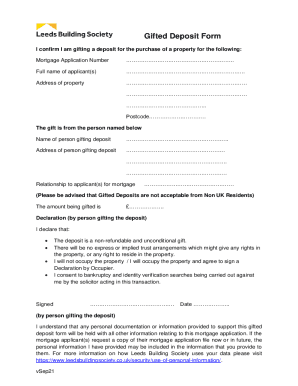

UK Leeds Building Society Gifted Deposit Form 2014 free printable template

Show details

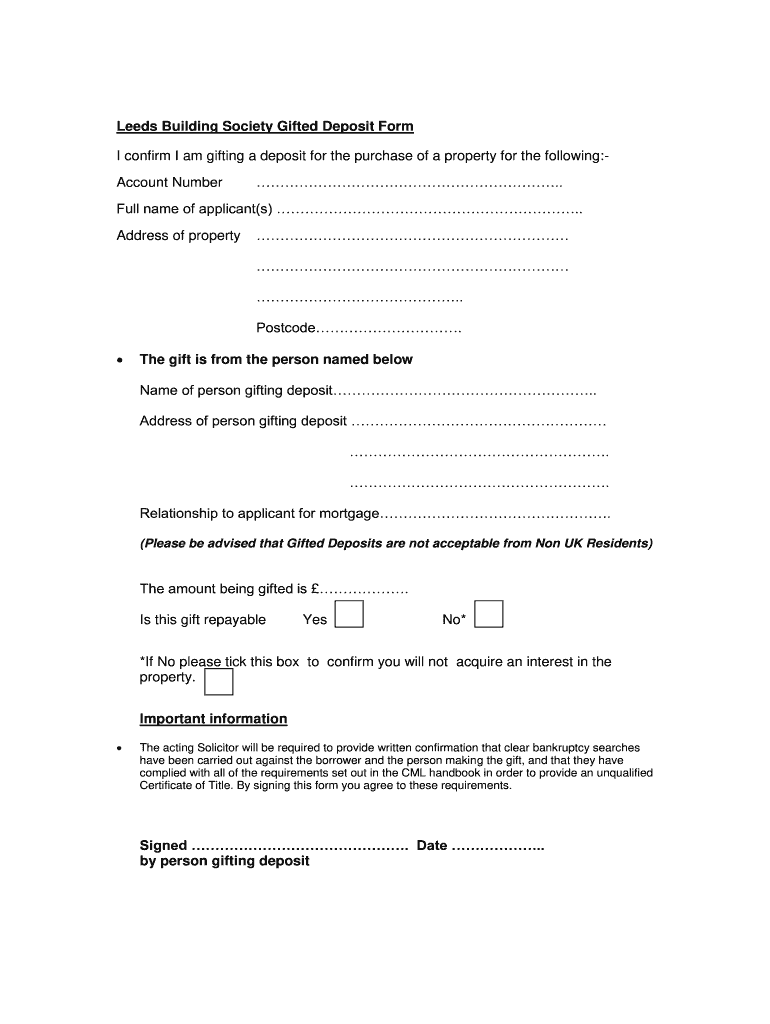

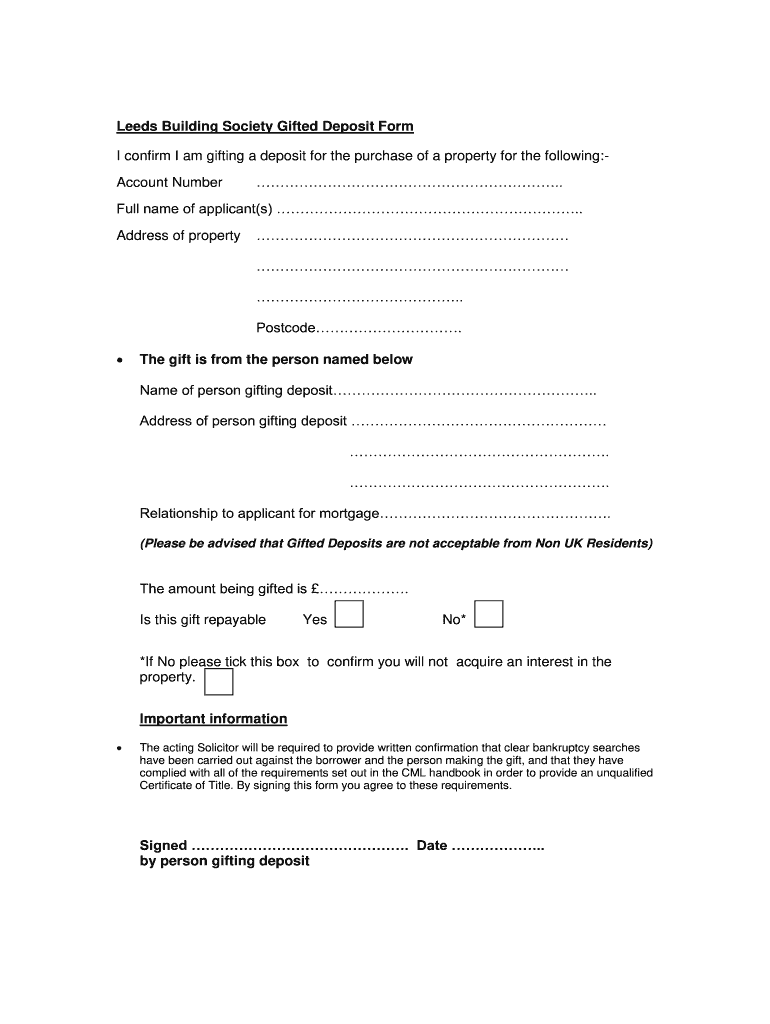

Leeds Building Society Gifted Deposit Form I confirm I am gifting a deposit for the purchase of a property for the following:Account Number. Full name of applicant(s). Address of property. Postcode

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign UK Leeds Building Society Gifted Deposit

Edit your UK Leeds Building Society Gifted Deposit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK Leeds Building Society Gifted Deposit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UK Leeds Building Society Gifted Deposit online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit UK Leeds Building Society Gifted Deposit. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK Leeds Building Society Gifted Deposit Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK Leeds Building Society Gifted Deposit

How to fill out UK Leeds Building Society Gifted Deposit Form

01

Download the Leeds Building Society Gifted Deposit Form from their official website.

02

Fill in the personal details of the gift donor, including their name, address, and relationship to the recipient.

03

Provide the amount of the gift being given to the recipient for their deposit.

04

Include information about the property being purchased, such as the address and purchase price.

05

Sign and date the form to confirm that the gift is unconditional and does not need to be repaid.

06

Submit the completed form along with any necessary identification documents to Leeds Building Society.

Who needs UK Leeds Building Society Gifted Deposit Form?

01

Individuals who are receiving a monetary gift to help with their house deposit.

02

First-time home buyers who require financial assistance from family or friends.

03

Those applying for a mortgage with Leeds Building Society and needing to declare gifted deposits.

Fill

form

: Try Risk Free

