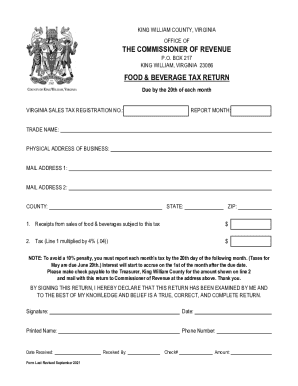

Receipts from sales of drinks subject to this tax .05 Tax (Line 1 multiplied by 4% The amount on line 4.06) 3. Sales of services subject to this tax: Amount 1,061.60 Tax (Line 1 multiplied by 4% The amount on line 4.07) 4. Other sales, not subject to tax 7.00 Note: 1.86 per dollar over 4,000.00. 5. Receipts from food service and accommodations 6,822,918.36 Tax (Line 1 multiplied by 4% The amount on line 4.08) 6. Receipts from sales of groceries other than food services and accommodations 3,731,631.30 Tax (Line 1 multiplied by 4% The amount on line 4.09) 7. Receipts from sale of fuels 8,974,243.72 Tax (Line 1 multiplied by 4% The amount on line 4.10) 8. Receipts from sales of fuel and heating oils 2,874,244.90 Tax (Line 1 multiplied by 4% The amount on line 4.11) 709. Receipts from transactions that result in purchase or sale of merchandise, and for which a value is not fixed: For merchandise sales: Tax rate and amount .00 11. Receipts from sales of gasoline, diesel, or liquefied petroleum gas 0.00 10. Receipts from gasoline, diesel, or liquefied petroleum gas and from the sale or lease of fuel or heating oil from any source : Tax rate and amount .02 4. Receipts from sales of motor vehicles : Tax rate and amount .00 3. Receipts from transactions not resulting in a purchase or sale of merchandise and not for which a value is not fixed, and for which a value is not fixed: Tax rate and amount .01 3. Receipts from the purchase of non-food products and services .01 2. Receipts from the sale of items which are not taxable at the sale price: Tax rate and amount .00 1. Receipts from sales of food for human consumption: Tax rate and amount .04 1. Receipts from sales of food for animal consumption: Tax rate and amount .04 1. Receipts from sale of food for pets: Tax rate and amount .04 1.

VA Food & Beverage Tax Return - King William County 2009 free printable template

Show details

KING WILLIAM COUNTY, VIRGINIA OFFICE OF THE COMMISSIONER OF REVENUE P.O. BOX 217 KING WILLIAM, VIRGINIA 23086 MEALS TAX RETURN Due by the 20th of the month VIRGINIA SALES TAX REGISTRATION NO.: REPORT

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your meals tax return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your meals tax return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing meals tax return online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit meals tax return. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

VA Food & Beverage Tax Return - King William County Form Versions

Version

Form Popularity

Fillable & printabley

Fill form : Try Risk Free

People Also Ask about meals tax return

What is the meals tax in King William County?

What is Prince William County 4% tax?

What is the meals tax in Manassas VA?

What is the meals tax in Virginia?

Does Prince William County have a 4% meal tax?

Does Prince William County have a food tax?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is meals tax return?

Meals tax return is a form used to report and pay taxes on meals served by establishments that are subject to a meals tax.

Who is required to file meals tax return?

Any establishment that serves meals and is subject to a meals tax is required to file meals tax return.

How to fill out meals tax return?

Meals tax return can be filled out by providing information about the establishment, total sales of meals, amount of tax collected, and any deductions or credits claimed.

What is the purpose of meals tax return?

The purpose of meals tax return is to report and pay taxes on meals served and ensure compliance with the applicable tax laws.

What information must be reported on meals tax return?

On meals tax return, information such as establishment details, total sales of meals, tax collected, and any deductions or credits must be reported.

When is the deadline to file meals tax return in 2023?

The deadline to file meals tax return in 2023 is typically determined by the tax authority in the specific jurisdiction. Please check with the relevant authority for the exact deadline.

What is the penalty for the late filing of meals tax return?

The penalty for the late filing of meals tax return may vary depending on the jurisdiction and the specific circumstances. It is recommended to consult the applicable tax laws or the tax authority for information regarding penalties.

How can I edit meals tax return from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your meals tax return into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I complete meals tax return online?

pdfFiller has made filling out and eSigning meals tax return easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I sign the meals tax return electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your meals tax return in seconds.

Fill out your meals tax return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.