Get the free Chapter 1 Accounting as a Form of Communication - belkcollegeofbusiness uncc

Show details

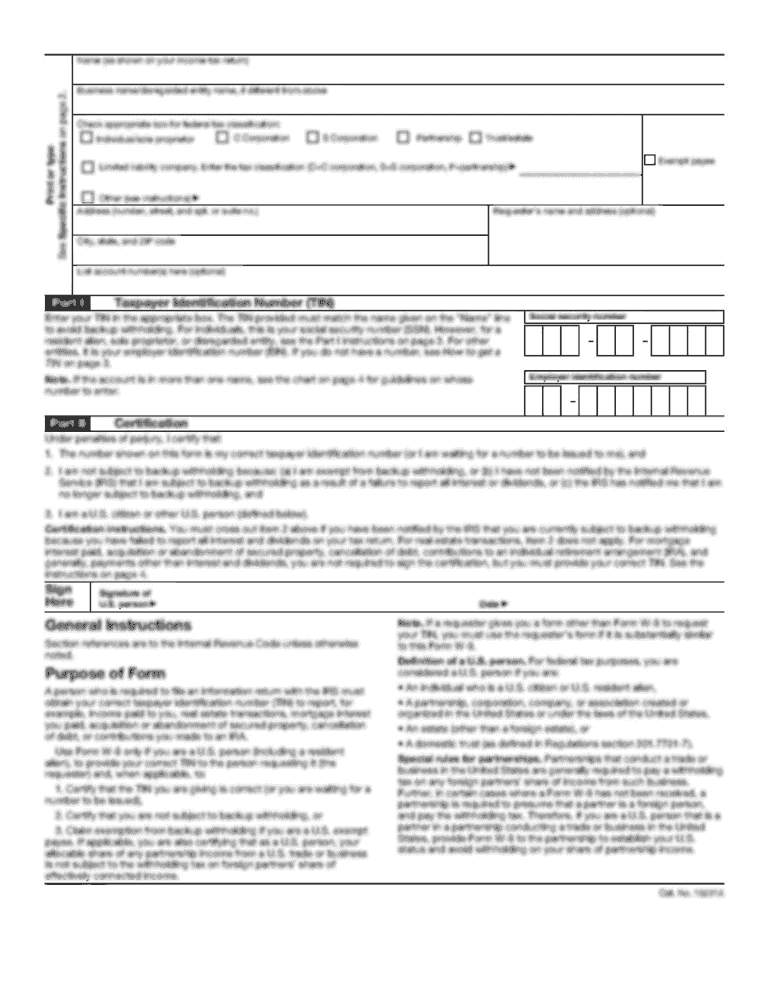

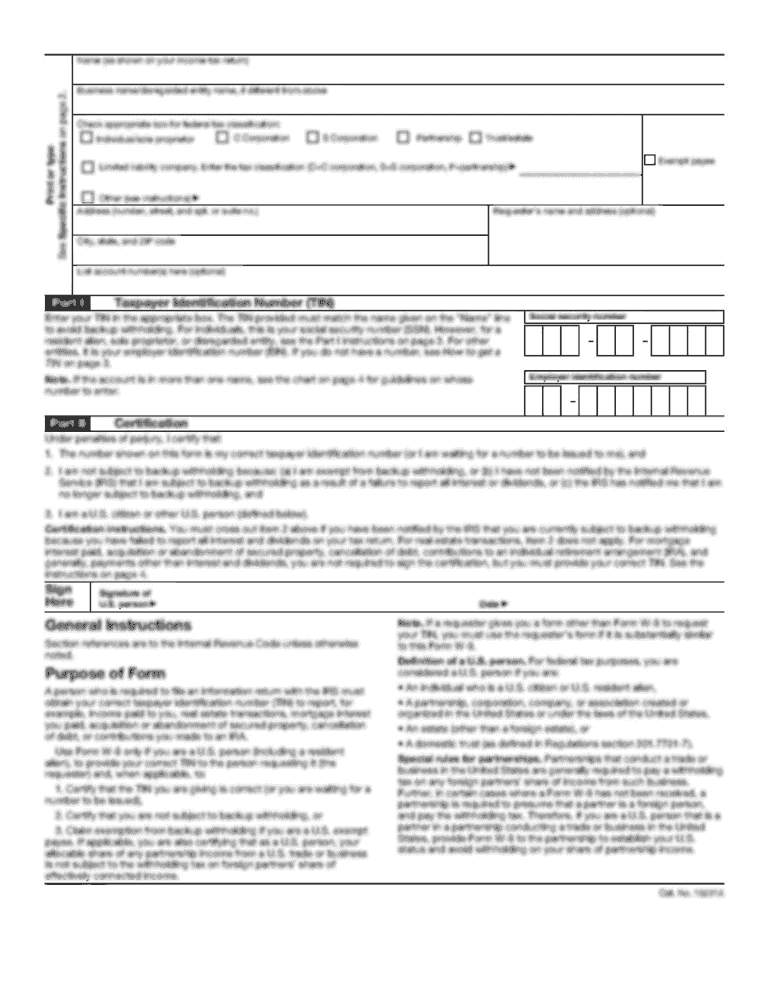

Test 2 Problem Solutions Problem 1 (5 points) The following information is taken from the income statement of the Castillo Inc. for the most recent year. Castillo uses a multi-step income statement.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your chapter 1 accounting as form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chapter 1 accounting as form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing chapter 1 accounting as online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit chapter 1 accounting as. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

How to fill out chapter 1 accounting as

How to fill out chapter 1 accounting as:

01

Start by carefully reading the instructions provided in chapter 1 of your accounting textbook.

02

Familiarize yourself with the concepts and principles covered in this chapter, such as the basic accounting equation, the double-entry system, and the different types of accounts.

03

Review the examples and practice exercises provided in the chapter to gain a better understanding of how to apply the concepts in real-life scenarios.

04

Take notes or create a study guide summarizing the key points and formulas discussed in chapter 1.

05

Complete any assigned homework or practice problems related to chapter 1, and seek help or clarification from your instructor or classmates if needed.

06

Once you feel confident in your understanding of chapter 1, attempt any quizzes or tests that may be assigned to assess your knowledge.

Who needs chapter 1 accounting as:

01

Students studying accounting: Chapter 1 accounting is essential for students pursuing a degree or certification in accounting. It lays the foundation for understanding the basic principles and concepts that will be built upon in subsequent chapters.

02

Business owners and managers: Even if you are not an accounting professional, understanding chapter 1 accounting can be beneficial as it provides insights into financial statements, budgeting, and decision-making processes within a company. This knowledge can help you make informed financial decisions and better manage your organization's resources.

03

