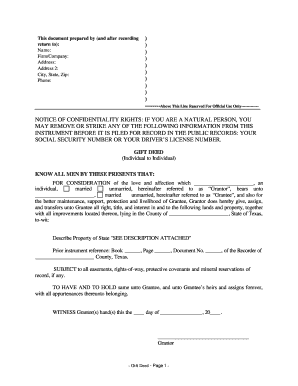

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Gift Deed — California— — Individual to Individual, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USAF control no. CA-020-77

Get the free gift deed california form

Show details

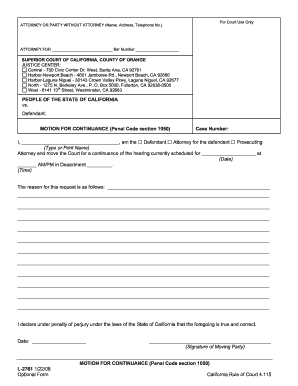

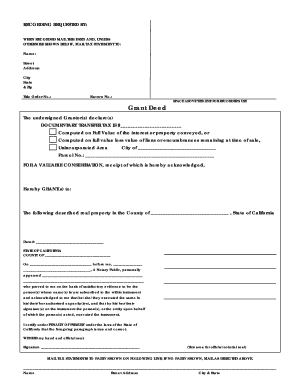

Recording Requested By: When Recorded Mail To: Name: Mailing Address: City: State: Zip Code: Space Above This Line Reserved for Recorders Use Assessor s Property Tax Parcel/Account Number: GIFT DEED

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your gift deed california form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift deed california form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gift deed california form online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit printable gift deed form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out gift deed california form

How to fill out gift tax?

01

Gather all necessary documents, including completed gift tax forms and supporting documentation such as receipts, appraisals, or valuation reports.

02

Calculate the total value of the gifts given during the tax year. This includes both cash and non-cash gifts.

03

Determine if the gifts are eligible for any exemptions or exclusions. Some gifts, such as those given to a spouse or qualified charitable organizations, may be exempt from gift tax.

04

Determine the fair market value of the gifts. For cash gifts, this is the amount of money given. For non-cash gifts, such as property or stocks, a fair market value must be determined.

05

Complete Form 709, the United States Gift (and Generation-Skipping Transfer) Tax Return. Provide accurate information about the gifts given, their values, and any applicable exemptions or exclusions.

06

Attach any necessary supporting documentation to the gift tax return. This may include appraisals or valuation reports for non-cash gifts.

07

Review the completed gift tax return for accuracy and completeness. Make any necessary corrections or additions before submitting it to the appropriate tax authority.

08

File the gift tax return by the deadline. In the United States, the gift tax return is generally due on April 15 of the year following the tax year in which the gifts were given.

09

Keep copies of the completed gift tax return and all supporting documentation for your records.

Who needs gift tax?

01

Individuals who have given gifts of a certain value during a tax year may be required to pay gift tax.

02

In the United States, the Internal Revenue Service (IRS) imposes gift tax on individuals who have given gifts above the annual gift tax exclusion amount, which is subject to change each year.

03

The gift tax is applicable to the donor, not the recipient of the gift. Therefore, if you are the person giving the gift, you may need to pay gift tax if the gifts given exceed the annual exemption amount.

04

It is important to consult with a tax professional or review tax guidelines specific to your country to determine if and when gift tax applies to your situation.

Video instructions and help with filling out and completing gift deed california form

Instructions and Help about gift deed california form trial

Fill gift deed california template : Try Risk Free

People Also Ask about gift deed california form

How does the IRS know if I give a gift?

Is there a penalty for filing a gift tax return late with no tax due?

What is a 709 gift tax form?

What is the difference between form 706 and form 709?

What happens if I don't file a gift tax return?

Do I really need to file a gift tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file gift tax?

Generally, the person who gives a gift is responsible for filing any required gift tax returns. However, if the gift is made by a trust or other entity, the tax filing responsibility may fall on the person who manages the trust or entity.

What is the purpose of gift tax?

