IRS 2555-EZ 2000 free printable template

Show details

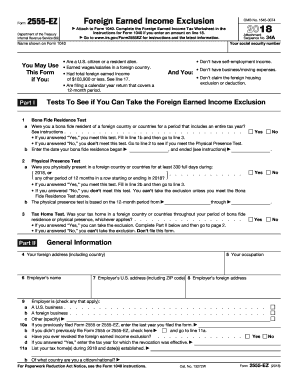

Form 2555EZ OMB No. 15451326 Foreign Earned Income Exclusion Department of the Treasury Internal Revenue Service See separate instructions. Attach to Form 1040. Name shown on Form 1040 You May Use

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign

Edit your 2000 form 2555-ez foreign form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2000 form 2555-ez foreign form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2000 form 2555-ez foreign online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2000 form 2555-ez foreign. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

IRS 2555-EZ Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 2000 form 2555-ez foreign

How to fill out 2000 form 2555-ez foreign:

01

Gather the necessary information: Before filling out the form, make sure to have all the required information readily available. This includes details about your foreign earned income, foreign housing expenses, and any other relevant financial information.

02

Begin with personal information: Start by entering your name, address, and Social Security number in the designated fields on the form. Ensure that the information provided is accurate and up-to-date.

03

Enter the tax year: Indicate the tax year for which you are filing the form 2555-ez foreign. Typically, this should be the same tax year in which you earned the foreign income.

04

Report the foreign earned income: In the appropriate sections, include the details of your foreign earned income. This may include wages, salaries, self-employment income, or any other form of foreign income you earned during the tax year.

05

Calculate the deductions: Determine your foreign housing deduction amount, if applicable. This deduction helps offset your foreign housing expenses, such as rent, utilities, and property insurance. Calculate the deduction accurately to reduce your taxable income accordingly.

06

Complete the tax computation: Fill out the tax computation fields on the form, ensuring that all calculations are accurate. This section helps determine the amount of foreign earned income exclusion you qualify for, based on your filing status and taxable income.

07

Sign and date the form: Once you have completed all the required sections of form 2555-ez foreign, sign and date the form in the designated areas. Remember, providing a signature indicates the accuracy and truthfulness of the information provided.

Who needs 2000 form 2555-ez foreign?

01

U.S. citizens or resident aliens living and working abroad: If you are a U.S. citizen or resident alien and you meet certain eligibility criteria, such as passing the bona fide residence test or the physical presence test, you may need to file form 2555-ez foreign to claim the foreign earned income exclusion.

02

Individuals earning income abroad: If you earned income from foreign sources during the tax year, you may need to complete form 2555-ez foreign. This form is designed to report and claim exclusions on foreign earned income, allowing you to potentially reduce your taxable income.

03

Those seeking to minimize tax liability: Filing form 2555-ez foreign can help individuals who qualify for the foreign earned income exclusion reduce their overall tax liability. By correctly reporting and excluding foreign income, eligible taxpayers can lower their taxable income and potentially owe less in taxes.

Note: It is always recommended to consult a tax professional or the IRS for specific guidance regarding your individual tax situation and filing requirements. The information provided here serves as a general guide and may not cover all scenarios or details specific to your situation.

Fill form : Try Risk Free

People Also Ask about 2000 form 2555-ez foreign

Who can file form 2555 EZ?

What is the IRS foreign earned income exclusion?

What is the difference between form 2555 and 2555 EZ?

Should I take the foreign earned income exclusion?

How does the foreign earned income exclusion work?

How much foreign income is tax exempt?

Who qualifies for foreign earned income exclusion?

What is the foreign earned income exclusion for 2022?

Can form 2555 be filed electronically?

What are forms 2555 and 2555-EZ used for?

Does form 2555-EZ still exist?

Is there a 2555 EZ for 2020?

What is form 2555 EZ?

Who can file form 2555-EZ?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 2000 form 2555-ez foreign in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing 2000 form 2555-ez foreign and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I sign the 2000 form 2555-ez foreign electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your 2000 form 2555-ez foreign in minutes.

How do I complete 2000 form 2555-ez foreign on an Android device?

On Android, use the pdfFiller mobile app to finish your 2000 form 2555-ez foreign. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your 2000 form 2555-ez foreign online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.