Individuals interested in personal finance: Learning chapter 1 accounting concepts can also be useful for managing personal finances. It can help you understand budgeting, track income and expenses, and make more informed financial decisions in your personal life.

Overall, chapter 1 accounting is essential for students, business professionals, and individuals interested in accounting concepts and financial management.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is chapter 1 accounting as?

Chapter 1 accounting is the initial chapter of an accounting book that sets the foundation for the rest of the financial statements.

Who is required to file chapter 1 accounting as?

All businesses, organizations, and entities that are required to maintain proper accounting records are required to file chapter 1 accounting.

How to fill out chapter 1 accounting as?

Chapter 1 accounting is filled out by documenting the opening balances of assets, liabilities, and equity at the start of the accounting period.

What is the purpose of chapter 1 accounting as?

The purpose of chapter 1 accounting is to establish the initial financial position of an entity and provide a starting point for future financial transactions.

What information must be reported on chapter 1 accounting as?

The information reported on chapter 1 accounting includes the opening balances of all assets, liabilities, and equity accounts.

When is the deadline to file chapter 1 accounting as in 2023?

The deadline to file chapter 1 accounting in 2023 depends on the specific reporting requirements of the entity, but typically it is within a few weeks after the end of the accounting period.

What is the penalty for the late filing of chapter 1 accounting as?

The penalty for late filing of chapter 1 accounting can vary depending on the jurisdiction, but it may include fines, interest charges, or other sanctions.

How can I edit chapter 1 accounting as on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing chapter 1 accounting as.

How do I edit chapter 1 accounting as on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share chapter 1 accounting as from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I complete chapter 1 accounting as on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your chapter 1 accounting as, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Fill out your chapter 1 accounting as online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.