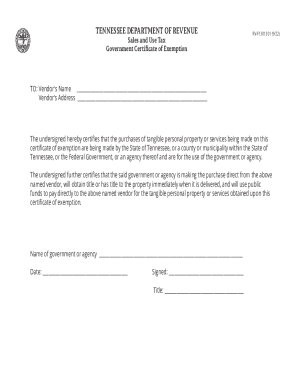

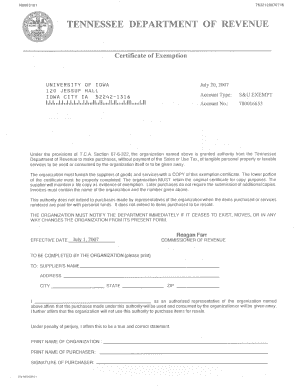

TN RV-F1301301 2008 free printable template

Get, Create, Make and Sign

Editing tennessee tax government exemption online

TN RV-F1301301 Form Versions

How to fill out tennessee tax government exemption

How to fill out tennessee tax government exemption:

Who needs tennessee tax government exemption:

Video instructions and help with filling out and completing tennessee tax government exemption

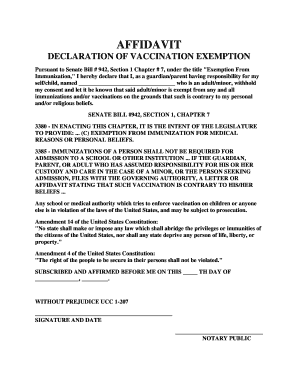

Instructions and Help about tennessee exemption certifies form

Hey guys this is a drew Darlington Merits risk management we know all sorts of insurance home auto business life I pretty much anything the ins and insurance but today what we're talking about is the workers' compensation exemption at Tennessee I'm going to share my screen here and show you a kind of walk you through this so here we go okay the is the dangers of workers compensation exemption forms in Tennessee the way it's always worked up to this point in time is you have a general contractor then you have a subcontractor and then employees or general contractor has the employees, or you have situations your general contractor and then a sub and then a sub Land rum, and it goes down for forever, or I'm even had guys that are trying to skirt the wall right now there'll be a general contractor, and then they'll call their employees subcontractors or actually have true subcontractors and the way the laws worked at this point is that if someone gets injured on a job you've got workers compensation is to protect you so in this situation employee gets injured the claim stops what the subcontractor general contractor doesn't have to worry about it consume workers comp sequin protecting, and he can move on from there the same is true on if the subcontractor doesn't have workers comp it does flow up to the general contractor general contractors workers comp kicks in, and he's then protected in this case where subcontractors involved same thing happens general contractor subcontractors employee gets injured one subcontractor doesn't have coverage it bucks stops at the subcontractor they're in a situation with all these again buck stops to the general contractor and everybody's happy again situation goes up to general contractor now workers' compensation what it basically does it prevent your employees from suing you except in situations of gross negligence so for the most part if you have someone that gets in it at work they shoot themselves with a nail gun fall off the roof whatever they're going to collect workers comp benefits, but they cannot sue you as an employer, so you're protected the worst case your experience mods going to go if you're Clinton your premiums going to go up, but your assets are safe workers comes basically on the employees going is medical bills paid, and he's going to pay for his lost wages and in death claims the state or errors are going to get a settlement because of that the employers are protected from being sued by the employee if they're into work, so it's this for that employers employees get these employers get that now your company assets are safe like I said the most that can be paid is whatever is under the workers comp law workers comp company has to pay for it, so your company assets are safe and most importantly your personal assets are safe now the game change when with the Tennessee exemption beforehand like we talked about what's happening is in these situations everyone on the job is considered basically an...

Fill tennessee use exemption : Try Risk Free

People Also Ask about tennessee tax government exemption

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your tennessee tax government exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.