boxes to provide more details.

What do I do with the form after its completion?

The completed form is forwarded to the student (payer) and filed with the local IRS office as well.