US Bank Underwriting C2 2002-2024 free printable template

Show details

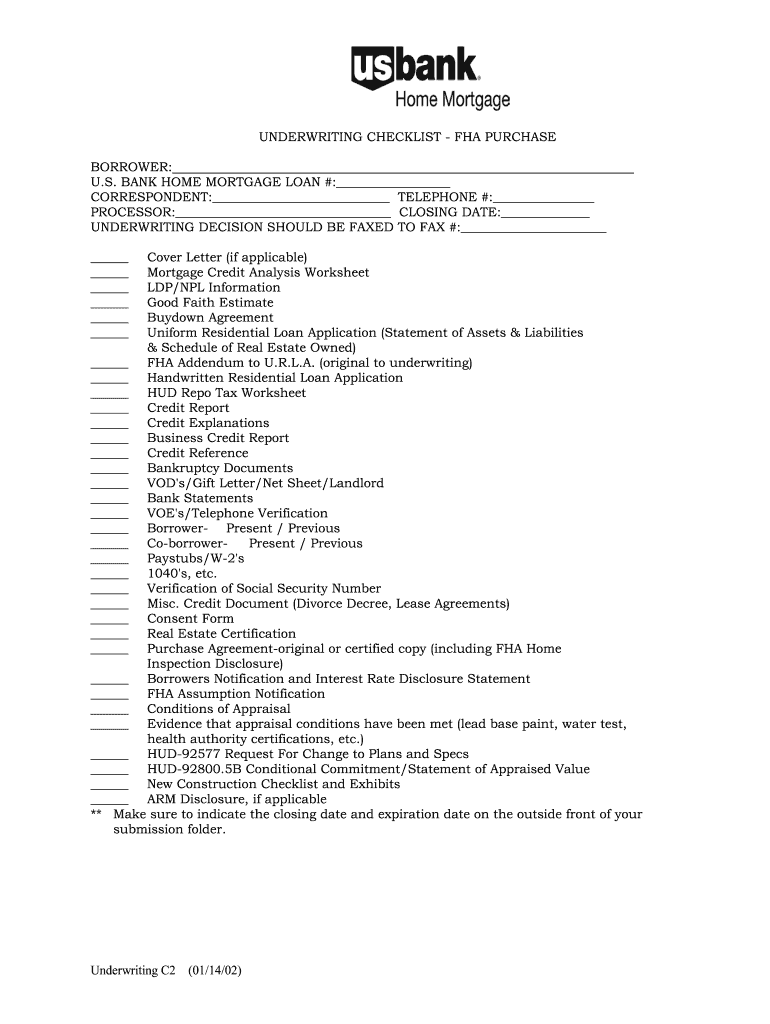

UNDERWRITING CHECKLIST - FHA PURCHASE BORROWER U.S. BANK HOME MORTGAGE LOAN CORRESPONDENT TELEPHONE PROCESSOR CLOSING DATE Cover Letter if applicable Mortgage Credit Analysis Worksheet LDP/NPL Information Good Faith Estimate Buydown Agreement Uniform Residential Loan Application Statement of Assets Liabilities Schedule of Real Estate Owned FHA Addendum to U. R.L.A. original to underwriting Handwritten Residential Loan Application HUD Repo Tax Worksheet Credit Report Business Credit Report...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your mortgage underwriting checklist template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage underwriting checklist template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage underwriting checklist template online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit underwriting checklist template form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

How to fill out mortgage underwriting checklist template

To fill out the underwriting checklist template, follow these steps:

01

Begin by reviewing the checklist thoroughly to understand its purpose and the specific requirements it includes.

02

Start collecting all the necessary documentation and information that the checklist requests. This may include financial statements, credit reports, insurance policies, and any other relevant documents related to the underwriting process.

03

Go through each item on the checklist one by one and provide the requested details or attach the corresponding documentation.

04

Double-check your entries to ensure accuracy and completeness. It is important to be meticulous in providing the required information as it will be used in the underwriting evaluation.

05

If there are any items on the checklist that you are unsure about or require clarification, reach out to the relevant parties such as underwriters, supervisors, or colleagues for guidance.

06

Once you have filled out all the necessary information, review the checklist again to ensure nothing has been missed or overlooked.

07

Finally, submit the completed checklist along with any required supporting documents to the designated recipient or department.

Anyone involved in the underwriting process, such as underwriters, insurance agents, loan officers, or risk analysts, may need to use the underwriting checklist template. It serves as a guide to ensure all the necessary information and documentation are provided, helping streamline the underwriting process and ensuring compliance with regulatory requirements.

Fill mortgage underwriting checklist pdf : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How to fill out underwriting checklist template?

1. Gather Necessary Documents: Gather all the necessary documents such as income and assets statements, tax returns, credit reports, and other verification documents.

2. Review Documents: Carefully review all the documents to confirm that the information is accurate and up to date.

3. Assess Risk: Assess the risk associated with the loan based on the information gathered.

4. Calculate Ratios: Calculate the credit and debt-to-income ratios.

5. Determine Loan Terms: Determine the loan terms such as interest rate, loan term, and points.

6. Make a Decision: Make a final decision on approving or denying the loan.

7. Communicate Decision: Communicate the decision to the borrower in writing.

What is the purpose of underwriting checklist template?

The purpose of an underwriting checklist template is to provide a standardized system for underwriters to follow when evaluating potential borrowers and their loan applications. This template outlines the main steps involved in the underwriting process, such as verifying information on the loan application, gathering documents, and performing a credit check. It also helps ensure that all loan applications are evaluated fairly and consistently.

What information must be reported on underwriting checklist template?

The information that must be reported on an underwriting checklist template typically includes:

• Loan purpose

• Loan amount

• Property appraisal

• Comparable sales

• Borrower’s credit score

• Collateral

• Title search

• Documentation of income

• Employment history

• Asset documentation

• Liability documentation

• Insurance coverage

• Property condition

• Environmental review

• Flood and hazard insurance

• Legal review

• Risk assessment

What is underwriting checklist template?

An underwriting checklist template is a document used by underwriters in the insurance or mortgage industry to ensure that all necessary information and documents are gathered and reviewed when evaluating a risk or a loan application. It serves as a guide for underwriters to systematically review specific criteria and requirements before approving or rejecting an application. The template typically includes sections containing a list of documents, information, and tasks that need to be completed during the underwriting process, helping underwriters to remain consistent and thorough in their evaluations.

Who is required to file underwriting checklist template?

The underwriting checklist template is typically used by underwriters or underwriting departments in organizations involved in the insurance, mortgage, or investment industries.

What is the penalty for the late filing of underwriting checklist template?

The penalty for the late filing of an underwriting checklist template can vary depending on the specific requirements of the organization or regulatory body. In some cases, there may be financial penalties imposed for late filing, which could include fines or fees. Additionally, late filing may result in other consequences such as the rejection or delay of the underwriting application, loss of privileges or benefits, or a negative impact on the organization's reputation. It is important to consult the specific guidelines and regulations applicable to the underwriting process to determine the exact penalties for late filing.

How can I send mortgage underwriting checklist template for eSignature?

To distribute your underwriting checklist template form, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I complete underwriting checklist online?

Easy online mortgage underwriting checklist completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I edit underwriting checklist fha on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share underwriter checklist form on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

Fill out your mortgage underwriting checklist template online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Underwriting Checklist is not the form you're looking for?Search for another form here.

Keywords relevant to mortgage checklist template form

Related to mortgage underwriting worksheet

If you believe that this page should be taken down, please follow our DMCA take down process

here

.