Get the free Permanent Account Number PAN - Income Tax Department - incometaxindia gov

Show details

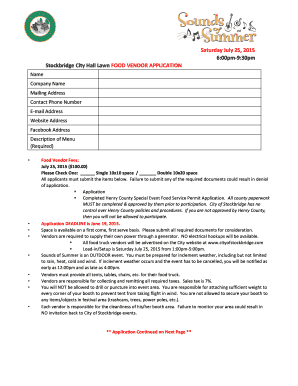

Permanent Account Number (PAN) Various aspects of PAN to be covered What is PAN? Utility of PAN Who has to obtain PAN? Transactions in which PAN is mandatory How to apply for PAN? How to correct any

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your permanent account number pan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your permanent account number pan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit permanent account number pan online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit permanent account number pan. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

How to fill out permanent account number pan

How to fill out permanent account number pan?

01

Visit the official website of the Income Tax Department of your country.

02

Look for the online application form for a Permanent Account Number (PAN) and click on it.

03

Fill in all the necessary details such as your personal information, contact details, and address.

04

Provide supporting documents such as proof of identity, proof of address, and proof of date of birth.

05

Double-check all the information provided to ensure accuracy and avoid any errors.

06

Once you have filled out the form completely, submit it online.

07

Pay the application fee, if applicable, as instructed on the website.

08

After submitting the application, you will receive an acknowledgment number which can be used to track the status of your application.

09

Wait for the verification process to be completed by the Income Tax Department.

10

Once your PAN application is processed and approved, you will receive your PAN card by mail.

Who needs permanent account number pan?

01

Individuals who earn taxable income are required to have a Permanent Account Number (PAN).

02

It is mandatory for those who wish to carry out financial transactions above a certain threshold set by the government.

03

PAN is necessary for opening a bank account, filing income tax returns, and conducting various financial transactions.

04

Any individual or entity involved in the business of buying, selling, or investing in properties must also have a PAN.

05

Persons receiving a salary above a certain amount specified by the government should also possess a PAN.

06

NRI's (Non Resident Indians) who have Indian taxable income must have a PAN.

07

It is also essential for individuals applying for loans, credit cards, or any other form of credit facility.

08

PAN is important for legal entities like companies, partnerships, trusts, etc., as it helps in identifying them for taxation purposes.

09

Even though having a PAN is not mandatory for all individuals, it is advisable to obtain one as it facilitates various financial transactions and simplifies the tax process.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

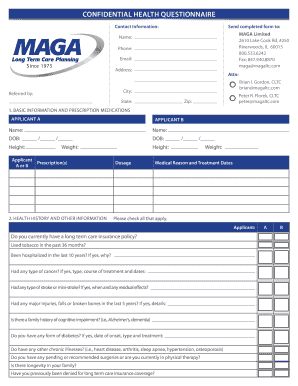

What is permanent account number pan?

Permanent Account Number (PAN) is a unique 10-digit alphanumeric code issued by the Indian Income Tax Department.

Who is required to file permanent account number pan?

Every individual or entity conducting financial transactions in India, including foreign nationals residing in India, is required to obtain a PAN.

How to fill out permanent account number pan?

To fill out a PAN application form, one needs to provide personal details, address proof, identity proof, and submit the form with the necessary documents to the relevant authorities.

What is the purpose of permanent account number pan?

PAN is primarily used as a means of identifying individuals for tax purposes, as well as for conducting various financial transactions such as opening a bank account, buying property, or investing in securities.

What information must be reported on permanent account number pan?

The PAN application form requires details such as name, date of birth, address, contact information, and supporting documents like Aadhaar card or passport.

When is the deadline to file permanent account number pan in 2023?

The deadline to file PAN for the financial year 2022-2023 is typically on or before July 31, 2023.

What is the penalty for the late filing of permanent account number pan?

There is a penalty of Rs. 10,000 for late filing of PAN, with an additional penalty of Rs. 100 per day if the delay continues.

How can I edit permanent account number pan on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing permanent account number pan.

How do I fill out permanent account number pan using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign permanent account number pan. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I edit permanent account number pan on an iOS device?

Use the pdfFiller mobile app to create, edit, and share permanent account number pan from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Fill out your permanent account number pan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.