Who needs a Form AU-196.10?

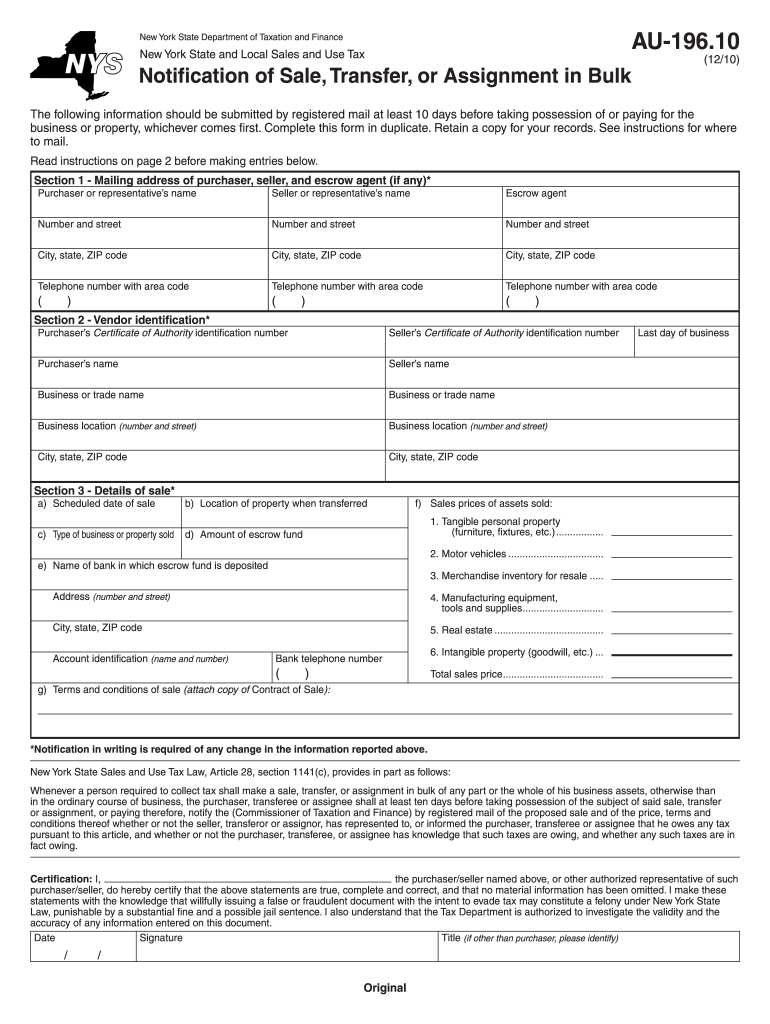

This form is issued by the New York State Department of Taxation and Finance and must be filed by a purchaser in a so-called bulk sale transaction to notify the Tax Department. The same form must be filed any time the information on originally filed form has changed.

What is Form AU-196.10 for?

This form is used by the Tax Department for the recording of all bulk transactions and control over taxes to be paid for such transactions. Sales prices of assets sold, type of business or property sold, terms and conditions of sale are to be reported using this form.

Is Form AU-196.10 accompanied by other forms?

Form DTF-17, Application for a Sales Tax Certificate of Authority should be submitted as a necessary accompaniment to the AU-196.10 in at least 20 days before taking possession of the business or paying for it. Failure to submit the form can result in a $200 penalty.

When is Form AU-196.10 due?

This form must be submitted at least ten days before taking possession of business or specified property or before paying for them, whichever comes first.

How do I fill out Form AU-196.10?

Form AU-196.10 is a one-page form. The following sections must be filled out in order to complete the form correctly:

-

Section 1 — Mailing Address of Purchaser, Seller, and Escrow Agent (if any);

-

Section 2 — Vendor Identification (notification required of any future change in the information reported in this section);

-

Section 3 — Details of Sale (notification required of any future change in the information reported in this section).

The second page of this fillable Form AU-196.10 contains an instruction for completing the form. Please, look through it before filling out the form.

Where do I send Form AU-196.10?

Once completed and signed in duplicate, this form must be directed by registered mail to the following address:

NYS Tax Department, TDAB-Bulk Sales Unit, W A Harriman Campus, Albany NY 12227.