Get the free PRINCIPAL-ONLY PAYMENT PLAN

Show details

PRINCIPAL-ONLY PAYMENT PLAN Instructions for Completing the RETAIL INSTALLMENT CONTRACT Exclusively for CNA National Vehicle Service Contracts (with minimum effective coverage of 24×24, 36×36 or

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your principal-only payment plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your principal-only payment plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

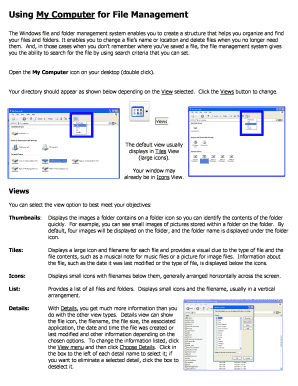

Editing principal-only payment plan online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit principal-only payment plan. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out principal-only payment plan

How to fill out principal-only payment plan:

01

Gather the necessary information: Start by collecting all relevant details about your loan, such as the loan balance, interest rate, and payment schedule. This information will help you determine how much you can allocate towards the principal only payment.

02

Review your budget: Evaluate your financial situation and determine how much money you can afford to allocate towards the principal-only payment each month. It is important to ensure that you can still meet your other financial obligations while making these additional payments.

03

Contact your lender: Reach out to your loan provider to inquire about their process for making principal-only payments. They will be able to provide you with the necessary instructions and may require you to submit a request in writing.

04

Fill out the necessary paperwork: If your lender requires any specific forms or documentation for principal-only payments, make sure to complete them accurately. Double-check all the information before submitting to avoid any errors that could delay or prevent your payment from being applied correctly.

05

Submit the payment: Once you have completed all the necessary steps, make your principal-only payment. It is important to include clear instructions that this amount is to be applied towards the principal only. Keep a record of your payment, including the date and amount, for your own records.

06

Monitor your loan balance: After making the principal-only payment, keep an eye on your loan balance to see how it decreases over time. You should see a noticeable reduction in the principal amount owed, which can help you pay off your loan faster and potentially save on interest payments.

Who needs a principal-only payment plan?

01

Individuals with high-interest loans: If you have a loan with a high-interest rate, making principal-only payments can help you reduce the total interest you would have paid over time.

02

Those looking to pay off debt faster: A principal-only payment plan can be beneficial for individuals who want to expedite their debt repayment process. By allocating additional funds towards the principal, you can shorten the loan term and become debt-free sooner.

03

Borrowers with excess cash flow: If you find yourself with surplus income each month, utilizing a principal-only payment plan can be an effective way to put that extra money towards paying down your loan. This strategy can help you make the most out of your available funds and reduce your overall debt burden.

Remember, before implementing a principal-only payment plan, it's always recommended to review the terms and conditions of your loan, consult with a financial advisor if needed, and ensure you understand the potential impact on your overall financial situation.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is principal-only payment plan?

A principal-only payment plan is a strategy that allows borrowers to make additional payments towards their loan principal in order to reduce the overall interest paid over the life of the loan.

Who is required to file principal-only payment plan?

Borrowers who wish to accelerate the pay off of their loan or reduce interest costs may choose to implement a principal-only payment plan.

How to fill out principal-only payment plan?

To fill out a principal-only payment plan, borrowers should contact their lender to discuss the additional payments they wish to make towards the loan principal.

What is the purpose of principal-only payment plan?

The purpose of a principal-only payment plan is to reduce the total interest paid over the life of the loan and to potentially pay off the loan sooner.

What information must be reported on principal-only payment plan?

The principal-only payment plan should include details of the additional payments made towards the loan principal and how they will be applied.

When is the deadline to file principal-only payment plan in 2024?

The deadline to file a principal-only payment plan in 2024 may vary depending on the terms of the loan agreement. It is recommended to check with the lender for specific deadlines.

What is the penalty for the late filing of principal-only payment plan?

The penalty for late filing of a principal-only payment plan may include additional interest charges or fees. Borrowers should check with their lender for specific penalties.

How do I edit principal-only payment plan in Chrome?

Install the pdfFiller Google Chrome Extension to edit principal-only payment plan and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I edit principal-only payment plan on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign principal-only payment plan. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I fill out principal-only payment plan on an Android device?

On an Android device, use the pdfFiller mobile app to finish your principal-only payment plan. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your principal-only payment plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.