Get the free form 668 w

Show details

?IRS Form 668-W?? Part 1 Form 668-W(ICS) (Jan. 2003) Department of the Treasury ? Internal Revenue Service Notice of Levy on Wages, Salary, and Other Income DATE: TELEPHONE NUMBER REPLY TO: OF IRS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 668 w form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 668 w form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 668 w online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 668 w part 3. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

How to fill out form 668 w

How to fill out form 668 w:

01

Gather all necessary information such as your personal details, income information, and any previous tax obligations.

02

Read the instructions carefully provided in the form 668 w to ensure you understand all the requirements.

03

Begin filling out the form by providing your full name, social security number, and contact information in the designated fields.

04

Proceed to the next sections of the form where you will be required to provide your income details, including any wages, dividends, or rental income.

05

If you have any existing tax liabilities, indicate the details in the appropriate section of the form.

06

Review the completed form to ensure all information is accurate and legible.

07

Sign and date the form before submitting it.

Who needs form 668 w:

01

Individuals who have been notified by the Internal Revenue Service (IRS) of an outstanding tax debt.

02

Individuals who have not paid their federal taxes and are facing potential enforced collection actions.

03

Taxpayers who want to request a hearing to dispute or negotiate the payment of their tax debt with the IRS.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

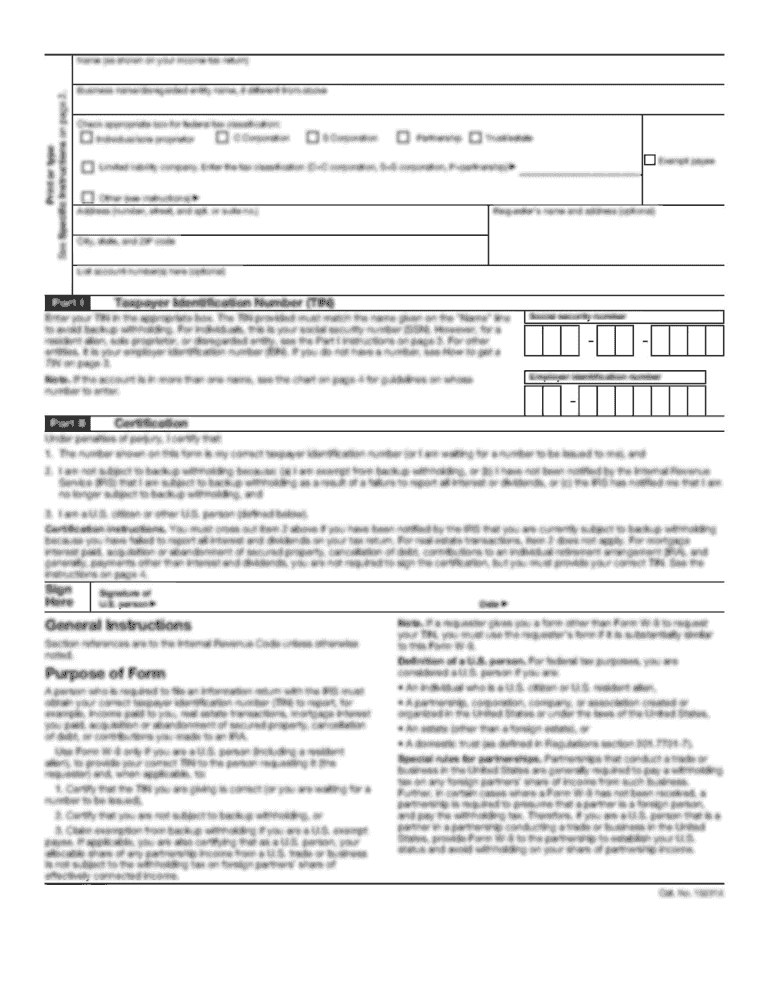

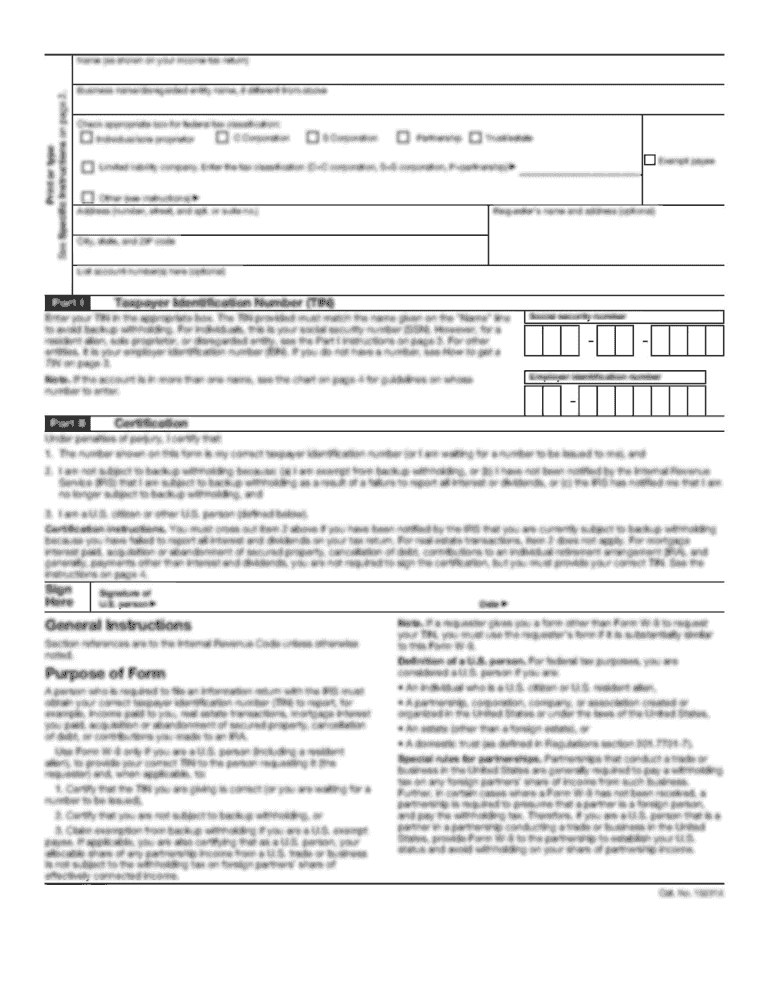

What is form 668 w?

