Get the free Form 8283 (Rev. December 2012) - Internal Revenue Service

Show details

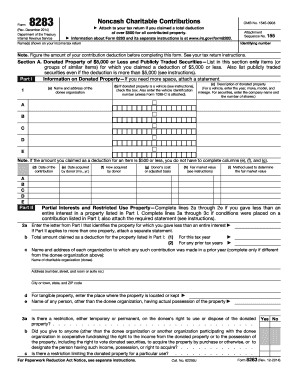

8283 Noncash Charitable Contributions Form Attaches to your tax return if you claimed a total deduction (Rev. December 2012) of over $500 for all contributed property. Department of the Treasury Information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 8283 rev december form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 8283 rev december form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 8283 rev december online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 8283 rev december. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 8283 rev december?

Form 8283 rev December is a tax form used by taxpayers to report noncash charitable contributions for the purpose of claiming deductions on their federal income tax return.

Who is required to file form 8283 rev december?

Individuals and businesses who donate property valued at $500 or more to a qualified charitable organization and want to claim a deduction for it on their tax return are required to file Form 8283 rev December.

How to fill out form 8283 rev december?

To fill out Form 8283 rev December, you need to provide your personal information, details about the donated property, its fair market value, the organization receiving the donation, and any previous or future benefits received or expected from the donation. The form also requires appraisals for certain types of property.

What is the purpose of form 8283 rev december?

The purpose of Form 8283 rev December is to provide the IRS with information about noncash charitable contributions, allowing taxpayers to claim deductions for their donations and ensuring compliance with tax laws regarding charitable deductions.

What information must be reported on form 8283 rev december?

Form 8283 rev December requires the taxpayer to report their personal information, description of donated property, names and addresses of the organizations receiving the donations, and details regarding any benefits received or expected from the donations. Appraisals may also be required for certain types of property.

When is the deadline to file form 8283 rev december in 2023?

The deadline to file Form 8283 rev December in 2023 is typically April 15th, unless that day falls on a weekend or holiday, in which case the deadline is the following business day.

What is the penalty for the late filing of form 8283 rev december?

The penalty for the late filing of Form 8283 rev December varies depending on the circumstances. Generally, the penalty is $50 for each late filed form, with a maximum penalty of $26,000 per return. However, there may be additional penalties if the late filing is deemed intentional or fraudulent.

How can I edit form 8283 rev december from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your form 8283 rev december into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I edit form 8283 rev december online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your form 8283 rev december to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an eSignature for the form 8283 rev december in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your form 8283 rev december and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Fill out your form 8283 rev december online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.