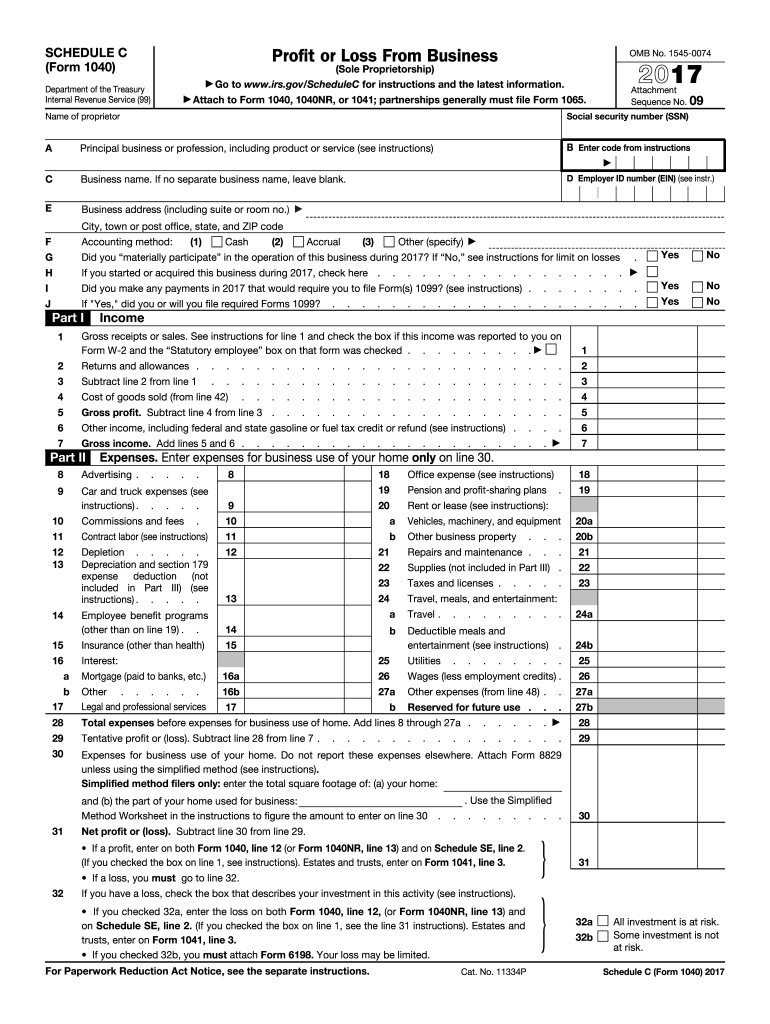

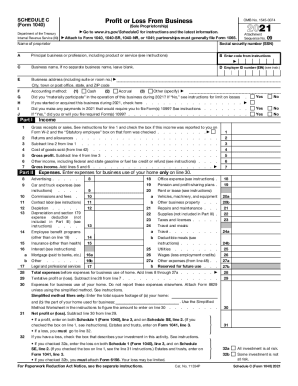

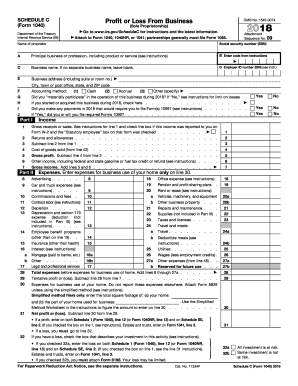

Who needs the Schedule C (Form 1040) 2016?

The Schedule C (Form 1040) is necessary for business owners, or “sole proprietors”. A sole proprietor is a business owner with no employees or partners, such as a freelance photographer.

If you earned money from a hobby or other sporadic activity, that does not count as a business.

The Schedule C (Form 1040) is also used to report any wages or expenses you had at a job that didn’t take taxes out for you. A good example of this would be an independent contractor or self-employed. You may also need to fill it out this form if you were a part of a qualifying joint venture, or received a form 1099-MISC for miscellaneous income.

Are there exceptions to who needs to fill out the Schedule C (Form 1040)?

