Get the free Mortgage Loan Application Checklist - sabinefcuorg

Show details

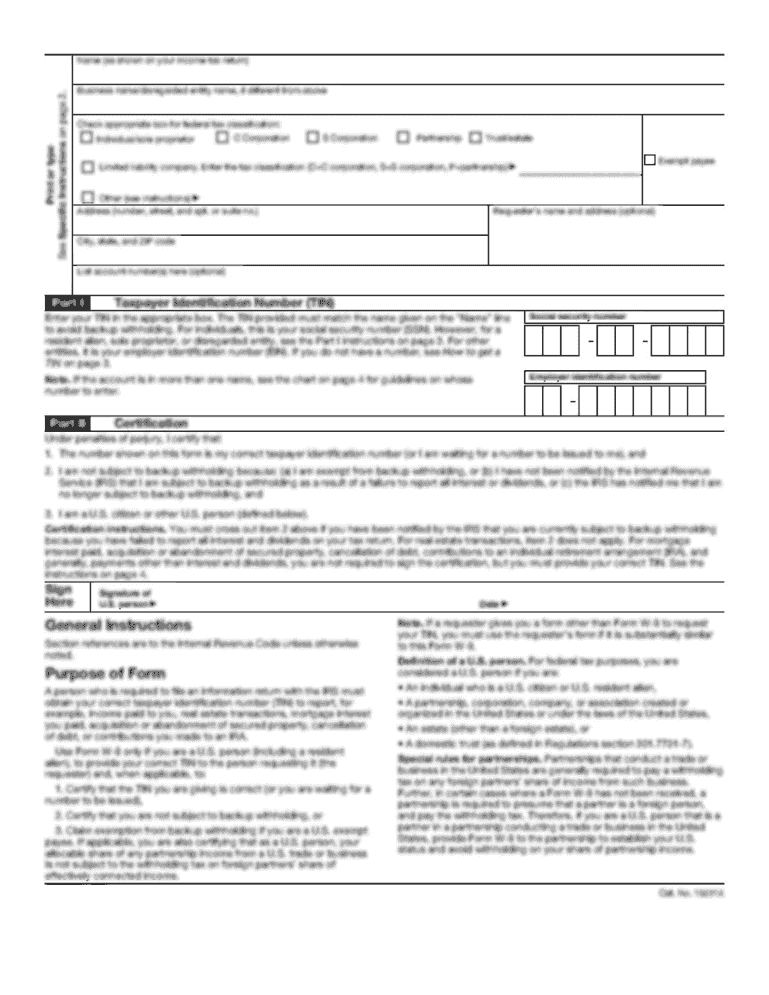

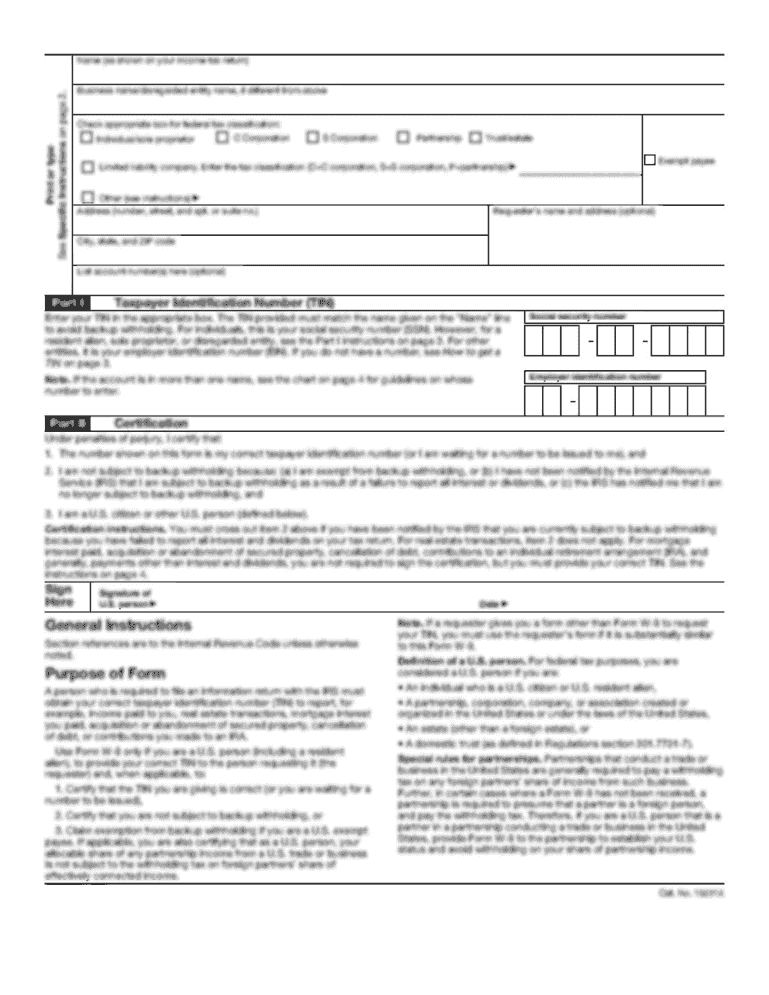

Mortgage Loan Application Checklist Earnest money sales contract, if purchase Copy of deed to the property, if refinance Social Security Numbers and date of birth for each borrower Name, address,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your mortgage loan application checklist form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage loan application checklist form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage loan application checklist online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mortgage loan application checklist. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out mortgage loan application checklist

How to fill out a mortgage loan application checklist:

01

Gather all necessary documents: This includes items such as identification documents, proof of income, bank statements, tax returns, and any other relevant financial documents.

02

Review the checklist thoroughly: Carefully go through the mortgage loan application checklist to ensure you understand all the requirements and gather the necessary documentation accordingly.

03

Complete the application form: Fill out all the required fields in the mortgage loan application form accurately and truthfully. Double-check the information before submitting.

04

Attach supporting documents: Arrange and attach all the necessary supporting documents as specified in the checklist. Make sure to organize them in a logical and orderly manner.

05

Provide explanations if needed: If there are any gaps in your employment history or other unusual circumstances, include an explanation to provide context and clarity to the lender.

06

Review and sign: Before submitting the application, thoroughly review all the information you have provided. Sign the application form as required.

07

Submit the application: Follow the instructions provided in the checklist to submit your completed mortgage loan application. This can usually be done online or in-person at the lender's office.

Who needs a mortgage loan application checklist?

01

First-time homebuyers: Those who are new to the mortgage loan application process can benefit from having a checklist to ensure they gather all the necessary documents and complete the application accurately.

02

Homeowners looking to refinance: Individuals seeking to refinance their existing mortgage should also use a mortgage loan application checklist to gather the required paperwork for their refinancing application.

03

Borrowers with complex financial situations: If you have multiple sources of income, self-employment, or other complex financial circumstances, a mortgage loan application checklist can help you stay organized and ensure you provide all the necessary documentation.

04

Anyone applying for a mortgage loan: Regardless of your level of expertise or financial situation, utilizing a mortgage loan application checklist is beneficial for all individuals applying for a mortgage loan. It helps streamline the process and ensures that nothing important is missed during the application stage.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute mortgage loan application checklist online?

pdfFiller makes it easy to finish and sign mortgage loan application checklist online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I make changes in mortgage loan application checklist?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your mortgage loan application checklist and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I make edits in mortgage loan application checklist without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing mortgage loan application checklist and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Fill out your mortgage loan application checklist online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.