Get the free Audit Report Form - The California State PTA

Show details

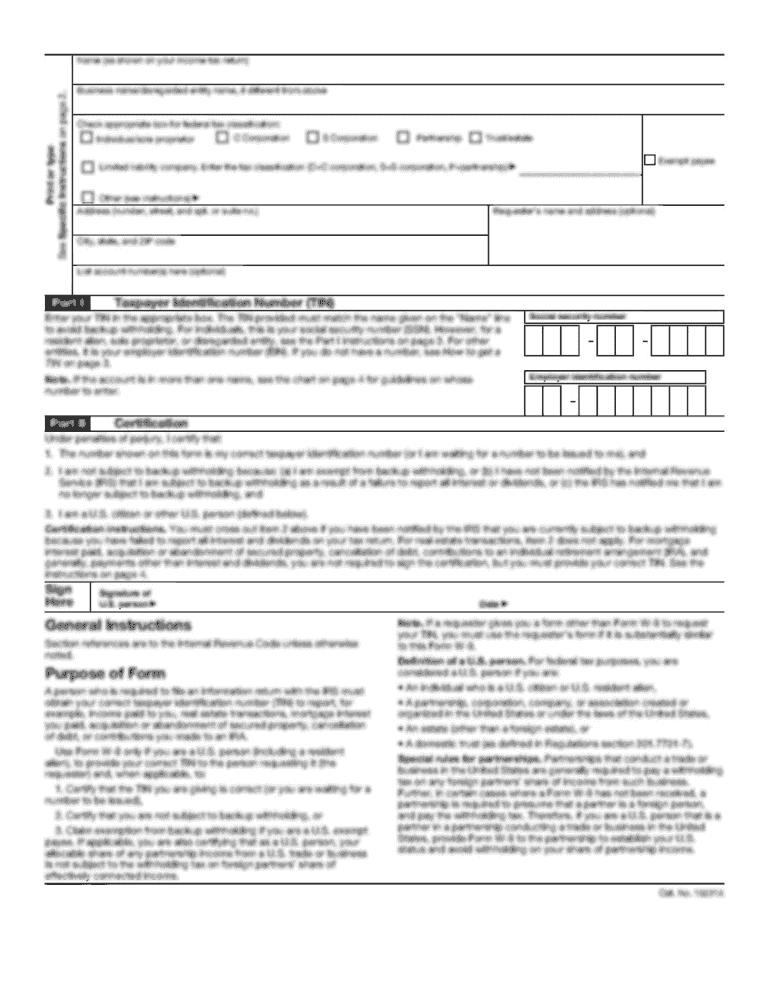

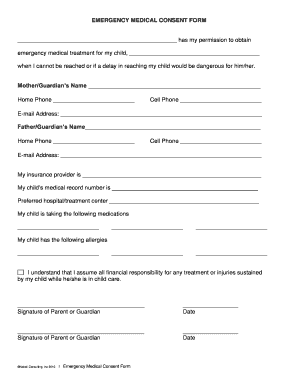

Attach copy of tax form(s) to next level PTA, if required to file.) Submit separate report of explanation and recommendations to executive board. A separate audit ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your audit report form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your audit report form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit audit report form online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit audit report form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

How to fill out audit report form

How to fill out audit report form:

01

Start by gathering all relevant information and documentation pertaining to the audit. This may include financial statements, invoices, receipts, and any other supporting materials.

02

Carefully review the audit report form and understand the specific requirements and sections to be completed. This may include sections for identifying the audited entity, providing background information, and summarizing the audit findings.

03

Begin filling out the form by accurately entering the necessary details in each applicable section. Provide clear and concise answers, ensuring that all information is correct and supported by the relevant documentation.

04

Pay close attention to any additional instructions provided on the form, such as specific formatting requirements or any requested supporting evidence.

05

Take the time to thoroughly review the completed audit report form for any errors, inconsistencies, or missing information. Make any necessary revisions to ensure the accuracy and integrity of the report.

06

Once you are satisfied with the content and accuracy of the audit report form, sign and date the document as required. If applicable, ensure that any required signatures from other stakeholders or authorities are obtained.

07

Keep a copy of the completed audit report form for your records and distribute it to the relevant parties as required, such as management, regulatory bodies, or other stakeholders.

Who needs audit report form:

01

Companies: Audit report forms are typically required by companies to comply with financial reporting and regulatory requirements. These forms provide a comprehensive summary of the results of an audit and help ensure transparency and accountability.

02

Government Agencies: Audit report forms are often necessary for government agencies to assess compliance with laws and regulations, monitor public spending, and ensure the proper use of public funds.

03

Non-profit Organizations: Non-profit organizations may need audit report forms to demonstrate their financial stewardship and accountability to donors, board members, and government bodies.

04

Financial Institutions: Banks, credit unions, and other financial institutions often require audit report forms to evaluate the financial stability and risk profile of their clients or borrowers.

05

Investors and Shareholders: Audit report forms are valuable for investors and shareholders to assess the financial health and performance of an organization before making investment decisions.

06

Regulatory Authorities: Regulatory bodies and authorities rely on audit report forms to supervise and enforce compliance with industry-specific regulations and standards.

07

Internal Stakeholders: Internal stakeholders, such as management and board members, use audit report forms to gain insights into the organization's operations, identify areas for improvement, and make informed decisions based on the audit findings.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is audit report form?

The audit report form is a document that provides an examination of an organization's financial statements.

Who is required to file audit report form?

Publicly traded companies are typically required to file an audit report form.

How to fill out audit report form?

To fill out an audit report form, one must gather financial information, perform necessary tests, and document findings.

What is the purpose of audit report form?

The purpose of an audit report form is to provide an independent assessment of an organization's financial statements.

What information must be reported on audit report form?

Information reported on an audit report form includes financial statements, test results, and any discrepancies found.

When is the deadline to file audit report form in 2023?

The deadline to file an audit report form in 2023 is typically the end of the organization's fiscal year.

What is the penalty for the late filing of audit report form?

The penalty for the late filing of an audit report form can vary depending on regulations and may include fines or other consequences.

How can I edit audit report form from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your audit report form into a dynamic fillable form that you can manage and eSign from anywhere.

Can I create an eSignature for the audit report form in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your audit report form and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

Can I edit audit report form on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as audit report form. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your audit report form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.