Gift tax is a tax imposed on the transfer of property by one individual to another while receiving nothing, or less than full value, in return. The purpose of this tax is to discourage people from giving away large amounts of money or property to avoid estate and inheritance taxes. It is also intended to ensure that the donor pays a portion of the taxes on the gift and does not pass the entire tax burden on to the recipient.

What information must be reported on gift tax?

For gifts that are subject to gift tax, the giver must report the following information on Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return: the date and amount of each gift, the name and address of the recipient, the relationship between the giver and recipient, and a description of the property gifted. The giver must also provide evidence of payment of any gift tax due.

When is the deadline to file gift tax in 2023?

The deadline to file gift tax in 2023 is April 15, 2024.

What is gift tax?

Gift tax is a tax imposed on the transfer of property or assets by one person to another without receiving full monetary compensation in return. It is a tax on the individual making the gift (donor) rather than the recipient (donee). The gift tax is intended to prevent individuals from avoiding estate taxes by transferring their assets as gifts during their lifetime. The Internal Revenue Service (IRS) imposes specific rules and exemptions on gift tax, allowing individuals to give a certain amount of money or assets as gifts without being subject to the tax. However, if the value of the gift exceeds the annual or lifetime exemption limit set by the IRS, the donor may be required to pay gift tax.

How to fill out gift tax?

Filling out a gift tax return can be a complex process, so it is advisable to consult with a tax professional or use tax preparation software. However, here is a general overview of the steps involved in filling out a gift tax return:

1. Determine if you need to file: For the tax year 2021, you need to file a gift tax return if you made gifts exceeding the annual exclusion amount, which is $15,000 per recipient. Additionally, if you made a gift to a non-U.S. citizen spouse exceeding $159,000, you are required to file a gift tax return.

2. Obtain the necessary forms: The primary form used to report gifts is Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return. You can find this form on the Internal Revenue Service (IRS) website or request a copy from the IRS.

3. Provide your personal information: Fill out your personal information, including your name, address, social security number, and filing status.

4. Report the gift details: List each gift made during the tax year. Include the recipient's information, the relationship to you, the fair market value of the gift, and the date it was given. If there were multiple gifts to a single recipient, add them together for a total value.

5. Determine if any deductions or exclusions apply: Certain gifts are exempt from being subject to the gift tax. For example, gifts to qualified charities, gifts to political organizations, gifts for medical or educational purposes, and gifts made to a spouse, among others. Make sure to identify any such gifts and apply the relevant deductions or exclusions.

6. Calculate the gift tax owed: Add up the total value of all the taxable gifts made during the year and subtract any deductions or exclusions. This will give you the net taxable gift. Refer to the IRS Gift Tax Rate schedule to calculate the gift tax owed on the net taxable gift amount.

7. File the completed form: Once you have filled out all the necessary information and calculated the gift tax owed, you can file Form 709 with the IRS. Make sure to sign the form and include any required attachments, such as a detailed listing of the gifts or appraisals for gifts of property.

Remember, this is just a general overview, and the specifics may vary based on your individual circumstances. It is always advisable to seek professional guidance or consult the IRS instructions for Form 709 when preparing your gift tax return.

What is the penalty for the late filing of gift tax?

The penalty for late filing of gift tax is generally 5% of the gift tax due for each month or part of a month that the return is late, up to a maximum penalty of 25% of the total gift tax due. However, if the failure to file is due to fraud, the penalty can be increased to 75% of the tax due. Note that penalties and interest may vary depending on the specific tax laws and regulations of a particular country or jurisdiction.

How can I send gift deed california form for eSignature?

printable gift deed form is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Where do I find california gift deed form?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific gift tax and other forms. Find the template you need and change it using powerful tools.

How do I complete deed of gift form on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your gift deed california form, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

Fill out your gift deed california form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

California Gift Deed Form is not the form you're looking for?Search for another form here.

Keywords relevant to gift property form

Related to california gift deed

If you believe that this page should be taken down, please follow our DMCA take down process

here

.