Get the free Model Form of Bank Guarantee Bond - rbidocs rbi org

Show details

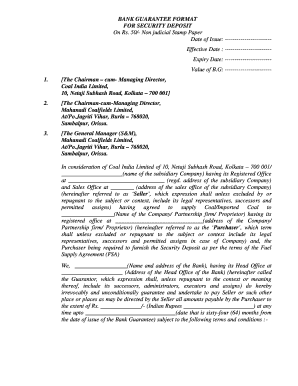

ANNEX 1 Model Form of Bank Guarantee Bond paragraph 2.2.7.2 GUARANTEE BOND 1. In consideration of the President of India (hereinafter called 'the Government') having agreed to exempt hereinafter called

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your model form of bank form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your model form of bank form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit model form of bank online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit model form of bank. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

How to fill out model form of bank

How to fill out a model form of bank:

01

Start by carefully reading all the instructions provided on the form. Pay attention to any specific requirements or sections that need to be completed.

02

Gather all the necessary documents and information required to complete the form. This may include personal identification, proof of address, account details, and any supporting documents requested by the bank.

03

Fill in your personal information accurately. This includes your full name, date of birth, contact details, and social security or tax identification number.

04

Provide your banking information, such as the account number you wish to link or open, and indicate the type of account you are applying for (savings, checking, etc.).

05

Input any additional required details, such as employment information, income sources, and financial history. Be honest and provide accurate information to the best of your knowledge.

06

Include any requested signatures or authorizations. Make sure to read all the terms and conditions carefully before signing.

07

Double-check all the information you have entered for accuracy and completeness. Any errors or missing information may delay the processing of your form.

08

Follow any specific submission instructions provided by the bank. This may involve submitting the form in person at a branch, mailing it, or submitting it online through a secure portal.

Who needs a model form of bank:

01

Individuals who want to open a new bank account.

02

Existing account holders who need to update their information, such as a change of address or beneficiaries.

03

Individuals applying for loans, mortgages, or credit cards may be required to fill out bank model forms as part of the application process.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is model form of bank?

A model form of a bank is a standardized document or template that represents the structure and framework of a bank. It typically includes information such as the organization's name, logo, contact details, terms and conditions, and various sections to capture essential banking details and services offered. The model form serves as a guide for banks to create consistent and compliant documents for their customers, such as account opening forms, loan application forms, or any other banking-related forms.

Who is required to file model form of bank?

There is no specific model form for banks that all individuals or entities are required to file. The filing requirements for banks can vary depending on the jurisdiction and the specific regulatory framework in place. Banks are generally required to file various financial reports and regulatory forms, such as balance sheets, income statements, capital adequacy reports, and regulatory compliance reports, to the relevant regulatory authorities. The specific forms and requirements will depend on the jurisdiction and the type of bank (commercial bank, investment bank, etc.).

How to fill out model form of bank?

To fill out a model form of a bank, you can follow these general steps:

1. Obtain the model form: Get a copy of the specific model form you need from your bank. This might be available on their website, in a branch, or through their customer service.

2. Read the instructions: Read through the instructions provided with the form carefully. This will guide you on how to complete different sections and what information is required.

3. Personal information: Start by filling in your personal information accurately. This usually includes your name, address, contact details, and any customer identification numbers provided by the bank.

4. Account details: If the form is related to a particular bank account, provide the relevant account details such as account number, type of account, and any additional information required to identify the account.

5. Authorization: If the form requires authorization, carefully read the authorization clause and sign it if required. This could involve giving permission for the bank to perform specific actions or access certain information.

6. Purpose of the form: Understand the purpose of the form and fill out any relevant sections accordingly. For example, if it's a loan application form, you'll need to provide details about the loan amount, purpose, repayment terms, and any collateral involved.

7. Supporting documents: Check if any supporting documents are required along with the form. Attach copies of these documents, such as identification proof, income statements, or any other specific documents mentioned in the instructions.

8. Review and revise: Before submitting the form, review all the information you've entered to ensure it is accurate and complete. Make any necessary revisions or corrections before proceeding.

9. Submission: Once you are satisfied with the accuracy of the form, simply follow the instructions to submit it to the bank. This may involve mailing it, submitting it in person at a branch, or using an online submission method if available.

Remember to keep a copy of the filled-out form for your records, in case you need to refer to it later.

What is the purpose of model form of bank?

The purpose of a model form in the context of a bank is to provide standardized templates or formats for various banking documents or agreements. These forms are designed to ensure consistency, accuracy, and compliance with regulatory requirements.

Some common examples of model forms used in banking include loan application forms, account opening forms, deposit slips, withdrawal slips, mortgage agreements, credit card application forms, and various other legal agreements.

By using model forms, banks can streamline their processes, save time and costs in creating customized documents for each customer or transaction, and ensure that all necessary information and terms are adequately captured. It also helps to enhance transparency and clarity for customers, as they are presented with standardized documents that are easy to understand and compare.

Moreover, model forms are often designed in collaboration with regulatory authorities to ensure adherence to relevant laws, regulations, and consumer protection guidelines. This helps to protect the interests of both the bank and the customers, as all parties have access to clearly specified terms and conditions.

Overall, the purpose of a model form in banking is to standardize and simplify the documentation process while ensuring compliance with legal and regulatory requirements, thereby promoting transparency, efficiency, and fairness in banking transactions.

What is the penalty for the late filing of model form of bank?

The penalty for the late filing of a model form of a bank can vary depending on the jurisdiction and specific regulations in place. It is best to consult the relevant banking authority or regulatory body to determine the specific penalty for late filing in a particular context.

How do I complete model form of bank online?

Filling out and eSigning model form of bank is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I make changes in model form of bank?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your model form of bank to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an eSignature for the model form of bank in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your model form of bank directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Fill out your model form of bank online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.