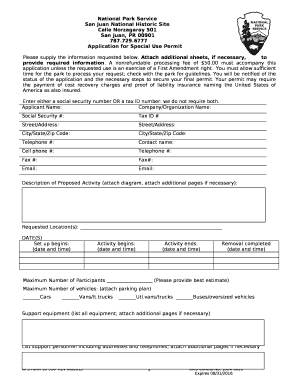

CT CT-3911 2016 free printable template

Show details

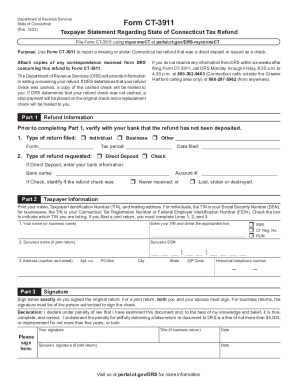

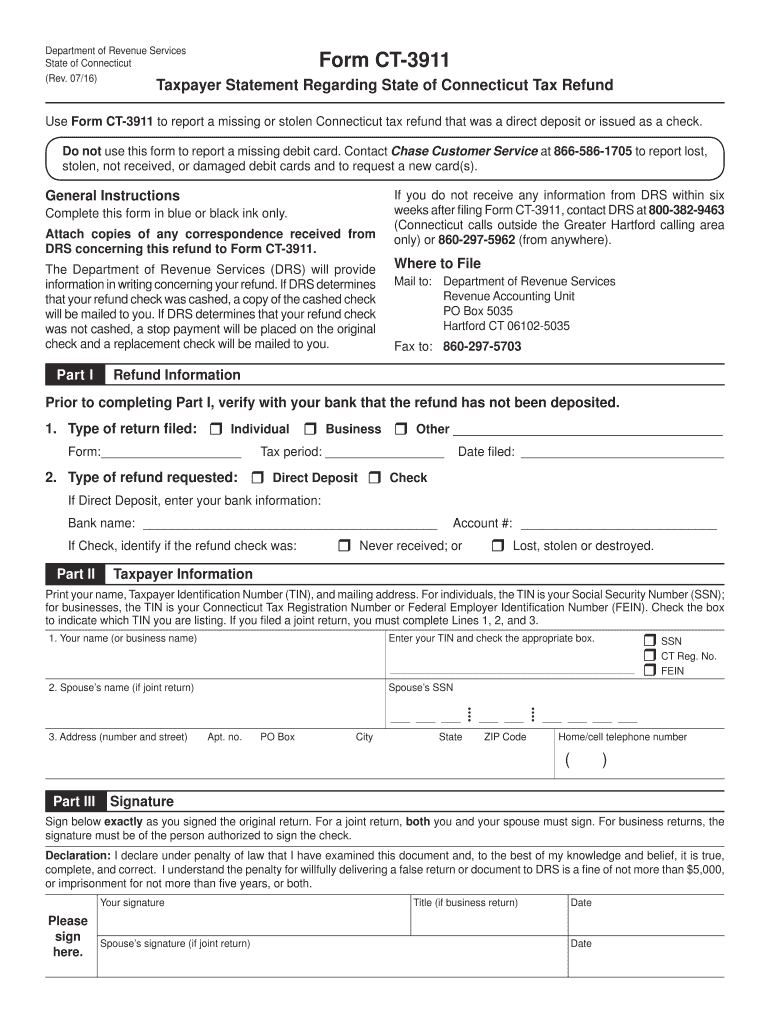

Department of Revenue Services State of Connecticut (Rev. 07/16) Form CT3911 Taxpayer Statement Regarding State of Connecticut Tax Refund Use Form CT3911 to report a missing or stolen Connecticut

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your ct 3911 2016 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct 3911 2016 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ct 3911 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ct 3911 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

CT CT-3911 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ct 3911 2016 form

How to fill out a ct 3911 form:

01

Start by accessing the official website of the organization or agency that requires the ct 3911 form.

02

Find the form on their website and download it onto your computer or print it out if a physical copy is needed.

03

Read through the instructions provided on the form carefully to ensure you understand the purpose of each section and the information required.

04

Begin filling out the form by entering your personal details such as your name, address, contact information, and any other required identifying information.

05

Move on to the next sections of the form, providing the necessary information based on the specific purpose of the form. This may include financial information, employment details, or other relevant data.

06

Double-check all the information entered to ensure accuracy and completeness.

07

If there are any supporting documents required, gather them and attach them to the completed form.

08

Before submitting the form, review it once again to make sure nothing has been missed and all the fields are filled out correctly.

09

Submit the completed form as directed by the organization or agency. This may involve mailing it to a specific address or submitting it electronically through their website.

Who needs ct 3911 form:

01

Individuals who are required to report certain financial information to a specific organization or agency.

02

Those who need to make a formal request or application to a particular institution or government body.

03

Individuals involved in legal proceedings or required to provide specific details as part of a legal inquiry or process.

Video instructions and help with filling out and completing ct 3911

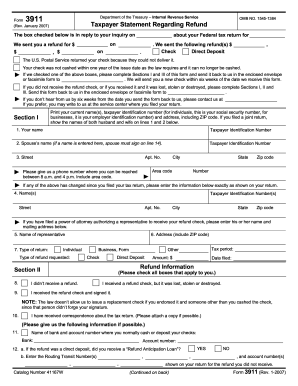

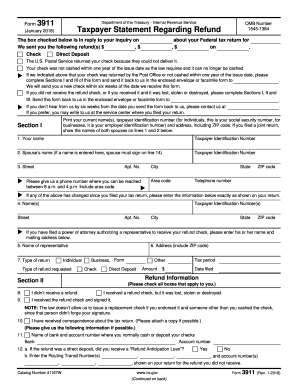

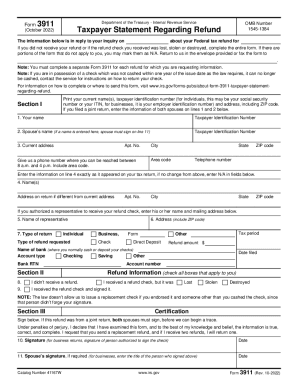

Instructions and Help about 3911 taxpayer refund form

Fill form 3911 : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What information must be reported on ct 3911 form?

The CT 3911 form is used to report information from a Connecticut sales and use tax return. Information that must be reported on this form includes the business name, address, taxpayer identification number, and sales and use tax permit number, as well as the amount of sales and use tax collected, the amount of sales and use tax due, and the amount of sales and use tax paid.

What is the penalty for the late filing of ct 3911 form?

The penalty for the late filing of Form CT-3911 is a penalty of 5% of the amount of tax due, with a minimum penalty of $10 and a maximum penalty of $50, plus interest at 1.5% per month.

Who is required to file ct 3911 form?

Form CT-3911 (Connecticut Enterprise Zone Business Facility Renovation or Expansion) is filed by taxpayers who have made qualifying improvements to a business facility located within a designated Connecticut enterprise zone.

This form is typically filed by individuals or businesses who have completed renovations or expansions on eligible business facilities and are seeking to claim tax incentives or credits provided by Connecticut for these improvements.

What is the purpose of ct 3911 form?

The CT-3911 form, also known as the Connecticut Tax Exempt Certificate, is used by businesses and organizations to claim exemption from Connecticut sales and use tax. It allows eligible entities to purchase items without paying sales tax by providing evidence of their tax-exempt status. This form serves as proof that the buyer is exempt from taxation and helps both the buyer and seller to comply with Connecticut's tax laws.

How do I execute ct 3911 online?

pdfFiller has made it simple to fill out and eSign ct 3911 form. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I edit form ct 3911 on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share connecticut 3911 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

How do I complete ct3911 on an Android device?

Complete connecticut ct 3911 form and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your ct 3911 2016 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Ct 3911 is not the form you're looking for?Search for another form here.

Keywords relevant to ct 3911 tax form

Related to ct ct 3911

If you believe that this page should be taken down, please follow our DMCA take down process

here

.