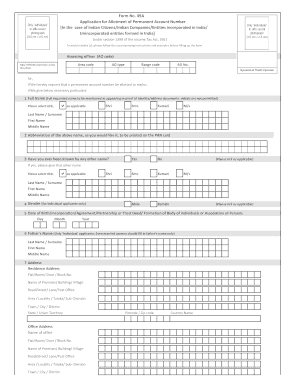

Get the free pan card back side pdf form

Show details

Pan card correction application form PDF download Pan card correction application form PDF download Pan card correction application form PDF download! DIRECT DOWNLOAD! Pan card correction application

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your pan card back side form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pan card back side form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pan card back side pdf online

To use the professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit pan card back side form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

How to fill out pan card back side

How to fill out pan card back side?

01

Start by flipping the pan card over to the back side.

02

Locate the space provided for filling out information on the back side of the pan card.

03

Fill in your address details accurately in the designated fields. Make sure to provide your complete address including house number, street name, city, state, and PIN code.

04

Next, you will find a section to provide your telephone number and email address. Fill in these details carefully.

05

If you have a foreign address, there will be a separate section for providing the foreign address details. Fill in the required information accurately in this section.

06

The next section is for providing details of representative assessee. If you have a representative authorized to act on your behalf for income tax purposes, fill in their information in this section.

07

After filling out all the necessary information on the back side of the pan card, make sure to double-check for any errors or missing details.

08

Once you are satisfied that all the required information has been accurately filled out, your pan card back side is complete.

Who needs pan card back side?

01

Individuals who hold a pan card and wish to update their address or contact information are required to fill out the back side of the card.

02

If you have a foreign address, you will need to provide the relevant details on the pan card back side.

03

Additionally, individuals who have authorized representatives for income tax purposes need to fill out the representative assessee section on the back side of the pan card.

Fill blank pan card pdf download : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

When is the deadline to file pan card back side in 2023?

The deadline to file PAN card back side in 2023 is December 31, 2023.

What is pan card back side?

The back side of a PAN card typically contains a barcode, a hologram sticker, and a space for the applicant's signature. The barcode contains essential information about the cardholder and is scanned for verification purposes. The hologram sticker is a security feature to prevent duplication or tampering of the card. Additionally, the applicant should sign on the back side of the PAN card as a form of authentication.

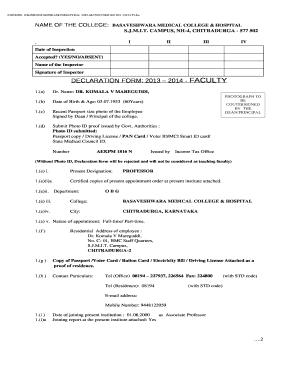

Who is required to file pan card back side?

The individual who is applying for a PAN (Permanent Account Number) card is required to fill and sign the back side of the PAN card application form. This is to ensure that the information provided on the form is accurate and to complete the application process.

How to fill out pan card back side?

To fill out the backside of a PAN card (Permanent Account Number), follow these steps:

1. Start by turning over your PAN card. The backside will have a set of columns to be filled.

2. In the first column, titled "Details of Representative Assessee," provide the name and address of the representative assessee (if applicable). If not applicable, leave it blank.

3. In the second column, titled "Registration Number of Registered Valuer," mention the registration number of the registered valuer (if applicable). Otherwise, leave it blank.

4. In the third column, titled "Details of MARS," fill in the details of MAR (Monitoring Agency Representative), such as the name and code. If it doesn't apply to you, leave it blank.

5. In the fourth column, titled "Details of Authorised Representative," provide the details (name and address) of the authorized representative, if any. If not applicable, leave it blank.

6. In the fifth column, titled "Details of Person Making the Transaction," fill in your details as the person making the transaction. It includes your name, date of birth, and the capacity in which you are making the transaction.

7. In the sixth column, titled "Identification Type," select the appropriate identification type from the options provided, and mention the corresponding identification number in the space provided.

8. Finally, provide your signature in the space provided at the bottom of the backside of the PAN card.

Make sure to transparently and accurately fill out the information without any abbreviations or additions. Proofread the details before submitting the form to avoid any mistakes or discrepancies.

What is the purpose of pan card back side?

The back side of a PAN (Permanent Account Number) card in India primarily bears the signature of the cardholder. The purpose of having a signature on the back of the PAN card is to authenticate the document and validate the identity of the cardholder. This helps in ensuring the integrity and security of the PAN card as an identification document.

What information must be reported on pan card back side?

The following information must be reported on the back side of a PAN card:

1. Acknowledgment number: The unique number generated during the PAN card application process.

2. Applicant's signature: The individual applying for the PAN card must sign on the back side of the card.

3. Date of birth: The applicant's date of birth should be mentioned on the back side.

4. Photograph: A recent passport-sized photograph of the applicant should be affixed on the back side.

5. Father's name: The full name of the applicant's father must be mentioned.

6. Thumb impression: In case the applicant is unable to sign, a left-hand thumb impression should be placed on the back side.

7. Address proof: If the address provided on the PAN card application is different from the address on record, the details regarding the address proof submitted should be mentioned.

It is important to note that the specific requirements for the back side of the PAN card may vary depending on the issuing authority or jurisdiction.

What is the penalty for the late filing of pan card back side?

There is typically no specific penalty for the late filing of the PAN card back side in particular. However, late filing or failure to file the PAN card can result in certain consequences. These consequences may include:

1. Late Filing Fee: If you fail to file your PAN card application within the prescribed timeline, you may be required to pay a late filing fee.

2. Rejection or Delay in Processing: Late filing can lead to a rejection or delay in the processing of your PAN card application. This can cause inconvenience and delays in receiving your PAN card.

3. Inability to Perform Certain Transactions: PAN card is required for various financial transactions, such as opening a bank account, conducting high-value transactions, filing income tax returns, etc. If you do not possess a valid PAN card or it is filed late, you may face difficulties in performing these transactions.

It is always advisable to file your PAN card application on time to avoid any potential penalties or complications.

How do I execute pan card back side pdf online?

With pdfFiller, you may easily complete and sign pan card back side form online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I fill out the blank pan card pdf form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign pan card back side download and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I edit pan card back side image download on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share pan card blank format pdf from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Fill out your pan card back side online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Blank Pan Card Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to pan card image pdf form

Related to blank pan card image pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.