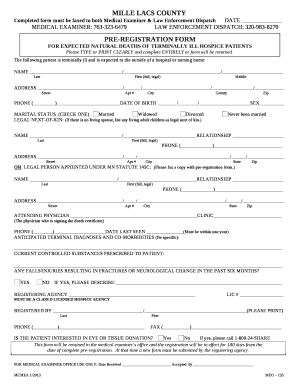

Get the free (SAMPLE) LONG FORM ACCOUNTABLE REIMBURSEMENT POLICY

Show details

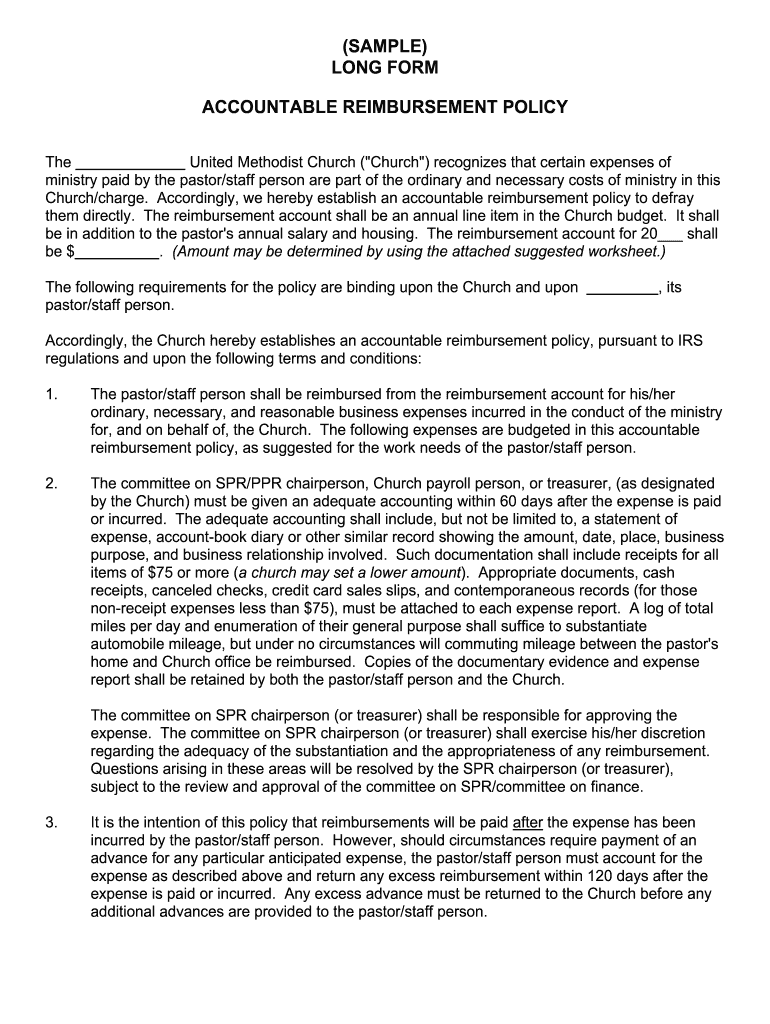

(SAMPLE) LONG FORM ACCOUNTABLE REIMBURSEMENT POLICY The United Methodist Church (Char h”) recognizes that certain expenses of ministry paid by the pastor/staff person are part of the ordinary and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your sample long form accountable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sample long form accountable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sample long form accountable online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit sample long form accountable. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out sample long form accountable

01

To fill out the sample long form accountable, begin by gathering all necessary information. This includes personal details such as your name, address, and contact information.

02

Next, carefully read and understand the instructions provided on the form. This will ensure that you provide accurate and complete information.

03

Fill in the required fields on the form, following the given format. Double-check for any errors or omissions before proceeding.

04

If there are any sections or questions you are unsure about, seek clarification from a supervisor, trusted colleague, or the appropriate authority.

05

Provide any supporting documentation or attachments as requested. This may include relevant receipts, invoices, or other proof of expenditures, depending on the purpose of the form.

06

Review the completed form to ensure all information is accurate and legible. Make any necessary corrections before submitting it.

07

Sign and date the form where required, and follow any additional submission instructions provided.

08

Finally, submit the filled-out form according to the specified method (e.g., mail, email, or online submission).

Who needs the sample long form accountable?

01

Individuals who are required to accurately report their expenses and provide a detailed account of financial transactions may need the sample long form accountable.

02

Organizations or businesses that enforce strict accountability measures for their employees, contractors, or members may also require the use of the sample long form accountable.

03

Individuals or organizations involved in financial auditing or compliance may use the sample long form accountable to gather necessary information or assess adherence to accountability standards.

Fill form : Try Risk Free

People Also Ask about sample long form accountable

How do I make a reimbursement policy?

What is an accountable plan reimbursement policy?

What is an accountable employee expense reimbursement plan?

How do you write a reimbursement policy?

How to set up an accountable plan for expense reimbursement?

What is a standard expense reimbursement policy?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sample long form accountable?

Sample long form accountable refers to a written document or template that outlines the necessary elements of an accountable report. It typically includes detailed information and descriptions of actions taken, decisions made, and outcomes achieved in a specific situation or project. The long form format allows for a comprehensive and in-depth account of the accountable party's activities and responsibilities. Such a document is often used to provide a record of transparency, responsibility, and justification for actions taken.

Who is required to file sample long form accountable?

Individuals who are required to file a sample long-form accountable plan are typically employees who receive reimbursement for business expenses. These individuals must fulfill certain criteria set by the Internal Revenue Service (IRS) to use the accountable plan method for reporting their expenses. The accountable plan allows employees to receive tax-free reimbursement for legitimate business expenses, but they must substantiate and report these expenses properly. The filing of a sample long-form accountable plan helps in maintaining proper documentation for tax purposes.

How to fill out sample long form accountable?

To fill out a long form accountable, follow these steps:

1. Start by entering the current date at the top of the form. This will establish the timeframe for the accountable transaction.

2. Identify the purpose of the accountable transaction. Provide a brief description of the reason for the expense or income.

3. Record the name of the person or entity the transaction involves. This can be an individual or a company.

4. Specify the amount of money involved in the transaction. Indicate whether it is an expense (outgoing) or income (incoming).

5. If applicable, provide any additional details about the transaction, such as the specific goods or services involved, payment methods, or any relevant notes.

6. If necessary, calculate any applicable taxes or deductions associated with the transaction and record them in the appropriate sections of the form.

7. Summarize the transaction by calculating the total amount involved, including any taxes or deductions.

8. If you received an income, deduct any expenses related to the transaction. Subtract these expenses from the total amount to calculate the net income.

9. If applicable, attach any supporting documentation (such as receipts) to the long form accountable.

10. Review the form for accuracy and completeness. Verify that all information provided is correct and that calculations are accurate.

11. Sign and date the form to indicate that you have filled it out truthfully and in compliance with all relevant guidelines or regulations.

Remember, the process may vary depending on the specific accountable form you are using. Ensure you follow any specific instructions provided by the form's issuer or your organization's policies.

What is the purpose of sample long form accountable?

The purpose of a sample long form accountable is to provide a template or example of a detailed report or document that showcases accountability. It is typically used as a guide or reference for professionals or organizations to structure their own accountability reports or documents. This long form accountable may include various sections such as a description of activities or events, detailed financial information, explanations of decisions and outcomes, analysis of performance or progress, and any other relevant information that helps demonstrate accountability and transparency.

What information must be reported on sample long form accountable?

The specific information that must be reported on a long form accountable form may vary depending on the jurisdiction and the purpose of the form. However, some common information that is typically required to be reported on a long form accountable may include:

1. Heading: The top of the form usually includes a heading that identifies the form as a long form accountable and provides information such as the name of the organization or company, the date of the report, and the period covered by the report.

2. Accountable person's details: The form generally requires the accountable person to provide their name, position, contact information, and any other relevant identifying information.

3. Accountable accounts: This section typically includes a list of all accountable accounts held by the accountable person. It may include information such as the account name, account number, financial institution, and the purpose or type of account.

4. Receipts and expenses: The form usually provides space to report individual transactions, including receipts and expenses. Each transaction is typically listed separately and may include details such as the date, description, amount, purpose, and any supporting documentation attached.

5. Accountable advances: If the accountable person has received any advances, the form may require details on the date of the advance, the purpose, the amount received, and any repayments made.

6. Total accountable amount: The form typically requires the accountable person to calculate and provide the total amount of accountable funds received, including advances, receipts, and expenses.

7. Certification and signatures: The form often includes a section where the accountable person certifies the accuracy and completeness of the report. It may require the accountable person's signature and the date of certification.

Note that this is just a general outline, and the specific requirements for a long form accountable may vary depending on the reporting guidelines set by the governing authority or organization.

How do I modify my sample long form accountable in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your sample long form accountable and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Can I sign the sample long form accountable electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your sample long form accountable in seconds.

How do I complete sample long form accountable on an Android device?

On Android, use the pdfFiller mobile app to finish your sample long form accountable. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your sample long form accountable online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.