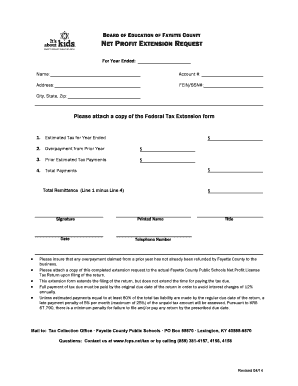

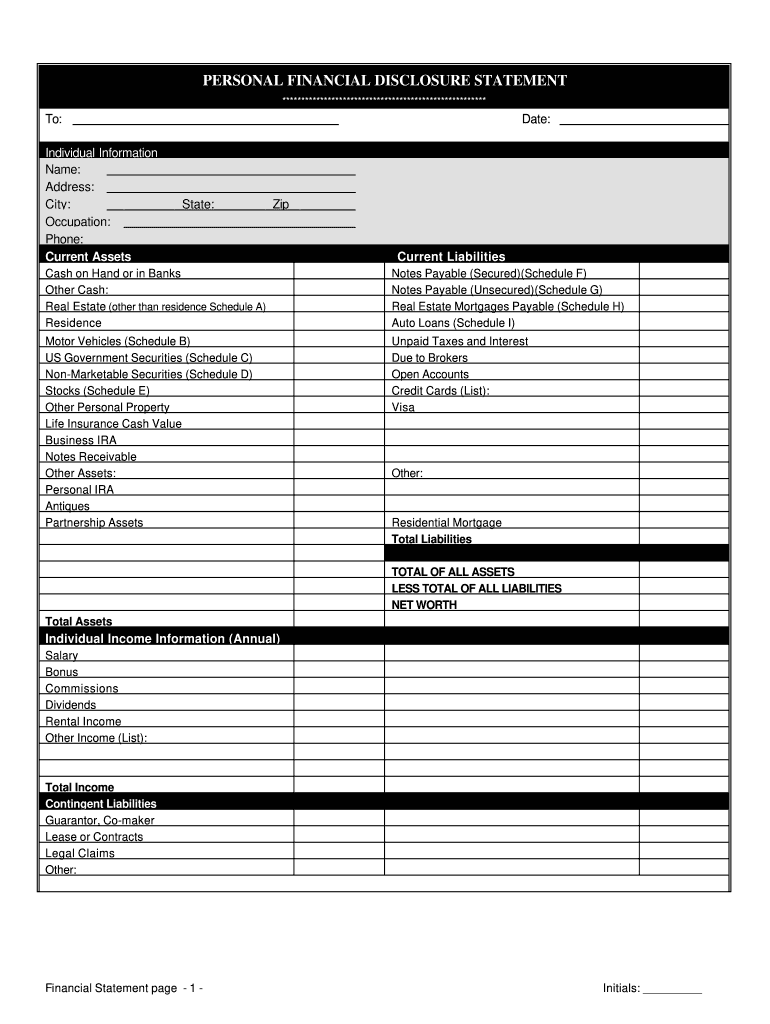

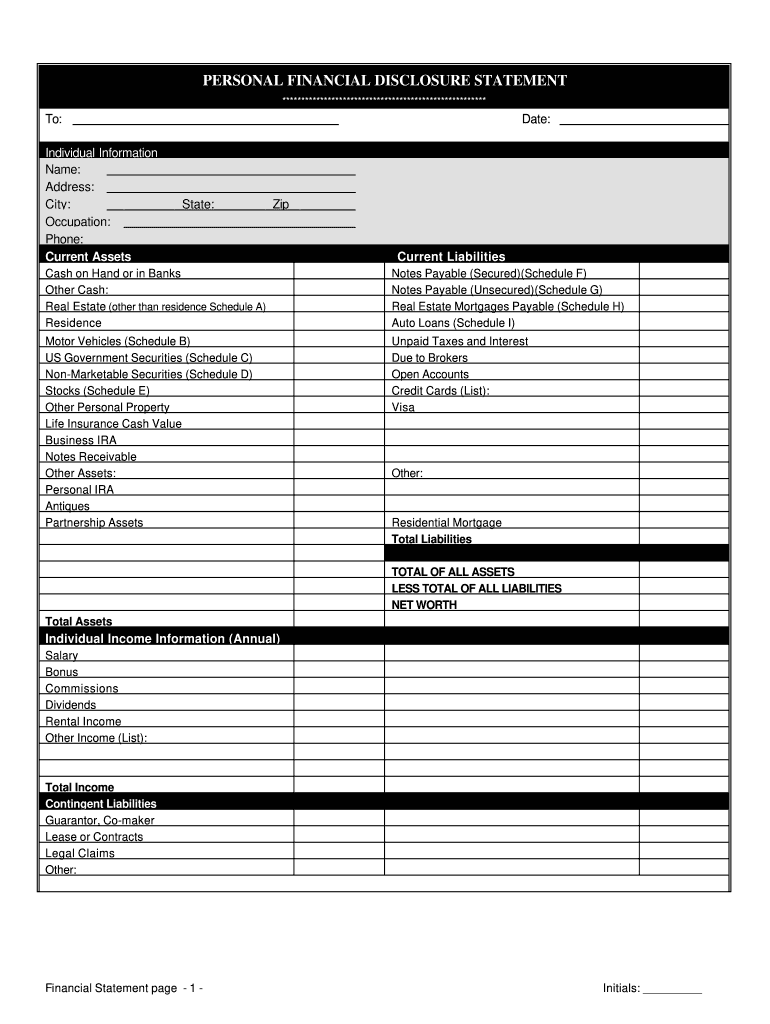

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

Get the free Kentucky Financial Statements only in Connection with Prenuptial Premarital Agreement

Show details

PERSONAL FINANCIAL DISCLOSURE STATEMENT ****************************************************** To: Individual Information Name: Address: City: Occupation: Phone: Current Assets Date: State: Zip Current

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your kentucky financial statements only form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kentucky financial statements only form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing kentucky financial statements only online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit kentucky financial statements only. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

How to fill out kentucky financial statements only

How to fill out Kentucky financial statements only:

01

Gather all relevant financial documents, such as bank statements, income statements, and balance sheets.

02

Start by filling in the basic information, such as your company's name, address, and federal employer identification number.

03

Proceed to the income section and record your company's total revenue and any deductions or expenses. Be sure to accurately categorize all income and expenses.

04

Move on to the balance sheet section, where you will list your company's assets, liabilities, and equity. Include information about your bank accounts, loans, and any outstanding debts.

05

Complete the cash flow statement by detailing all cash inflows and outflows for the specified period. This section will help analyze the company's ability to generate cash and manage its liquidity.

06

Double-check all the calculations and ensure that all sections and entries are accurately completed.

07

Sign and date the financial statements and provide any required additional signatures or certifications.

Who needs Kentucky financial statements only:

01

Business owners in Kentucky who are required to submit financial statements as part of their legal or regulatory obligations.

02

Small businesses or startups seeking funding or loans from banks or other financial institutions may need to provide financial statements to demonstrate their financial health.

03

Other stakeholders, such as investors, creditors, or potential business partners, may request financial statements to assess the company's financial status and make informed decisions.

Fill form : Try Risk Free

People Also Ask about kentucky financial statements only

Do I need a prenup in Kentucky?

How do prenups form invalid?

Are prenuptial agreements enforceable in Kentucky?

What are five things that Cannot be included in a prenuptial agreement?

What is a financial statement for a prenuptial agreement?

What makes a prenup unenforceable?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is kentucky financial statements only?

Kentucky financial statements only refer to the financial statements that are prepared specifically for the state of Kentucky, providing an overview of the financial position, performance, and cash flows of an entity operating in Kentucky.

Who is required to file kentucky financial statements only?

Entities operating in Kentucky, such as corporations, partnerships, and other business entities, may be required to file Kentucky financial statements only. The specific requirements can vary based on the entity's size, structure, and industry.

How to fill out kentucky financial statements only?

To fill out Kentucky financial statements only, the entity should gather relevant financial information, including balance sheets, income statements, cash flow statements, and any additional required disclosures. The statements should be prepared in accordance with generally accepted accounting principles (GAAP) and any specific guidance provided by the Kentucky Department of Revenue or other regulatory bodies.

What is the purpose of kentucky financial statements only?

The purpose of Kentucky financial statements only is to provide accurate and transparent financial information about entities operating in Kentucky. These statements are used by various stakeholders, including tax authorities, regulators, lenders, investors, and the public, to assess an entity's financial health, compliance with regulations, and tax liabilities.

What information must be reported on kentucky financial statements only?

Kentucky financial statements only typically include information such as the entity's assets, liabilities, equity, revenue, expenses, net income, cash flows, and any other relevant financial data. The specific requirements may vary based on the entity's size, structure, and industry.

When is the deadline to file kentucky financial statements only in 2023?

The deadline to file Kentucky financial statements only in 2023 may vary depending on the entity's fiscal year-end date and specific regulations. It is advised to consult the Kentucky Department of Revenue or a qualified accounting professional to determine the specific filing deadline.

What is the penalty for the late filing of kentucky financial statements only?

The penalty for the late filing of Kentucky financial statements only can vary based on the entity's size, structure, and applicable regulations. Common penalties may include monetary fines, interest on unpaid taxes, and potential legal consequences. The exact penalties can be found in the Kentucky tax code or by consulting the Kentucky Department of Revenue.

How do I complete kentucky financial statements only online?

pdfFiller has made filling out and eSigning kentucky financial statements only easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I sign the kentucky financial statements only electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your kentucky financial statements only in seconds.

How can I edit kentucky financial statements only on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing kentucky financial statements only right away.

Fill out your kentucky financial statements only online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.