Get the free 403(b) Retirement Savings Plan 402 South Kentucky Ave - bisd

Show details

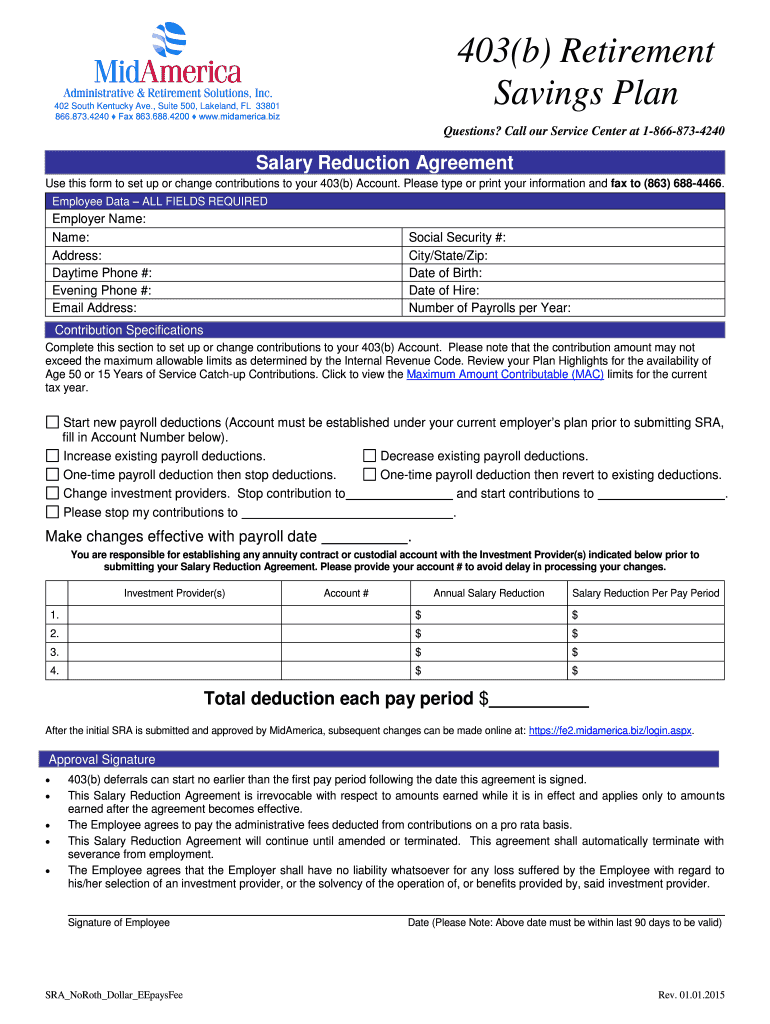

403(b) Retirement Savings Plan 402 South Kentucky Ave., Suite 500, Lakeland, FL 33801 866.873.4240 Fax 863.688.4200 www.midamerica.biz Questions? Call our Service Center at 18668734240 Salary Reduction

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 403b retirement savings plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 403b retirement savings plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 403b retirement savings plan online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 403b retirement savings plan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

How to fill out 403b retirement savings plan

How to fill out 403b retirement savings plan:

01

Begin by gathering all the necessary information and documents such as your Social Security number, employment details, and any existing retirement plans.

02

Research and select a financial institution or provider that offers a 403b retirement savings plan. Consult with experts or financial advisors to help you choose the most suitable option for your needs.

03

Contact the chosen financial institution or provider and inquire about their application process and required forms.

04

Complete the necessary application forms, providing accurate and up-to-date information. Ensure you understand the terms and conditions of the plan, including any fees, restrictions, or investment options.

05

Review all the provided investment options and consider consulting with a financial advisor to help you make informed decisions about allocating your savings.

06

Determine the contribution amount that suits your financial situation and goals. Consider factors such as your income, expenses, and any employer match programs.

07

Set up automatic contributions if available, as it ensures consistent saving and helps avoid any missed contributions.

08

Review and understand the plan's vesting schedule, which defines when you become fully entitled to all contributions made by your employer.

09

Consider designating beneficiaries for your 403b savings plan. This ensures that your retirement savings will pass on to your chosen individuals or organizations in the event of your passing.

10

Monitor your 403b retirement savings plan regularly to assess its performance, make adjustments if necessary, and stay informed about any changes or updates to the plan.

Who needs 403b retirement savings plan:

01

Eligible employees of tax-exempt organizations such as public schools, hospitals, non-profit organizations, and religious organizations may require a 403b retirement savings plan.

02

It is a suitable option for individuals looking to save for retirement while taking advantage of potential tax advantages.

03

Those who wish to supplement or diversify their retirement savings beyond other available options like Social Security or pension plans.

04

People who want to take control of their retirement future and have the flexibility to choose how their contributions are invested.

05

Individuals seeking a retirement savings plan that allows for contributions directly deducted from their salary, making saving effortless and consistent.

06

Those who want the option to borrow against their savings for certain financial needs, such as purchasing a home or covering unexpected expenses.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 403b retirement savings plan?

A 403b retirement savings plan is a tax-advantaged retirement plan available to employees of certain non-profit organizations, public schools, and government agencies.

Who is required to file 403b retirement savings plan?

Employees working for eligible organizations are required to participate in a 403b retirement savings plan if offered by their employer.

How to fill out 403b retirement savings plan?

Employees can generally enroll in a 403b retirement savings plan through their employer by completing the necessary paperwork and selecting their contribution amount and investment options.

What is the purpose of 403b retirement savings plan?

The purpose of a 403b retirement savings plan is to help employees save for retirement through tax-deferred contributions and potential employer matching contributions.

What information must be reported on 403b retirement savings plan?

Information such as employee contributions, employer contributions, investment options, and account balances must be reported on a 403b retirement savings plan.

When is the deadline to file 403b retirement savings plan in 2024?

The deadline to file a 403b retirement savings plan in 2024 is typically the same as the deadline for filing individual tax returns, which is April 15th.

What is the penalty for the late filing of 403b retirement savings plan?

The penalty for late filing of a 403b retirement savings plan can vary, but typically includes fines and interest on any unpaid taxes.

How do I complete 403b retirement savings plan online?

Filling out and eSigning 403b retirement savings plan is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit 403b retirement savings plan on an iOS device?

Create, edit, and share 403b retirement savings plan from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I edit 403b retirement savings plan on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as 403b retirement savings plan. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your 403b retirement savings plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.