Get the free allocated spending plan pdf form

Get, Create, Make and Sign

How to edit allocated spending plan pdf online

How to fill out allocated spending plan pdf

How to fill out allocated spending plan pdf:

Who needs allocated spending plan pdf:

Video instructions and help with filling out and completing allocated spending plan pdf

Instructions and Help about spending form

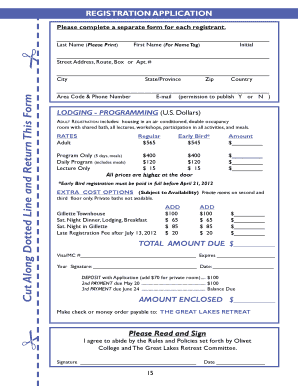

Hi guys its Tracy and this is my allocated spending plan for the month of September the first thing I'm doing is just widen out certain sections and writing in headers that actually apply to me, I'm not saying that you have to do the allocated spending plan because to me this is like two paychecks to paycheck budget I do it because its how I really got started and how I understood how to spin every check down to zero, so I got a clearer understanding of the purpose of each check that I got, and I only get two per month um, so it's a habit and I like doing it I like being able to forecast out my budgeted amount about a fifteenth of the current month so for the 15th of September I am actually budgeting for the 15th of September I will be budgeting for the month of October and that's how I do things I like to see how close I am its like a lot of gaining for me, but it helps me a lot especially when I'm nervous about paying off something do I have enough money to do that like I was for the month of September I was really nervous because I really want to pay my car off so what I'm doing here is my total income was two thousand eight eighty-four forty-eight I subtract eighty dollars and fifty-seven cents which is the Christmas and gifts from that number and that gives me twenty-eight oh three point nine one in that remaining column and I do that all the way down a sheet until I get to zero once you get to zero you stop spending you can't do anything else, so that's the clearer stop sign in the budgeting process and for some reason during this form just click with me when I went through FPU and here is my groceries in restaurants, so this is my food and my clothing sinking fund is ten dollars and then of course my laundry a lot of my household type expenses are going to be coming out on my paycheck number one and then paycheck number two is going for like utilities and stuff like that, so gas is 50, and I subtracted that 50 from 14 1966 which gave me 13 69-66 my life insurance and health insurance I get to work I know Dave Ramsey talks about getting turned outside of work just in case you lose your job or something like that I kept mine because my boys worked in they're both adults, so technically they're not dependent on my income they live with me, but they could live without me, they could go and move on their own and do things for themselves if something were to happen to me, and so I feel like that's enough insurance just to get them started, but it's not going to be something where they can say oh I'm a quit my job they're going to have to go to work you know working is good for you so and that's the way I figured, and I just left that in place because I don't have small children there, and I don't have a spouse or anything like that that's dependent on me or my income, and you know we got to get them out of house those little birdies need to fly but anyway now down to my bank fees that is a service charge that I get charged at my primary bank...

Fill allocated spending plan form : Try Risk Free

People Also Ask about allocated spending plan pdf

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your allocated spending plan pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.