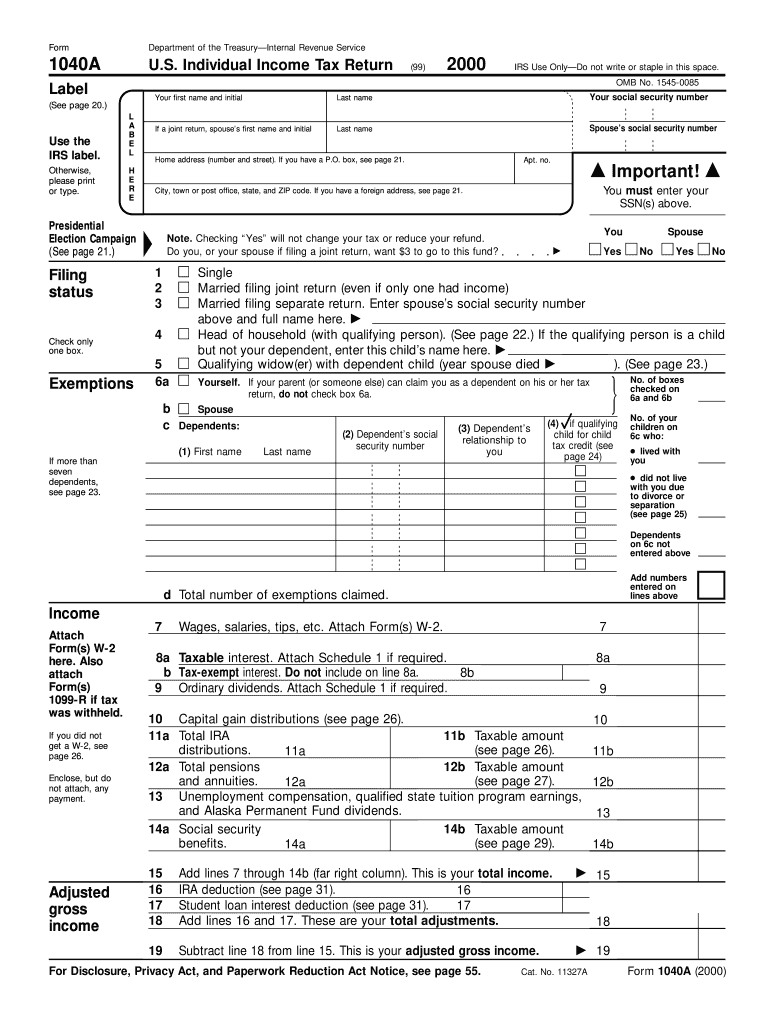

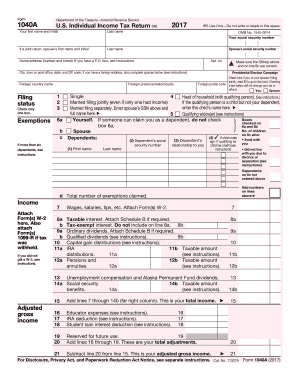

Who needs an IRS 1040A Form?

Form 1040A is US Internal Revenue Service tax form that should be used for the taxpayer for filing their individual tax return report used. It is a short form as it is a cut-down version up the long 1040. The IRS Form 1040A can be used by individuals whose annual income does not exceed $100,000, and who do not itemize their deductions. The full list of requirements to be liable for filling out this version of should be checked out at the IRS website.

What is Form 1040A for?

The completed Form 1040A serves an individual tax return report, which is necessary to make sure that a person reported the annual income properly and paid the due amount of taxes or the government owes a refund to the filer.

Is Form 1040A accompanied by other forms?

The forms that are expected as an attachment are indicated in the body of the form (1099 and W-2). And most often, the 1040A should be supported by Schedule B (interest and dividends), Schedule R (credit for the elderly and disabled), EIC (earned income credit), and 8812 (child tax credit). The necessity to provide any other supporting documents is described in the corresponding instruction at the IRS website.

When is IRS 1040A Form due?

The federal income tax return report is always due by the Tax Day that usually falls on 15th April, that is the middle of the fourth month of the fiscal year. In 2016, the report is expected on the 18th April, because of the federal holiday.

How do I fill out IRS Form 1040A?

The filled out form is to indicate the following:

- Personal information of the reporting taxpayer

- Filing status

- Exemptions Income and adjusted gross income

- Tax, credits, and payments

- Refund, etc.

Where do I send Form 1040A?

The form 1040A must be filed with the local IRS office; the exact address can be found in chart by the link.