Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

A form refers to a structured document or template used to collect information or data in a standardized manner. Forms are commonly used in various fields such as business, government, education, and healthcare to gather details from individuals or groups. They usually consist of fields, checkboxes, radio buttons, drop-down menus, and text areas that users can fill out or select.

Forms provide a systematic way to organize and capture data, making it easier to process and analyze. They can be in physical paper format or digital, such as online forms found on websites or software applications. Additionally, forms often include instructions or guidelines to assist users in completing them correctly.

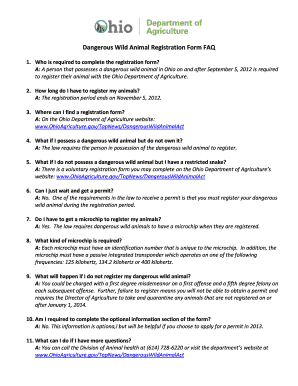

Who is required to file form?

There are various forms that individuals and entities may be required to file, depending on their specific circumstances. Some common forms that individuals are required to file include:

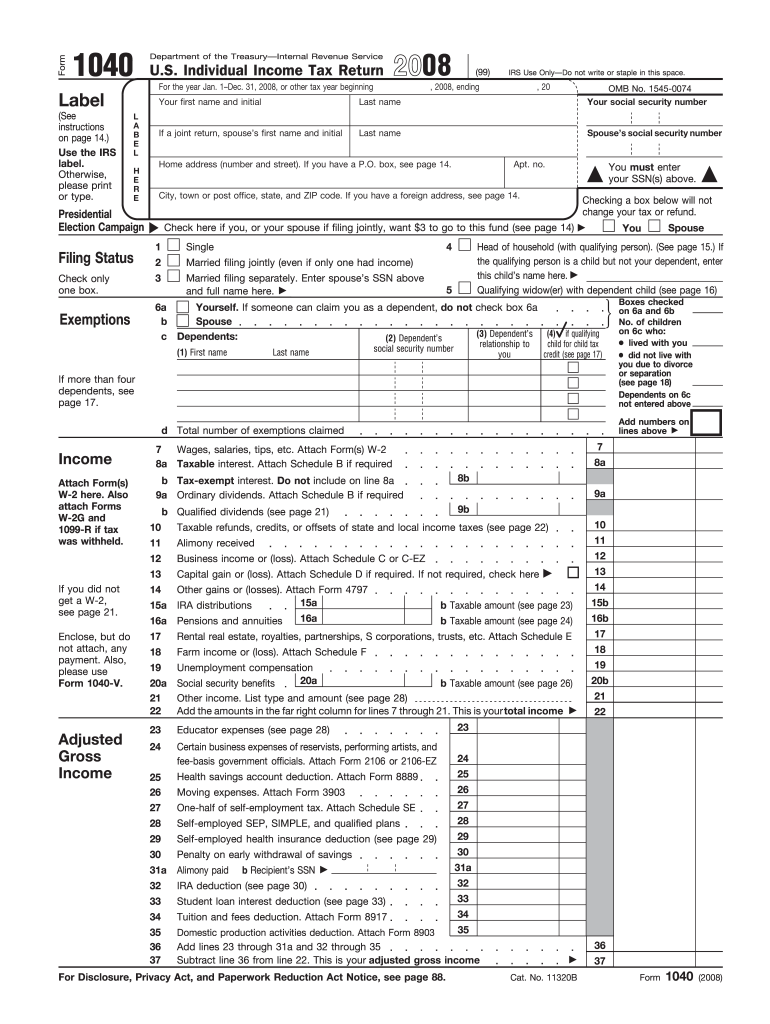

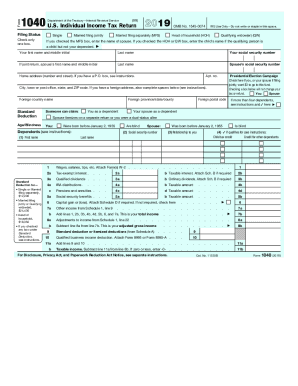

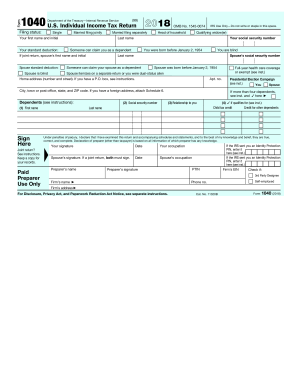

1. Form 1040: This is the standard individual tax return form that most American taxpayers are required to file to report their income, deductions, and credits.

2. Form 1040-EZ: This is a simplified version of the individual tax return form and can be used by taxpayers with less complex financial situations.

3. Form 1099: This form is used to report income earned from sources other than employment, such as freelance work or rental income.

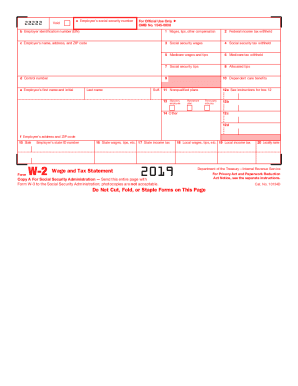

4. Form W-2: This form is provided by employers to their employees and is used to report the wages, tips, and other compensation paid to an individual.

Businesses and entities, on the other hand, may be required to file forms such as:

1. Form 1120: This is the standard corporate income tax return form that most domestic corporations are required to file.

2. Form 1065: This form is used by partnerships to report their income, deductions, and credits.

3. Form 990: Non-profit organizations must file this form to report their financial information and activities to the Internal Revenue Service (IRS).

It is important to note that the specific filing requirements depend on an individual's or entity's income, deductions, and other circumstances. It is recommended to consult with a tax professional or review the guidelines provided by the tax authority in your jurisdiction to determine which forms you are required to file.

To fill out a form, follow these steps:

1. Read the instructions: Go through the form and understand what information is being requested. Make sure you have all the necessary documents or details with you before you begin.

2. Gather required information: Collect all the necessary information, such as your name, address, contact details, Social Security number, etc. This will make the filling process easier.

3. Start with basic details: Begin by providing your personal information, such as your name, date of birth, and address. Fill in each field legibly and accurately.

4. Follow the format: Some forms may have specific formats for dates, phone numbers, or ID numbers. Make sure to enter the information in the requested format to avoid any errors or delays.

5. Use a black or blue pen: Unless specified otherwise, use a black or blue pen to fill out the form. This ensures that the information is clearly visible and can be easily read.

6. Be accurate and honest: Provide accurate and honest information on the form. Falsifying information can have legal consequences.

7. Check for completeness: Review the form once you have filled it out to ensure all the required fields have been completed. Check for any missing or incomplete information.

8. Proofread: Before submitting the form, double-check for any spelling errors or mistakes. Correct any errors neatly by crossing them out with a single line and writing the correct information beside it.

9. Sign and date: If the form requires a signature, sign it in the designated space. Also, include the date when you are filling out the form.

10. Submit the form: Send the completed form through the designated method, such as mail, email, or in-person submission. Keep copies of the form and any supporting documents for your records.

Remember to follow any specific instructions provided on the form or accompanying documentation to ensure accurate completion of the form.

What is the purpose of form?

The purpose of a form is to collect, organize, and submit information in a structured manner. Forms are commonly used in many domains such as business, government, education, and web applications. They serve various purposes, including:

1. Data collection: Forms allow for the collection of specific information from individuals or organizations, ensuring that the required data is obtained accurately and efficiently.

2. Communication: Forms act as a means of communication between different parties. For example, customer feedback forms serve as a communication channel for customers to express their opinions and experiences with a product or service.

3. Documentation and record-keeping: Forms provide a standardized format for documenting and recording information. They ensure consistency and make it easier to retrieve and reference information when needed.

4. Requesting action or services: Forms are often used to request action or services from individuals or organizations. Examples include job application forms, loan application forms, or service request forms.

5. Systematic organization: By organizing information into predefined fields or sections, forms make it easier to process and analyze data. This organization allows for efficient data entry, sorting, and retrieval.

6. Compliance and legal purposes: Forms are often used to comply with legal regulations or requirements. Examples include tax forms, application forms for licenses or permits, and consent forms for medical procedures.

Overall, forms simplify and streamline various processes by providing a structured and standardized way to collect and manage information.

What information must be reported on form?

The information that must be reported on a form can vary depending on the specific form and its purpose. However, some common types of information that may need to be reported on a form include:

1. Personal details: This typically includes the individual's full name, address, date of birth, contact information, and social security or identification number.

2. Employment information: If the form pertains to employment or taxes, it may require reporting details about the individual's employment status, employer's name and address, job title, salary, and other relevant employment details.

3. Financial information: In certain forms related to taxes or financial transactions, individuals may need to report information about their income, assets, debts, investments, and other financial details.

4. Legal information: When filling out legal forms, individuals may be required to report legal information such as case numbers, court-docket numbers, attorney details, and other relevant legal information.

5. Medical information: Some forms related to healthcare may require individuals to report medical information, such as medical history, current medications, allergies, and other health-related details.

6. Educational information: In forms related to education, individuals may need to report information about their educational background, schools attended, academic achievements, and qualifications.

7. Consent and authorization: Many forms require individuals to provide consent or authorization for certain actions or disclosures. This can include signing and dating the form, indicating agreement to the terms and conditions, or providing written consent for specific activities.

It is essential to carefully read and understand each form's instructions to determine which specific information is required to be reported and ensure accurate and complete reporting.

What is the penalty for the late filing of form?

The penalty for the late filing of a form can vary depending on the specific form and the jurisdiction in which it is being filed. In many cases, there is a monetary penalty associated with late filings. This penalty may be a fixed amount or it could be calculated based on a percentage of the tax owed or the amount being reported on the form. The exact amount of the penalty can also depend on how late the form is filed. Additionally, there may be other consequences such as loss of certain deductions or credits if the form is filed late. It is important to consult the specific regulations and guidelines for the particular form and jurisdiction in question.

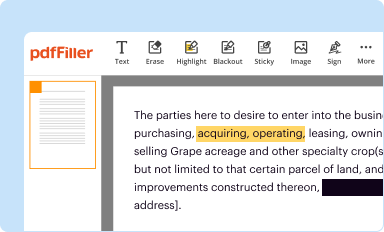

How do I modify my 2008 form - irs in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your 2008 form - irs along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I send 2008 form - irs to be eSigned by others?

Once your 2008 form - irs is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

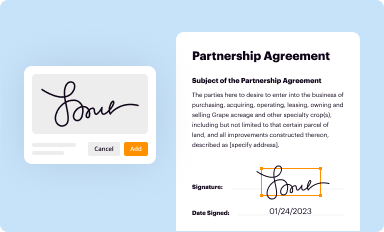

Can I create an eSignature for the 2008 form - irs in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your 2008 form - irs and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.