Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

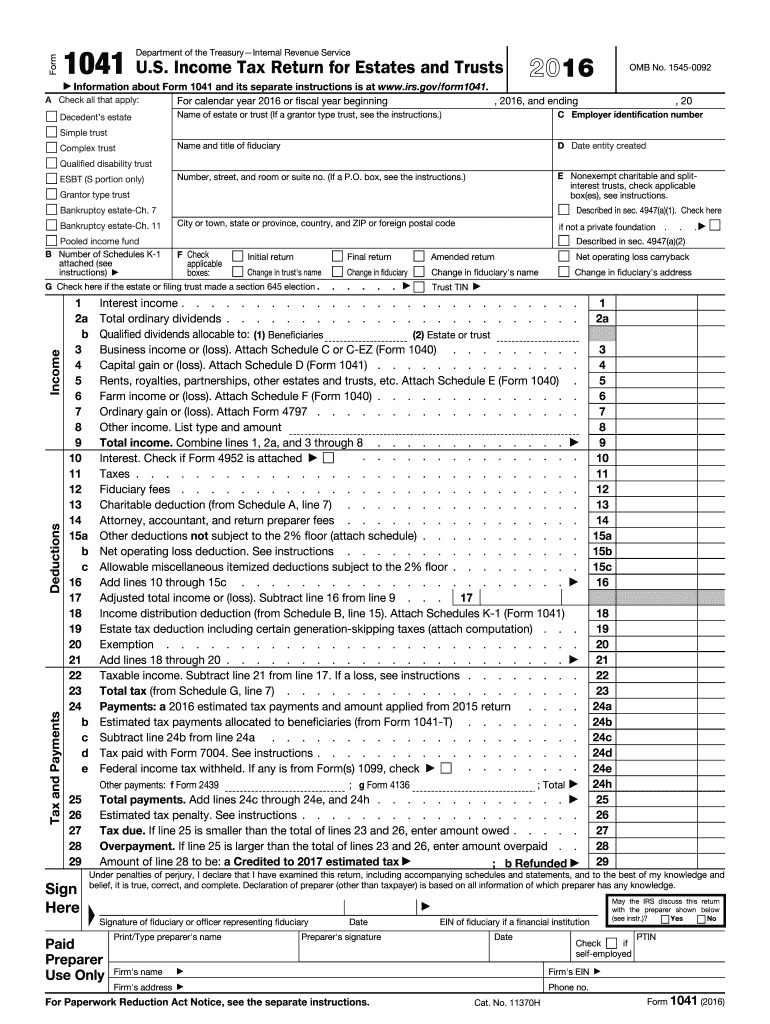

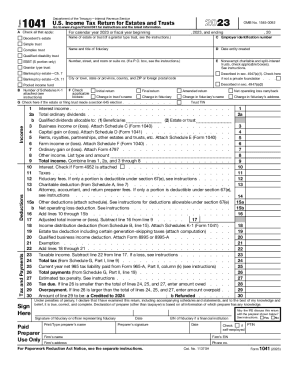

Form 1041 is an income tax return filed by estates and trusts in the United States. It is used to report income, deductions, and taxes for an estate or trust that operates as a separate legal entity. The form is used to calculate and report the taxable income of the estate or trust and determine the amount of tax owed. The form is filed annually with the Internal Revenue Service (IRS).

Who is required to file form 1041?

Form 1041 is required to be filed by estates and trusts that have income, deductions, or distributions during the taxable year. This includes:

1. Estates of individuals who died during the tax year, if the estate has gross income of $600 or more for the tax year.

2. Trusts that have income, including ordinary business income, capital gains, or both, that exceeds $600 for the tax year.

3. Grantor-type trusts that have any taxable income or gross income of $600 or more regardless of whether the income is distributed or required to be distributed.

It is important to consult with a tax professional or reference the official IRS guidelines to determine the specific filing requirements for Form 1041 in individual situations.

What is the purpose of form 1041?

Form 1041, also known as the U.S. Income Tax Return for Estates and Trusts, is used by estates and trusts to report their income, deductions, gains, losses, and tax liabilities to the Internal Revenue Service (IRS). The purpose of Form 1041 is to determine and report the taxable income of the estate or trust and calculate any associated taxes. The form is used to report income received by the estate or trust from various sources such as investments, real estate, and business activities. It also allows the estate or trust to claim deductions and credits, and ultimately calculate the tax owed or receive a refund if applicable.

When is the deadline to file form 1041 in 2023?

The deadline to file Form 1041 (U.S. Income Tax Return for Estates and Trusts) for the tax year 2023 is April 17, 2024. Please note that if April 15 falls on a weekend or a holiday, the deadline is extended to the next business day.

What is the penalty for the late filing of form 1041?