People Also Ask about

How do you bypass a gifted deposit?

This can be quite simple. A signed letter or document outlining that the deposit is a gift and not a loan is typically enough to satisfy lenders. The signed document should clearly state that the deposit is not a loan and doesn't need to be repaid back.

How do you prove money is a gift?

A gift letter is a formal document proving that money you have received is a gift, not a loan, and that the donor has no expectations for you to pay the money back. A gift can be broadly defined to include a sale, exchange, or other transfer of property from one person (the donor) to another (the recipient).

How do I avoid gift tax on a down payment?

ing to the IRS gift tax exclusions in 2022, any down payment gift below $16,000 does not have to be reported. Beyond that amount, the funds must be reported on the donor's gift tax return. In turn, parents can collectively give up to $32,000 per child without needing to report those funds to the IRS.

What is an example of a gifted deposit letter UK?

Dear Sirs, (I/We) confirm that (I/we) (am/are) gifting (full names of purchaser/s) of (address of purchaser/s), (my/our) (relationship to giver/s), £(amount being gifted) from (source of funds) towards the deposit for the purchase of the above property.

How do you write a gift letter?

How To Write a Gift Letter The exact dollar amount of the gift. The donor's name, address, and phone number. The donor's relationship to the loan applicant. The date when the funds were or will be transferred. A statement that no repayment is expected. The address of the property being purchased (if known at the time)

How much money requires a gift letter?

Gift Letters And Taxes The annual gift exclusion is $15,000 for 2021, which means your donor doesn't need to report anything if they give you less than $15,000. They'll need to file a gift tax return if they give you more than that amount. A gift tax return discloses to the government the amount they've given to you.

What is a letter for a gift of money?

