Sample CPA Letter free printable template

Show details

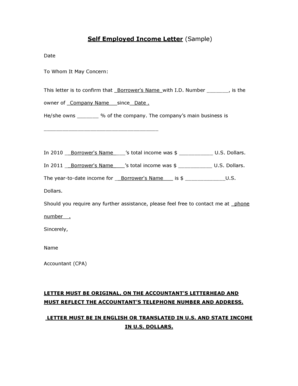

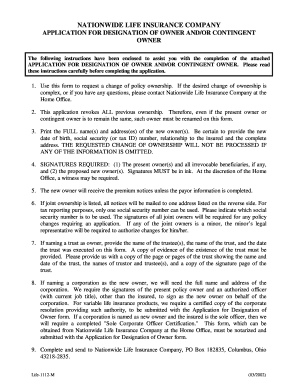

SAMPLE CPA LETTER CPA LETTER HEAD Date To Whom It May Concern This letter certifies that I have been preparing or I have reviewed the Federal tax returns for since. To my knowledge has been operating the business known as since. Mr/Mrs/Ms owns of this business. Sincerely CPA or enrolled agent name License or IRS.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sample cpa letter for self employed form

Edit your cpa letter for self employed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cpa letter example form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sample engagement letter cpa online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit cpa letter for mortgage form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cpa letter sample form

How to fill out Sample CPA Letter

01

Start by writing the date at the top of the letter.

02

Include the CPA's name and contact information below the date.

03

Write a salutation, addressing the recipient appropriately.

04

State the purpose of the letter clearly in the opening paragraph.

05

Provide any necessary financial information or statements in a structured format.

06

Include any specific disclosures or disclaimers required.

07

Conclude the letter with a summary of the key points.

08

Sign the letter and include the CPA's credentials and license number.

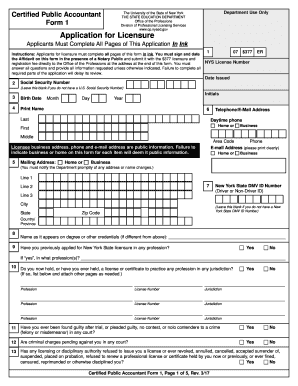

Who needs Sample CPA Letter?

01

Individuals applying for loans or mortgages.

02

Businesses seeking funding or investment.

03

Professional service providers needing confirmation of financial status.

04

Taxpayers needing to verify income or deductions.

05

Organizations requiring financial statements for audits.

Fill

cpa letter template

: Try Risk Free

People Also Ask about what is a cpa letter

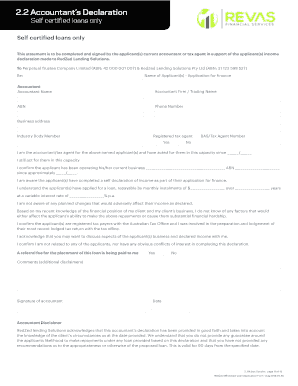

What is a CPA letter for use of business funds?

CPA Letter For Use Of Business Funds This is a reminder that lenders do not allow borrowers to use business funds (from any “business account”) towards a down payment or closing costs, unless borrowers can get a letter from their CPA that states the withdrawal will not adversely impact the business.

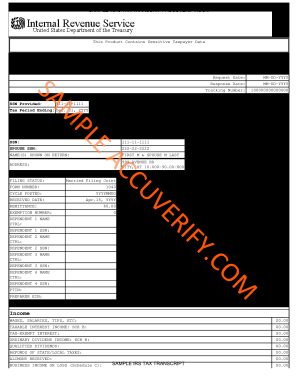

What is a letter of proof of income?

What is a Proof of Income Letter? A proof of income letter determines and confirms an individual's income and employment status. It is a formal, official letter usually composed by employers in order to confirm that an individual currently works for them or has worked for them in the past.

What is a CPA letter of proof of income?

CPA Letter for Verification of Self Employment is a document issued by the CPA who affirms that he/she has prepared or has reviewed the applicant's tax returns and that the applicant is self-employed. The primary purpose of the letter is to independently verify the self-employment status of the loan applicant(s).

Can I write my own CPA letter?

Can I write my own CPA letter? Yes, you can write your own CPA letter, but lenders will still need an official document signed by a CPA or Enrolled Agent to approve it.

What is a CPA letter used for?

What is a CPA Letter? This is a letter from a certified public accountant, or a CPA, to a prospective lender that vets a borrower's financial health at the time they apply for a home loan. Lenders need the letter before approving funds for a home loan.

What is a CPA letter for self-employed?

A self-employment verification letter from a CPA is a document issued by a CPA that affirms he or she has prepared or reviewed the tax return of the applicant and that the applicant is self-employed.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the letter sample cpa in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your cpa letter self employed in seconds.

How do I fill out the sample cpa letter for mortgage form on my smartphone?

Use the pdfFiller mobile app to complete and sign letter cpa on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit include the cpa's name and contact information below the date text write a salutation addressing the recipient appropriately text state the purpose of the letter clearly in the opening paragraph text provide any necessary financial information or stat on an Android device?

You can make any changes to PDF files, like cpa letter for mortgage template, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is Sample CPA Letter?

A Sample CPA Letter is a standard document prepared by a Certified Public Accountant (CPA) that outlines certain financial information or assertions about a client’s financial statements or conditions.

Who is required to file Sample CPA Letter?

Individuals or businesses that require verification of their financial status, such as those applying for loans, investors seeking assurance, or entities involved in audits are typically required to file a Sample CPA Letter.

How to fill out Sample CPA Letter?

To fill out a Sample CPA Letter, one must provide accurate financial information, follow the prescribed format, ensure all necessary details are included, and obtain a signature from a licensed CPA to validate the document.

What is the purpose of Sample CPA Letter?

The purpose of a Sample CPA Letter is to provide assurance regarding the accuracy of financial information, enhance credibility with third parties, and fulfill regulatory or lender requirements.

What information must be reported on Sample CPA Letter?

The Sample CPA Letter should include identifying information about the client, financial statements being reported on, assertions from management, CPA's opinion, and any significant accounting policies used.

Fill out your Sample CPA Letter online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cpa Verification Letter is not the form you're looking for?Search for another form here.

Keywords relevant to sample cpa letter for self employed pdf

Related to cpa letter for use of business funds sample

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.