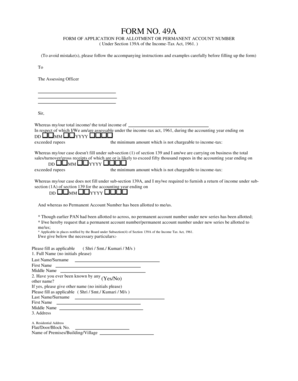

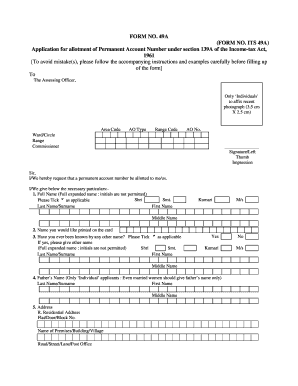

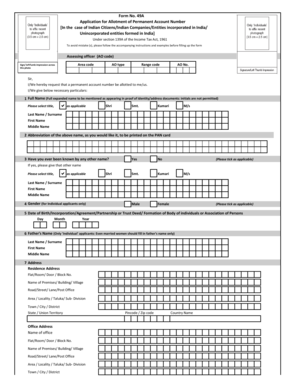

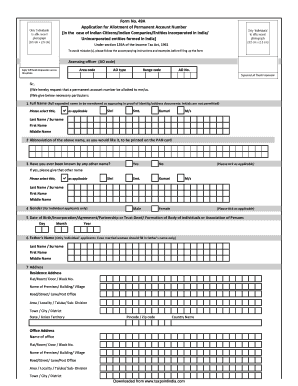

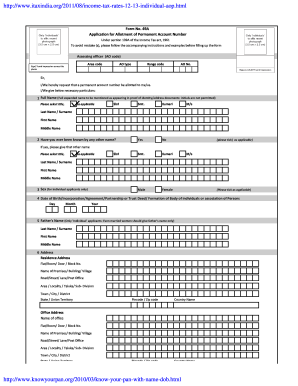

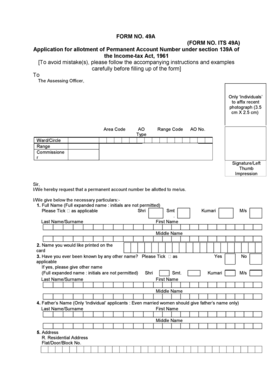

Form No. 49a

What is Form No. 49a?

Form No. 49a is a form issued by the Income Tax Department of India for the purpose of applying for a Permanent Account Number (PAN). PAN is a unique identification number that is assigned to individuals, organizations, and other entities for tracking financial transactions. Form No. 49a is used to apply for a PAN for Indian citizens, including those who are residing outside of India.

What are the types of Form No. 49a?

There are two types of Form No. 49a:

Form No. 49a for Indian citizens residing in India.

Form No. 49a for Indian citizens residing outside India.

How to complete Form No. 49a

To complete Form No. 49a, follow these steps:

01

Download Form No. 49a from the official website of the Income Tax Department of India.

02

Fill in the required personal and contact information, such as name, date of birth, address, and phone number.

03

Provide details about your identity proof and address proof documents, such as Aadhaar card, voter ID card, or passport.

04

Pay the applicable fee for processing the PAN application.

05

Submit the completed form along with the supporting documents to the designated PAN application center. Alternatively, you can also submit the form online through the income tax e-filing portal.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the form 49A?

49A. Application for Allotment of Permanent Account Number. [In the case of Indian Citizens/Indian Companies/Entities incorporated in India/ Unincorporated entities formed in India]

Can I download PAN with Aadhar?

Step 1: Visit site https://www.incometaxindiaefiling.gov.in/home. Step 2: Click on 'Instant PAN through Aadhaar' icon provided on the left-hand side under Quick Links. Step 3: Click on the 'Check Status / Download PAN' icon. Step 4: Enter Aadhaar number.

How can I download PAN application form?

Individuals can download PAN Form online from the PAN UTIITSL website. After downloading and filling all the required details in PAN, the PAN Form has to be submitted to the NSDL office with the required self-attested documents.

Where do I send my 49A for PAN card?

The aforesaid documents are required to be forwarded in original to NSDL e-Gov ('Income Tax PAN Services Unit, NSDL e-Governance Infrastructure Limited, 5th floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune - 411016'.)

How can I get PAN card online?

Online application can be made either through the portal of NSDL ( https://tin.tin.nsdl.com/pan/index.html) or portal of UTITSL (https://www.pan.utiitsl.com/PAN/).

Can we download PAN card form online?

a) This facility is available for PAN holders whose latest application was processed through NSDL e-Gov. b) For the PAN applications submitted to NSDL e-Gov where PAN is alloted or changes are confirmed by ITD within last 30 days, e-PAN card can be downloaded free of cost three times.

Related templates