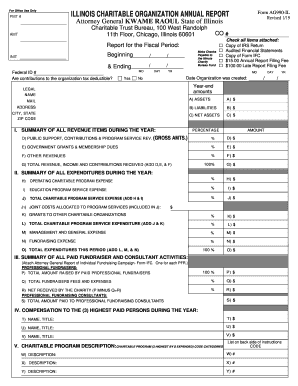

Who needs the AG990-IL form?

The AG990-IL is the Illinois Charitable Organization Annual Report form that must be filed by any charitable organization operating in the State of Illinois and registered with the Illinois Attorney General’s office.

What is the purpose of the Illinois Form AG990?

The annual report is supposed to provide comprehensive information about the contributions made to the reporting charity organization.

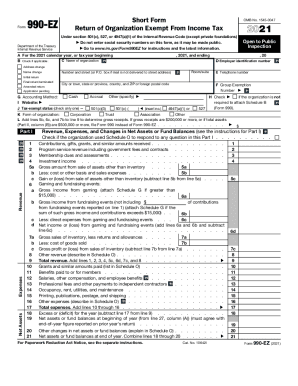

Should the Charitable Organization Annual Financial Report be accompanied by any other forms?

There is a whole package of documents that must be submitted together with the AG990-IL form:

-

The check or money order to pay the $15 filing fee;

-

The IRS 990 form (or equivalent) or explanation of the reasons why it hasn’t been filed;

-

Audited Financial Statements (are to be provided by public charities if contributions exceeded $300,000 or if the public charity raised contributions in excess of $25,000 through the services of professional fund-raiser)

-

IFC Form — a Report of Individual Fund-Raising Campaign (must be filed by the organizations that use the services of a fundraising specialist).

If the charity organization is classified as small, the filing options are simplified, they can be checked here.

When is the Illinois Charitable Organization Annual Report due?

Charity Organizations are supposed to file their form AG990-IL within six months of the organization's fiscal year-end.

How to fill out the Charitable Organization Annual Report form?

To properly complete the AG 990 form it is necessary to provide the following information on the first page of the form:

-

The reported period;

-

Details about the organization (creation date, name, address, assets, liabilities);

-

All revenue items for the year;

-

All expenditures for the year;

-

Payments and compensations for the fundraiser and consultant activities;

-

Descriptions of charitable programs.

The second page of the form is a list of yes/no questions. If the answer is “yes”, the filer must also attach an explanation for that particular issue.