Form 668-W is a document used by the Internal Revenue Service (IRS) in the United States to levy on certain assets when a taxpayer has unpaid taxes. A levy is a legal process where the IRS seizes a taxpayer's property or rights to property to satisfy the tax debt. Form 668-W provides information about the taxpayer, the amount owed, and the property being levied upon. It is typically sent to banks, employers, or other third parties that owe money to the taxpayer.

Who is required to file form 668 w?

Form 668-W is filed by the Internal Revenue Service (IRS) to notify a taxpayer's employer or other third party that they are required to withhold a specific amount from the taxpayer's wages to satisfy unpaid tax liabilities. Therefore, it is the employer or the third party who is required to file Form 668-W.

How to fill out form 668 w?

Form 668-W is a form used by the Internal Revenue Service (IRS) to notify the taxpayer's employer of a wage levy. To fill out this form, follow these steps:

1. Obtain a copy of Form 668-W from the IRS website or from your local IRS office.

2. Enter the contact information of the taxpayer at the top of the form. This includes the taxpayer's name, address, and social security number.

3. Complete the section titled "Return Completed Levy to" with the name and contact information of the IRS employee or department designated to receive the completed form.

4. In the "Employee Information" section, provide the name and contact information of the taxpayer's employer, including the name of the company, address, and phone number.

5. Specify the effective date of the wage levy in the "Effective Date" box. This is the date from which the employer should start withholding wages from the taxpayer's paycheck.

6. Indicate the total amount to be withheld from the employee's wages each pay period in the "Amount to Withhold Each Pay Period" box. This should be the amount specified by the IRS.

7. Check the appropriate box that represents the type of levy being imposed. This could be a continuous wage levy or a noncontinuous wage levy, as determined by the IRS.

8. Sign and date the form, certifying that the information provided is accurate and complete.

9. Provide a copy of the form to the employer and retain a copy for your records.

It is worth noting that Form 668-W is typically completed by the IRS, rather than the taxpayer. If you have received this form from the IRS, it is advisable to consult with a tax professional or contact the IRS directly to ensure correct completion.

What is the purpose of form 668 w?

Form 668-W is a federal tax levy notice used by the Internal Revenue Service (IRS) to inform a taxpayer that a levy has been issued against their assets or income. The purpose of Form 668-W is to notify the taxpayer that certain property or rights to property have been seized and to provide information on the taxpayer's right to appeal or release the levy. The form also serves as a notice to third parties, such as banks or employers, that they are required to comply with the levy by withholding and remitting funds to the IRS.

What information must be reported on form 668 w?

Form 668-W is used by the Internal Revenue Service (IRS) to inform a taxpayer that their assets have been seized to satisfy a tax debt. The information that must be reported on Form 668-W includes:

1. Taxpayer information: This includes the name, address, and Social Security number or Employer Identification Number (EIN) of the individual or business that owes the tax debt.

2. Tax debt details: The amount of tax debt owed, the tax year(s) the debt relates to, and any penalties and interest that have been added to the debt.

3. Seized property information: The form must include a description of the property or assets that have been seized to satisfy the tax debt. This can include real estate, vehicles, bank accounts, wages, or other valuable assets like jewelry or investments.

4. Due process rights: The form should outline the taxpayer's due process rights and provide information on how to appeal or challenge the seizure.

5. Contact information: The name, address, and phone number of the IRS office or representative handling the seizure should be provided on the form.

It is important to note that Form 668-W is typically sent to the taxpayer after the assets have been seized, as a notification of the seizure. The form is not used to report information to the IRS, but rather to inform the taxpayer about the actions taken by the IRS.

When is the deadline to file form 668 w in 2023?

The deadline to file Form 668-W in 2023 will depend on the specific circumstances and the type of tax debt it relates to. Form 668-W is typically used by the Internal Revenue Service (IRS) to notify a taxpayer's employer of a wage garnishment. If you are referring to the deadline for the employer to comply with the wage garnishment, it is usually 30 days from the date of receipt of the notice. However, it is always advisable to consult with the IRS or a tax professional to get accurate and up-to-date information regarding your specific situation.

What is the penalty for the late filing of form 668 w?

The penalty for the late filing of Form 668-W is typically a monetary penalty. The exact amount may vary depending on the specific circumstances and the time period of the delay. The penalty is usually calculated based on a percentage of the tax liability of the delinquent taxpayer. It is important to note that the penalty can accumulate for each month or part of a month the form remains unfiled, with a maximum penalty limit. It is recommended to consult with a tax professional or refer to the official guidelines from the Internal Revenue Service (IRS) to get accurate and up-to-date information on penalties.

How do I make changes in form 668 w?

The editing procedure is simple with pdfFiller. Open your form 668 w part 3 in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an electronic signature for the form 668 w pdf in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your form 668 w in seconds.

Can I edit form 668 w part 3 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign form 668 w pdf. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Fill out your form 668 w online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 668 W Pdf is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.