CO EM9-9-12 2012-2025 free printable template

Show details

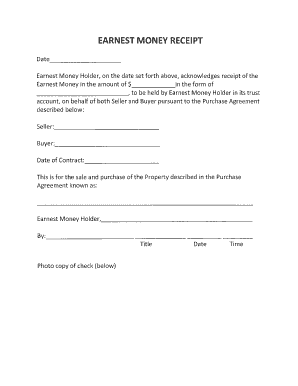

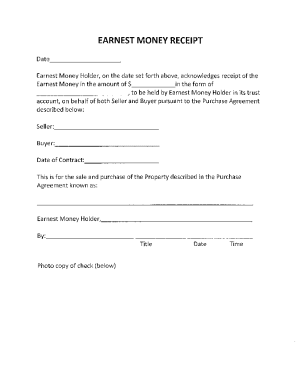

This document serves as a receipt for earnest money received in a real estate transaction, acknowledging the amount and the parties involved, while outlining the terms related to the holding of said

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign earnest money release form

Edit your CO EM9-9-12 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CO EM9-9-12 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CO EM9-9-12 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit CO EM9-9-12. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CO EM9-9-12 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CO EM9-9-12

How to fill out CO EM9-9-12

01

Gather all necessary information about the subject of the CO EM9-9-12 form.

02

Start by entering the required identification details in the top section.

03

Fill out the date and relevant timestamps as needed.

04

Provide detailed descriptions in the appropriate fields, ensuring clarity and accuracy.

05

Double-check for any missing signatures or required approvals.

06

Review the completed form for any errors and make corrections.

07

Submit the form according to the specified guidelines or procedures.

Who needs CO EM9-9-12?

01

Individuals or organizations required to report certain data or incidents.

02

Regulatory bodies that need documentation for compliance purposes.

03

Professionals managing specific projects that require detailed reporting.

Fill

form

: Try Risk Free

People Also Ask about

How do you write a deposit receipt?

Basic Components of a Receipt Name of vendor (person or company you paid) Transaction date (when you paid) Detailed description of goods or services purchased (what you bought) Amount paid. Form of payment (how you paid – cash, check, or last four digits of a credit card)

How do you write an earnest money check?

Most importantly, in the “note” section at the bottom left corner of the check, write “Earnest Money” or “EM” and the address of the property you are buying. Please get at least a copy of your check (dated and with a signature of who received it) when you drop off your check.

How do you record earnest money paid?

Line 3: Earnest money typically is a check made out of your cash/bank account as a security for the contract, so it should have already been recorded as a separate journal entry with a credit to “Checking” and a debit to “Earnest Money.” For recording it here as part of the new purchase, you will utilize “Earnest Money

How is earnest money recorded in accounting?

Line 3: Earnest money typically is a check made out of your cash/bank account as a security for the contract, so it should have already been recorded as a separate journal entry with a credit to “Checking” and a debit to “Earnest Money.” For recording it here as part of the new purchase, you will utilize “Earnest Money

What type of expense is earnest money?

Earnest money is essentially a deposit a buyer makes on a home they want to purchase. A contract is written up during the exchange of the earnest money that outlines the conditions for refunding the amount. Earnest money deposits can be anywhere from 1–10% of the sales price, depending mostly on market interest.

What is an earnest document?

An earnest money agreement is a legal document that outlines the terms between two parties, typically for the purchase and sale of real estate. When buying a property, a buyer will provide an earnest money deposit to signal their intentions are high to move forward with the transaction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit CO EM9-9-12 from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like CO EM9-9-12, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I make changes in CO EM9-9-12?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your CO EM9-9-12 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out CO EM9-9-12 on an Android device?

Complete your CO EM9-9-12 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is CO EM9-9-12?

CO EM9-9-12 is a form used within certain jurisdictions for reporting environmental management details.

Who is required to file CO EM9-9-12?

Entities or individuals involved in activities that impact the environment, typically businesses or organizations regulated by environmental laws, are required to file CO EM9-9-12.

How to fill out CO EM9-9-12?

To fill out CO EM9-9-12, gather the necessary information about your activities and impact, complete each section of the form accurately, and submit it following the guidelines provided by the relevant authority.

What is the purpose of CO EM9-9-12?

The purpose of CO EM9-9-12 is to collect data on environmental practices and compliance from organizations to ensure they adhere to regulations and minimize their environmental impact.

What information must be reported on CO EM9-9-12?

The information required includes details about the entity, nature of the activities, emissions data, compliance status, and any measures taken to mitigate environmental impacts.

Fill out your CO EM9-9-12 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CO em9-9-12 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.