The penalty for the late filing of Form 1041 (U.S. Income Tax Return for Estates and Trusts) is generally calculated based on the amount of tax due that remains unpaid after the due date. The penalty is 5% of the unpaid tax amount for each month, or part of a month, that the return is late, with a maximum penalty of 25% of the unpaid tax.

If the return is more than 60 days late, the minimum penalty is the lesser of $215 or the amount of tax due. Additionally, interest accrues on the unpaid tax amount until it is fully paid. It is important to note that the penalty may be waived or reduced if there is a reasonable cause for the delay in filing.

How to fill out form 1041?

Filling out Form 1041, also known as U.S. Income Tax Return for Estates and Trusts, can be a complex process. Here are the general steps to complete the form:

1. Gather all the necessary information and documents, including the decedent's social security or taxpayer identification number, income statements, and expense receipts.

2. Provide the basic details in the top section of Form 1041, including the name of the estate or trust, the address, and the filing status (calendar year or fiscal year).

3. Identify the filer by checking the applicable box for the type of entity—estate, simple trust, complex trust, or bankruptcy estate.

4. Complete Part 1: Income. This section requires you to report all sources of income earned by the estate or trust, including interest, dividends, rental income, capital gains, and any other taxable income. Enter the income amounts in the corresponding lines and attach any necessary schedules or statements.

5. Deduct the allowable expenses in Part 2: Deductions. This may include administrative expenses, mortgage interest, property taxes, attorney fees, and other qualified deductions. Refer to the instructions for Form 1041 to ensure you claim the appropriate deductions.

6. Calculate the taxable income in Part 3: Taxable Income. Subtract the total deductions (line 18) from the total income (line 17) to arrive at the taxable income.

7. Determine the tax liability in Part 4: Tax and Payments. Use the tax rate schedule provided in the Form 1041 instructions to calculate the tax owed based on the taxable income.

8. Report any estimated tax payments made during the tax year in Part 5: Estimated Tax Payments, as well as any withholding from beneficiaries, if applicable.

9. Complete the sections for credits and other taxes in Part 6 and Part 7 if they are applicable to the estate or trust.

10. Enter any other necessary information or schedules to support the tax return, such as Schedule A for itemized deductions or Schedule B for interest and dividend income.

11. Sign and date the form as the fiduciary or authorized representative.

12. Attach all supporting schedules and statements to the Form 1041 before mailing it to the appropriate IRS address. Keep a copy of the filled-out form for your records.

It is highly recommended to consult a tax professional or utilize tax software to ensure accuracy when completing Form 1041, as the process can be complex and subject to changes in tax laws.

What information must be reported on form 1041?

Form 1041, also known as the U.S. Income Tax Return for Estates and Trusts, is used to report income, deductions, and taxes for estates and trusts. Here is a summary of the key information that must be reported on Form 1041:

1. Basic Information: The form requires details about the estate or trust, including its name, address, employer identification number (EIN), and the filing period.

2. Income: All income earned by the estate or trust during the tax year must be reported on Form 1041. This includes taxable interest, dividends, capital gains, rental income, royalties, business income, and any other income sources.

3. Deductions: Deductible expenses associated with the estate or trust's administration and income generation can be included on Form 1041. Common deductions include costs for attorney fees, trustee fees, executor fees, investment advisory fees, accounting fees, charitable contributions, real estate taxes, and other allowable expenses.

4. Tax Computation: Form 1041 calculates the taxable income of the estate or trust based on the reported income and deductions. The appropriate tax rates are then applied to determine the tax liability.

5. Schedule K-1: If the estate or trust has beneficiaries, Schedule K-1 must be completed for each beneficiary. This schedule reports each beneficiary's share of the estate or trust's income, deductions, credits, and tax liability. Beneficiaries use this information on their own individual tax returns.

6. Estimated Tax Payments: If the estate or trust is required to make quarterly estimated tax payments, these must be reported on Form 1041.

7. Tax Payments and Refunds: The estate or trust must report any taxes already paid, such as withholding or estimated tax payments. Additionally, any overpayment of taxes can be claimed as a refund or applied to the following year's taxes.

8. Other Required Forms and Schedules: Depending on the specific circumstances, additional forms or schedules may be required to be attached to Form 1041. These may include Schedule D (Capital Gains and Losses), Schedule I (Alternative Minimum Tax), Schedule J (Accumulation Distribution for Certain Complex Trusts), and others.

It's important to note that this is a general overview, and the specific reporting requirements may vary based on the complexity and nature of the estate or trust. Consulting with a tax professional or referring to the official instructions for Form 1041 is recommended for accurate reporting.

How do I edit 2016 form 1041 online?

The editing procedure is simple with pdfFiller. Open your 2016 form 1041 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I make edits in 2016 form 1041 without leaving Chrome?

2016 form 1041 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How can I fill out 2016 form 1041 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your 2016 form 1041. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.