Get the free tri merge credit report sample pdf form

Get, Create, Make and Sign

Editing tri merge credit report sample pdf online

How to fill out tri merge credit report

How to fill out tri merge credit report:

Who needs tri merge credit report:

Video instructions and help with filling out and completing tri merge credit report sample pdf

Instructions and Help about tri merge credit report

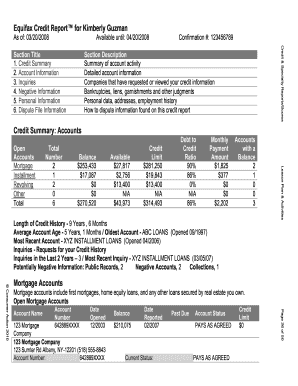

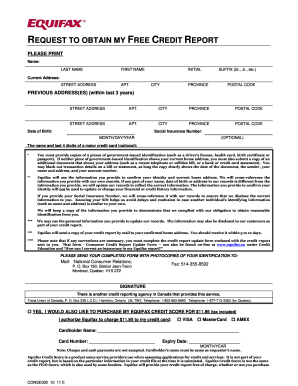

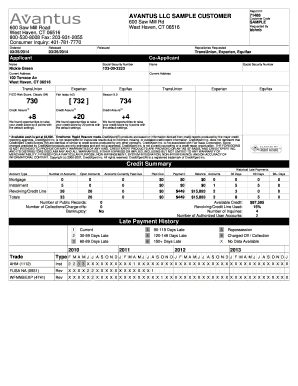

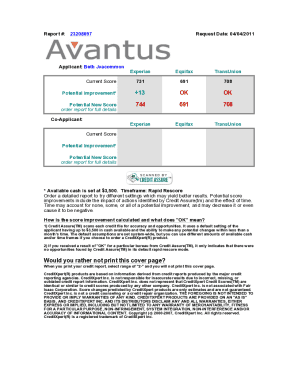

Hi everybody Marco Adam here from business credit blogger com today's blog post were going to talk about how to order a tribe merge credit report for pre-qualification now one of the things I want to talk about when it comes to ordering a tribe merge credit report first would is a tribe merge credit report a tribe merge credit report is basically a one report that contains all three information from Equifax TransUnion Experian all condense into a single report, so most tribe merge credit reports come with three different columns that lists all three bureaus all three credit scores and this allows an underwriter to do a more complete assessment an easier assessment because it's laid out on one report as opposed to going through three different separate reports now as far as for those of you looking to obtain a TRI merge credit report you require this in order to conduct a pre-qualification review for funding for you now the beauty of ordering your own credit report is because it doesn't incur a hard inquiry to your credit so most of the time if you go out there and apply for credit on your own or you or many funny companies will say let us check your credit you get a hard inquiry so anytime you apply for a loan or line of credit yourself or submit out a credit application or rental application they're going to pull your credit every time you incur a hard inquiry keep in mind there's a limit to how many Hardin ways you can occur as an individual on your credit before banks will start shying away from not wanting to issue you loans or lines of credit because you have excessive inquiries because what excessive occurs means the triggers to banks and lenders that you're out there aggressively searching for funding or for money, so that's more of a red flag for them so the beauty of pre-qualification with what we do here through business funding engine comm is we allow you to submit a try merge credit report to us so when you order a TRI merge credit report on your own it's not a hard inquiry because obtain your own credit report were not pulling your report to do a review so when you submit a tribe merge report to us this allows our underwriters to do a review on your complete report the industry that you're involved in the age of your business obviously these are other important factors that allow us to determine what funding amount you can qualify for based on our network of banks we have over 400 banks credit unions and lenders that we have relationships established for over 20 years now so this allows us to determine which banks which is only about four to five we choose for you within our network and what type of funding vehicles you qualify for this is really powerful because while you may think you only want a loan when we come back with a projection you may also qualify for a line of credit or some revolving lines of credit for the business, so this allows you to kind of know firsthand what you can get and what you qualify for and this gives...

Fill form : Try Risk Free

People Also Ask about tri merge credit report sample pdf

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your tri merge credit report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.