Get the free Bank Acct Reconciliation Form 10-08 - bursar unl

Show details

Rev: 9/2008 Date Printed: 10/8/2008 Monthly Departmental Bank Account Reconciliation Revolving Account Smith Department 215 XX Hall Fund Balance at 1. Wells Fargo Bank, Acct #123456789 July 31, 2008,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your bank acct reconciliation form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bank acct reconciliation form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bank acct reconciliation form online

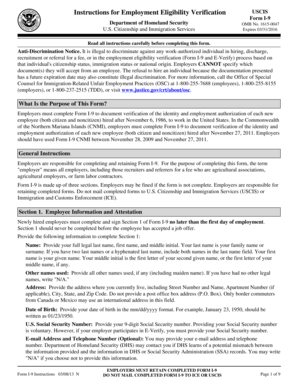

Follow the steps down below to benefit from a competent PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit bank acct reconciliation form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

How to fill out bank acct reconciliation form

How to fill out bank acct reconciliation form:

01

Gather all relevant financial documents, such as bank statements and records of transactions.

02

Start by entering the beginning balance in the corresponding section of the form.

03

Compare each transaction listed on the bank statement with your own records. Mark off any transactions that match.

04

Identify any discrepancies between your records and the bank statement. This may include missing transactions or errors in the amounts.

05

Adjust your records accordingly to match the bank statement. Make sure to keep track of any adjustments made.

06

Calculate the ending balance by adding or subtracting any outstanding deposits or withdrawals from the beginning balance.

07

Fill in the ending balance on the reconciliation form.

08

Sign and date the completed form for record-keeping purposes.

Who needs bank acct reconciliation form:

01

Businesses and organizations of all sizes, whether they are sole proprietorships, partnerships, or corporations, can benefit from using bank account reconciliation forms.

02

Individuals who have personal bank accounts and want to ensure the accuracy of their financial records may also use these forms.

03

Banks and financial institutions may require their customers to fill out reconciliation forms to verify the accuracy of their account balances.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is bank acct reconciliation form?

Bank account reconciliation form is a document used to compare the balance in a company's bank account with the balance shown in the company's own records.

Who is required to file bank acct reconciliation form?

All businesses or individuals that maintain a bank account for their financial transactions are required to file a bank account reconciliation form.

How to fill out bank acct reconciliation form?

To fill out a bank account reconciliation form, you need to gather the bank statement, compare transactions with your own records, identify any discrepancies, and make adjustments accordingly.

What is the purpose of bank acct reconciliation form?

The purpose of a bank account reconciliation form is to ensure that the company's recorded bank balance matches the bank's reported balance, and to identify any discrepancies or errors that need to be corrected.

What information must be reported on bank acct reconciliation form?

The bank account reconciliation form typically includes the company's name, bank account number, starting and ending balances, list of deposits in transit, outstanding checks, bank fees, and any adjustments made to reconcile the balances.

When is the deadline to file bank acct reconciliation form in 2023?

The deadline to file the bank account reconciliation form in 2023 may vary depending on the jurisdiction or regulations. It is recommended to consult with the relevant authorities or your financial advisor for the specific deadline.

What is the penalty for the late filing of bank acct reconciliation form?

The penalty for the late filing of the bank account reconciliation form may vary depending on the jurisdiction or regulations. It is advisable to check with the relevant authorities or your financial advisor to determine the specific penalties.

How do I make changes in bank acct reconciliation form?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your bank acct reconciliation form to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my bank acct reconciliation form in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your bank acct reconciliation form and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out the bank acct reconciliation form form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign bank acct reconciliation form and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Fill out your bank acct reconciliation form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.