I/We [name of gift-giver(s)] intend to make a GIFT of $ [dollar amount of gift] to [name(s) of recipient(s)] , my/our [relationship, such as son or daughter], to be applied toward the purchase of property located at: [address of the house you're buying, if known] .

Can a family member gift you money for a down payment?

Most conventional mortgage loans allow homebuyers to use gift money for their down payment and closing costs as long as it's a gift from an acceptable source, such as from family members. Fannie Mae and Freddie Mac define family as the following: Parent. Children (including adopted, step and foster children)

Is a gift letter a legal document?

A gift letter is a formal legal document that declares that a loan applicant received funds as a gift and not a loan. All gift letters explicitly state that the gift does not need to be repaid. Loan applicants need to submit a gift letter when using a monetary gift on a mortgage down payment.

What is a gift explanation letter?

Letter of Explanation (LOE): gift letter A gift letter is required when a borrower is using gift money as part or all of their down payment on a mortgage. The gift letter requests a statement from the donor confirming that no repayment is expected from the borrower.

How do you document a gift of money?

A gift letter should include the following information: The exact dollar amount of the gift. The donor's name, address, and phone number. The donor's relationship to the loan applicant. The date when the funds were or will be transferred. A statement that no repayment is expected.

How do you write a gifted deposit letter?

Gifted deposit letter template Their name. Your name. The total amount given. A statement that it is a gift. A statement that the gift has no commercial interest. Confirmation that the gift giver has no stake in the property. Confirmation that the gift giver can afford to give you the money.

How do I provide proof of gifted deposit?

You will need to provide your solicitor with a letter that confirms the deposit is a gift. The letter should lay out that the giver has no right to the property. This is known as a gifted deposit letter. This letter proves that you won't have to pay back the money given at a later date.

How do you write a real estate gift letter?

A mortgage gift letter should include specific details about the donor, buyer, and gift amount, including: Donor's name, address, and relationship to the buyer. Buyer's name. Address of property being purchased. Gift amount, transfer date, and banking details. A statement certifying that the donor doesn't expect repayment.

How do you write a gift declaration?

The parties declare the full name of the person giving and receiving the gift, their relationship to them and the purpose. For example: We assisting our daughter whose full name is Claudine Smith in their purchase of 41 An Example Road, B4 1NE.

What is a gifted deposit declaration?

What is a gifted deposit declaration or letter? If you receive a gifted deposit, your lender may require whoever is gifting you the money to sign a 'Gifted Deposit Letter'. This will need to include: The name of the person receiving the gift. The source of the funds.

How do you prove gifted deposit for a mortgage?

Prove The Source Of Your Down Payment A gift letter is a statement that ensures your lender the money that came into your account is a gift and not a loan. The person who gave you the money must write and sign the gift letter as well as provide their personal information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my UK Leeds Building Society Gifted Deposit in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign UK Leeds Building Society Gifted Deposit and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send UK Leeds Building Society Gifted Deposit to be eSigned by others?

When your UK Leeds Building Society Gifted Deposit is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit UK Leeds Building Society Gifted Deposit straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing UK Leeds Building Society Gifted Deposit right away.

What is UK Leeds Building Society Gifted Deposit Form?

The UK Leeds Building Society Gifted Deposit Form is a document that allows a borrower to declare that the deposit for a mortgage is being gifted to them by a family member or friend, rather than being earned or saved by the borrower.

Who is required to file UK Leeds Building Society Gifted Deposit Form?

The form is required to be filled out by borrowers who are receiving a gifted deposit from a third party, typically a family member, as part of their mortgage application process.

How to fill out UK Leeds Building Society Gifted Deposit Form?

To fill out the form, the gifter must provide their personal details, including their relationship to the borrower, the amount of the gift, and their declaration confirming that the funds are indeed a gift and do not need to be repaid.

What is the purpose of UK Leeds Building Society Gifted Deposit Form?

The purpose of the form is to ensure transparency in the source of the deposit, allowing the building society to assess the financial situation of the borrower accurately and mitigate the risk associated with gifted deposits.

What information must be reported on UK Leeds Building Society Gifted Deposit Form?

The form requires the gifter to provide their personal information, the amount being gifted, their relationship to the borrower, and a declaration of the nature of the gift.

Fill out your UK Leeds Building Society Gifted Deposit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK Leeds Building Society Gifted Deposit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.