Get the free Donation bReceiptb Form - Puget Sound bCivilb War Roundtable - pscwrt

Show details

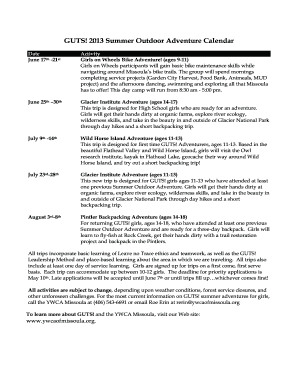

PUGET SOUND CIVIL WAR ROUND TABLE A Washington State Non Profit Corporation www.pscwrt.org DONATION RECEIPT: Donation Received From: Address: Items Received: Value: $ By: Title: Date: The Officers

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your donation breceiptb form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your donation breceiptb form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing donation breceiptb form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit donation breceiptb form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out donation breceiptb form

How to fill out a donation receipt form:

01

Start by obtaining a blank donation receipt form. You may be able to find a template online or get one from your charitable organization. It's important to use a standardized form to ensure accuracy and compliance with tax regulations.

02

Fill in your organization's name and contact information at the top of the form. This includes the name of your charitable organization, address, phone number, and any other relevant contact details.

03

Include the donor's information. Write down the donor's full name, address, and contact information. This is crucial for record-keeping purposes and to properly acknowledge the donation.

04

Specify the donation details. Indicate the date of the donation, the amount or items donated, and any restrictions or special instructions related to the donation. This ensures clarity and transparency about the nature and value of the contribution.

05

Describe the type of donation. Specify whether it is a monetary donation, in-kind donation (goods or services), or a combination of both. If it is a non-cash donation, provide a detailed description of the items donated.

06

Determine the fair market value of the donation. If applicable, calculate the fair market value of any non-cash donations. This is particularly important for non-profit organizations as it helps in providing accurate tax information to the donor.

07

Include a statement of acknowledgement and a tax-deductible statement. Add a statement that acknowledges the donation and expresses gratitude to the donor for their support. Also, include a statement indicating whether the donation is tax-deductible or not. Consult with your organization's tax advisor or accountant to ensure accuracy.

08

Provide a receipt number and keep a copy for your records. Assign a unique receipt number to each donation receipt form for easy tracking and record-keeping. Make sure to keep a copy of the receipt for your organization's files and provide a copy to the donor for their records.

09

Review and double-check the completed form. Before finalizing the donation receipt form, review all the information filled in to ensure accuracy and compliance. Any mistakes or omissions could lead to complications later on.

10

Distribute the completed donation receipt form. Give a copy of the completed form to the donor as proof of their contribution. Keep another copy for your organization's records, and if necessary, submit a copy to your accounting or finance department for further processing.

Who needs a donation receipt form?

01

Charitable organizations: Donation receipt forms are essential for charitable organizations as they serve as a record of the donations received, help with tax filings, and provide proper acknowledgement to donors.

02

Donors: Individuals or businesses that make donations to non-profit organizations or other eligible entities may need donation receipt forms for tax purposes. These forms can be used as supporting documentation for claiming deductions on their tax returns.

03

Accountants and tax advisors: Accounting professionals and tax advisors often rely on donation receipt forms when preparing tax returns for their clients. These forms provide evidence of charitable contributions and assist in ensuring accurate reporting of deductions.

Overall, both charitable organizations and donors benefit from the use of donation receipt forms as they help maintain accurate records, acknowledge donor contributions, and facilitate tax compliance.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my donation breceiptb form directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign donation breceiptb form and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I get donation breceiptb form?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific donation breceiptb form and other forms. Find the template you want and tweak it with powerful editing tools.

How can I edit donation breceiptb form on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing donation breceiptb form, you can start right away.

Fill out your donation breceiptb form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.