Get the free ngis car loan form

Show details

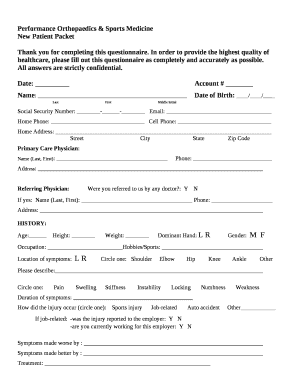

Form NGIF/VCL/01. APPLICATION FORM FOR GRANT OF CONVEYANCE CAR LOAN Name Rank No. Establishment/ Ship Station Date of Commission/ Enrolment Date of Birth Date of Retirement/ Release Martial Status Driving License No. enclose attested photo copy for vehicle loan only. Rupees Only on account of Motor Car/ Scooter/ Personal Computer Loan. under intimation to me. I also authorise LO I/C NPO Mumbai to recover the loan and the loan interest thereon through my IPA as per EMI fixed by NGIF. Signed...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your ngis car loan form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ngis car loan form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

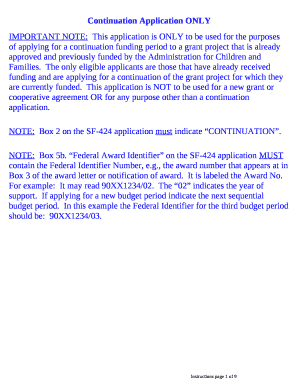

Editing ngis car loan online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ngif car loan form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out ngis car loan form

How to fill out ngis car loan:

01

Gather all necessary documents such as identification, proof of income, and proof of insurance.

02

Visit the ngis website or contact their customer service to obtain the loan application form.

03

Carefully fill out the application form with accurate information including personal details, financial information, and desired loan amount.

04

Ensure that all required fields are completed and all supporting documents are attached.

05

Double-check the application form for any errors or omissions before submitting it.

06

Submit the completed application form and supporting documents either online or in-person as per ngis instructions.

07

Wait for ngis to review your application and make a decision on the car loan.

08

If approved, carefully review the loan terms and conditions offered by ngis.

09

Sign the loan agreement if you agree with the terms and conditions.

10

Follow any additional instructions provided by ngis for completing the loan process, such as providing a down payment or selecting a car from their approved dealerships.

Who needs ngis car loan:

01

Individuals who are looking to purchase a new or used car but do not have sufficient funds to make the purchase outright.

02

Those who prefer to finance their car purchase to spread out the cost over a period of time.

03

People who may not qualify for traditional bank loans due to factors such as low credit scores or limited credit history.

04

Individuals who want to take advantage of ngis competitive interest rates and flexible repayment options.

05

Those who value the convenience and simplicity of applying for a car loan through ngis.

Fill form : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file ngis car loan?

The person who took out the car loan from NGIS (Navy Gateway Inns and Suites) would be required to file the loan.

How to fill out ngis car loan?

To fill out an NGIS car loan application, follow these steps:

1. Visit the NGIS website: Go to the NGIS website (www.ngis.com) and look for the car loan section.

2. Navigate to the car loan application: Locate the car loan application form on the website. It may be labeled as "Car Loan Application" or something similar.

3. Gather necessary information: Before starting the application, collect all the required information, including personal details, employment information, driver's license number, contact information, income details, details of the car you intend to purchase, and any other requested documentation.

4. Start the application: Begin filling out the form by entering your personal details accurately. This will typically include your full name, address, date of birth, and social security number.

5. Provide employment details: Enter your current employment information, including your employer's name, your position, and how long you have been working there.

6. Enter financial information: Provide details about your income, including your monthly salary or wages. You may also need to include any additional sources of income if applicable.

7. Enter car details: Enter the necessary details about the vehicle you intend to purchase, including the make, model, year, and VIN (Vehicle Identification Number).

8. Review the application: Once you have completed all the required fields, check the form thoroughly to ensure accuracy and completeness. Correct any errors or missing information before proceeding.

9. Submit the application: Once you are confident with the application, submit it electronically through the NGIS website. Some loan applications may also require you to print and mail/fax them to the NGIS office.

10. Follow-up: After submitting the application, wait for a response from NGIS. They will review your application and may contact you for additional information or clarification. Be prepared to provide any requested documents promptly.

Note: It is always advisable to read and understand all the terms and conditions associated with the car loan before submitting the application. If needed, consult with an NGIS representative or financial advisor for guidance.

What is the purpose of ngis car loan?

The purpose of the NGIS car loan is to provide financial assistance to individuals who wish to purchase a car but do not have the full amount to pay upfront. The loan allows borrowers to spread out the cost of the car over a set period of time, making it more affordable and manageable.

What information must be reported on ngis car loan?

When reporting on an NGIS car loan, the following information should be included:

1. Loan Details:

- Loan amount: The total amount borrowed for the car loan.

- Interest Rate: The annual interest rate charged on the loan.

- Loan term: The length of time over which the loan will be repaid (e.g., 5 years).

- Repayment Schedule: The amount and frequency of payments, including the due dates for each installment.

2. Borrower Information:

- Name: The full name of the individual or entity taking the car loan.

- Contact Information: Phone number, email address, and mailing address of the borrower.

- Social Security Number/Identification Number: For individual borrowers, their unique identification number is required.

- Employment Information: Employment status, employer name, and contact information.

- Credit History: Information about the borrower's creditworthiness, including credit score and any negative credit events.

3. Vehicle Details:

- Make and Model: The brand and model of the vehicle being financed.

- Vehicle Identification Number (VIN): A unique identification number assigned to the particular vehicle.

- Purchase Price: The total cost of purchasing the vehicle.

- Trade-in Details: If any trade-in transaction is involved, the details of the vehicle being traded, including make, model, and value.

4. Loan Terms:

- Down Payment: The initial amount paid by the borrower towards the purchase price.

- Insurance: Details about the required auto insurance coverage.

- Collateral: Whether the loan is secured by the purchased vehicle, and if so, details of the collateral.

5. Lender Information:

- Lender Name: The name of the financial institution providing the car loan.

- Contact Information: Phone number, email address, and mailing address of the lender.

It is important for the reporting entity to ensure accuracy and compliance with relevant regulations when reporting on an NGIS car loan.

How can I modify ngis car loan without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your ngif car loan form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit ngif latest four wheeler loan in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your ngis car loan, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I complete ngif car loan form on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your ngif latest four wheeler loan, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Fill out your ngis car loan form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ngif Latest Four Wheeler Loan is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.