If you are a small business owner or a statutory employee with less than $5,000 in business expenses, you are exempt from filling out the Schedule C (Form 1040). Instead, you can fill out a much simpler form, 1040 schedule C-EZ.

What is the Schedule C (Form 1040) for?

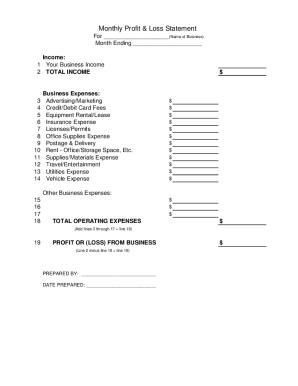

The form is for small business owners, sole proprietors, statutory employees, and anyone with miscellaneous income to report their business’ income or loss.

What information do you need when you file the Schedule C (Form 1040)?

The Schedule C (Form 1040) can require many pieces of information. It really depends on how your business operates. At the very least, you will need:

- Your contact information such as phone number, full mailing address, etc.

- Your business’ contact information

- Your social security number, and your business’ tax ID

- Your financial records for the year

- Your filled out 1040 tax return

Is the Schedule C (Form 1040) accompanied by other forms?

While the Schedule C (Form 1040) does not require other forms itself, you may be required to fill out related forms. The IRS lists the following forms as closely related in its 1040 schedule C instructions manual:

- Schedule A (Form 1040) to deduct interest, taxes, and casualty losses not related to your business.

- Schedule E (Form 1040) to report rental real estate and royalty income or loss that is not subject to self-employment tax.

- Schedule F (Form 1040) to report profit or (loss) from farming.

- Schedule J (Form 1040) to figure your tax by averaging your farming or fishing income over the previous 3 years. Doing so may reduce your tax.

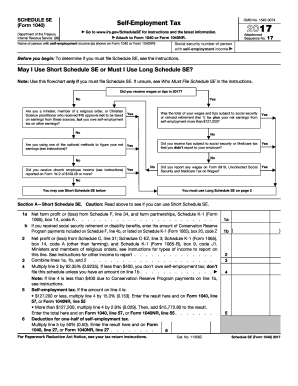

- Schedule SE (Form 1040) to pay self-employment tax on income from any trade or business.

- Form 3800 to claim any of the general business credits.

- Form 4562 to claim depreciation (including the special allowance) on assets placed in service in 2014, to claim amortization that began in 2014, to make an election under section 179 to expense certain property, or to report information on listed property.

- Form 4684 to report a casualty or theft gain or loss involving property used in your trade or business or income-producing property.

- Form 4797 to report sales, exchanges, and involuntary conversions (not from a casualty or theft) of trade or business property.

- Form 6198 to figure your allowable loss if you have a business loss, and you have amounts invested in the business for which you are not at risk.

- Form 8582 to figure your allowable loss from passive activities. Form 8594 to report certain purchases or sales of groups of assets that constitute a trade or business.

- Form 8824 to report like-kind exchanges.

- Form 8829 to claim actual expenses for business use of your home.

- Form 8903 to take a deduction for income from domestic production activities.

What else do I need to send with the Schedule C (Form 1040)?

Depending on your particular tax situation, you may send your Schedule C (Form 1040) on its own or with documents that prove your expenses and income for the year. In almost all cases, the Schedule C (Form 1040) will be accompanied by the IRS form 1040, which should be filled out before a schedule form. If the IRS needs any additional information with your tax return, they will request it through mail.

When is the Schedule C (Form 1040) due?

Your 1040 schedule C form is due at the same time as your tax return, on April 15 of every tax year.

Where do I send a 1040 schedule C?

Where you send your physical 1040 schedule C form depends on your state, and whether you are sending payment with your tax return. Your 1040 schedule C will always accompany your other 1040 tax return forms.

How do I fill out the Schedule C (Form 1040)?

The Schedule C (Form 1040) can be filled out and filed in many ways. If you wish, you can print it out and send it in yourself using filler. For more assistance, check out the following video: