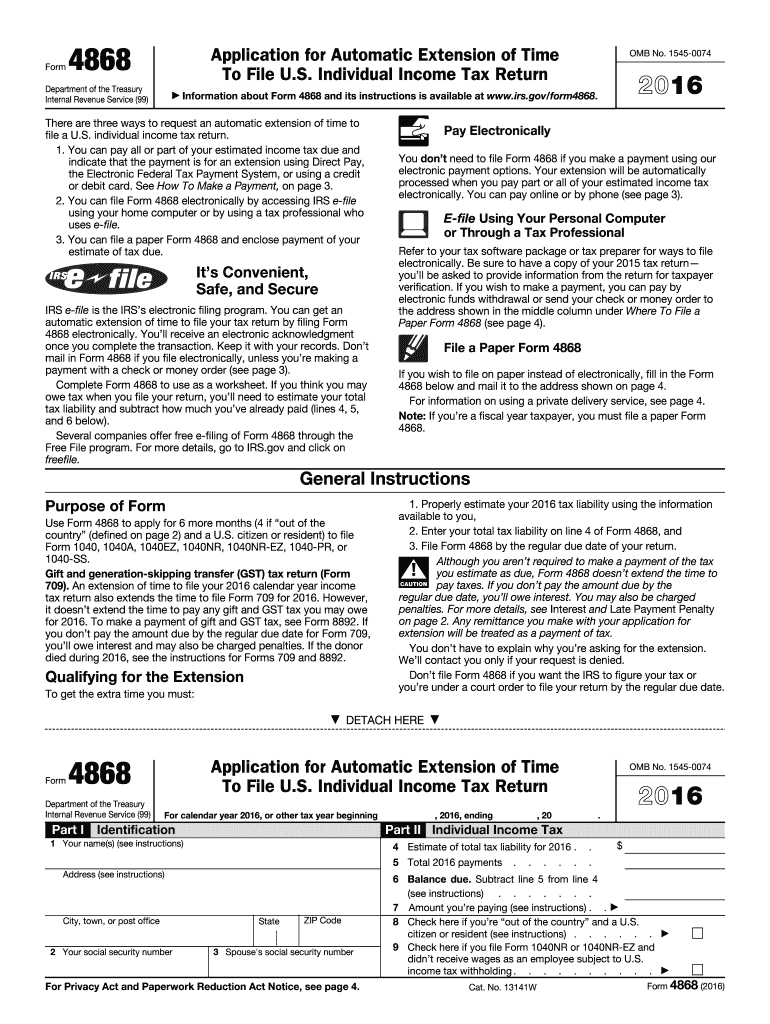

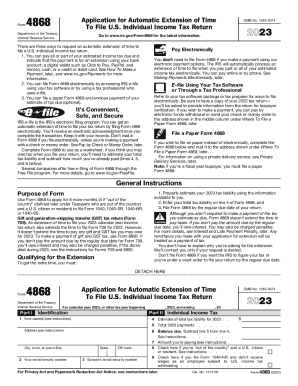

Who needs form 4868?

Form 4868 is the Application for Automatic Extension of Time to File a U.S. Individual Tax Return. This is the form is designed for all US citizens who pay taxes.

What is form 4868 for?

The form serves to prolong the time given for every individual to file their tax return. It means that if you aren't able to file your tax return by the due date, you should fill out form 4868 that will give you the right to have 6 more months for tax return completion.

However, the extension of the time given for filing tax return does not concern the actual tax payment. It must be done by the due date.

The extension of time to file tax return automatically moves the deadline for completion of the following forms:

-

Form 709

-

Form 1040 and its variants.

Check out the full list of forms that fall under time extension along with tax return on the IRS official website.

Is form 4868 accompanied by other forms?

Generally, the application for time extension does not require any additional form or explanations. However, the individual who is going to fill out form 4868 should clearly understand and evaluate his upcoming tax return.

When is form 4868 due?

Every one who is looking for a time extension to complete their tax return must file the application form 4868 by April, 18, 2017 except fiscal year taxpayers who are to file the form 4868 by the due date of the fiscal year return.

How do I fill out form 4868?

The form 4868 is short and clear. Yet some information should be clarified. To begin with, the form comprises two parts. The first one is for the taxpayer`s identification. You should enter your name, address, and social security number. If it's a joint application, the spouse's name should also be included.

Don't forget to inform the Social Security Administration about any changes of your name or address.

The second part of the form requires information about the amount of tax to be paid. In form 4868 you are allowed to round off the amounts. To fill out the lines suggested in part two use information from your form 1040.

Where do I send form 4868?

You can quickly file form 4868 online on the IRS website with the payment information attached.