Get the free bonus form d format in excel

Show details

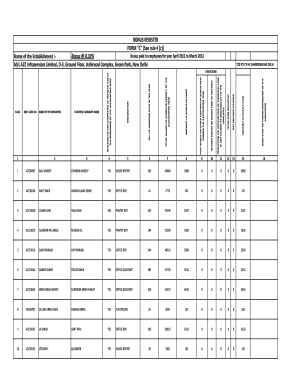

Payment of Bonus Act FORM D See rule 5 ANNUAL RETURNBONUS PAID TO EMPLOYEES FOR THE ACCOUNTING YEAR ENDING ON THE 1. Name of the establishment and its complete postal address: 2. Nature of industry:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your bonus form d format form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bonus form d format form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bonus form d format in excel online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit bonus register form d format in excel download. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

How to fill out bonus form d format

How to fill out bonus form d format:

01

Gather all necessary information, such as personal details, employment information, and payment details.

02

Carefully read the instructions provided on the form to ensure that you understand all requirements.

03

Begin by filling in your personal information, including your name, address, and social security number.

04

Provide your employment information, including the name of your employer, your job position, and the dates of your employment.

05

Next, fill out the section regarding the bonus amount. Specify the exact amount you received and the date of payment.

06

If applicable, provide any additional details or explanations required in the designated section.

07

Double-check all the information you have entered to ensure accuracy and completeness.

08

Sign and date the form at the bottom to certify that the provided information is correct to the best of your knowledge.

Who needs bonus form d format:

01

Employees who have received a bonus payment from their employer.

02

Employers who are required to report bonus payments to the relevant authorities.

03

Individuals who need to keep a record of their bonus payments for tax or accounting purposes.

Fill bonus form d format in excel : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is bonus form d format?

Bonus form D is a form that must be filed with the United States Securities and Exchange Commission (SEC) by companies that are raising capital through the sale of securities. The Form D discloses information about the company and its offering, including the amount of securities offered and the price of such securities. Additionally, the Form D requires that the company provide contact information for its broker-dealer or other placement agent, as well as information about any bad actor disclosures.

How to fill out bonus form d format?

The specifics of how to fill out Bonus Form D will depend on the company or organization from which you are receiving the bonus. Generally, a Bonus Form D will ask for basic information such as your name, address, Social Security number, and the amount of the bonus. It may also ask for the purpose of the bonus, the date it was paid, and the terms and conditions of the bonus. Some forms may also require you to sign and date the form in order to confirm your agreement with the terms and conditions of the bonus.

What information must be reported on bonus form d format?

Form D is an Internal Revenue Service (IRS) form used to report bonus payments made to employees. The information that must be reported on Form D includes the employer’s name and address, the employee’s name and Social Security number, the date of payment, the amount of the bonus, and the taxable income that is attributable to the bonus.

When is the deadline to file bonus form d format in 2023?

The deadline to file bonus form d format in 2023 is usually the 15th of April, so the deadline for 2023 would be April 15th, 2023.

What is the penalty for the late filing of bonus form d format?

The penalty for the late filing of bonus form D format is a fine of up to Rs. 10,000.

Who is required to file bonus form d format?

The question is not clear. Could you please provide more information or rephrase the question?

What is the purpose of bonus form d format?

Bonus Form D is a format or template used by companies or organizations to report employee bonuses to the Internal Revenue Service (IRS) in the United States. The purpose of this format is to provide accurate information about the bonuses paid to employees, including the amount, the recipient's identification information, and any applicable taxes withheld.

By using Bonus Form D, companies can fulfill their tax reporting obligations and ensure that both employees and the IRS are properly informed about the bonus payments made during the tax year. This format helps maintain transparency and accountability in the taxation of bonuses and facilitates the calculation of the employees' overall tax liabilities accurately.

Where do I find bonus form d format in excel?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the bonus register form d format in excel download in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an electronic signature for the bonus form d format in excel in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your bonus form a b c d in excel.

How do I fill out bonus form d format in excel on an Android device?

On an Android device, use the pdfFiller mobile app to finish your form d bonus act excel format. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your bonus form d format online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bonus Form D Format In Excel is not the form you're looking for?Search for another form here.

Keywords relevant to form d bonus act in excel format

Related to bonus form d pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.