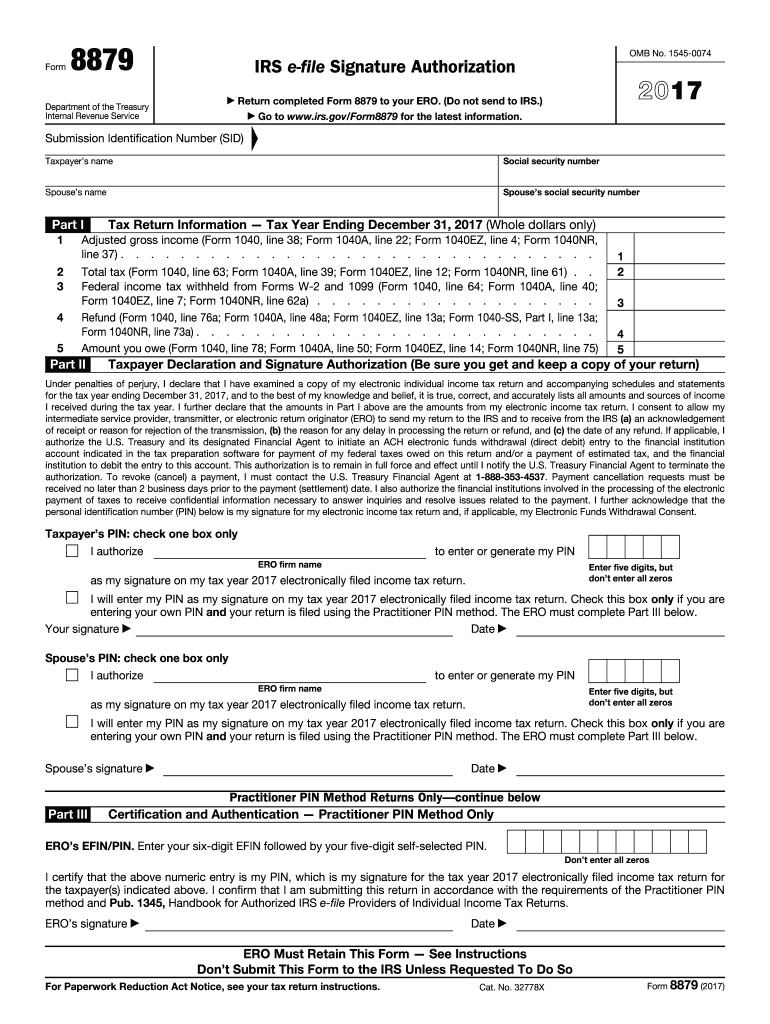

What is form 8879?

Form 8879 is the declaration document and signature authorization for an electronically filed income tax return filed by an Electronic Return Originator (ERO). Complete IRS form 8879 when your Personal Identification Number (PIN) is used or when you authorize the ERO to insert or create your PIN on your e-filed individual income tax return.

Who should file the 8879 form 2017?

Taxpayers who electronically file their tax returns via the ERO e-filing service must fill out and send form 8879 to the ERO for each return transmission. An ERO accepts a separate 8879 form as an authorization to file a return for each return they want to transmit. Please note you cannot complete and sign consent to e-file returns for multiple years.

What information do you need to provide in the 8879 form?

While filling out IRS form 8879, you should provide the following information:

- Submission identification number (SID)

- Taxpayer's full name and Social Security Number (SSN)

- Taxpayer spouse's name and SSN

- Tax return information

- Taxpayer's PIN

- Spouse's PIN

- ERO firm name

- Date of completion

- Both the taxpayer's and their spouse's signatures

An ERO also fills out the 8879 form on their side, providing the ERO's 6-digit EFIN followed by its 5-digit self-selected PIN, the ERO's signature, and document completion date.

How do you fill out the IRS form 8879 in 2018?

You can complete the 8879 form on paper with a handwritten signature or fill it out electronically, saving time and money on printing services.

Here's how you can quickly prepare your form 8879 electronically with pdfFiller:

- Open the sample in the editor by clicking Get Form.

- Type in your SID number and click Next to proceed to the following text fields.

- Click on checkboxes to give consent using your PIN as a signature authorization.

- Click on the Date field and choose your current date in the calendar.

- Click on the Signature area and type in your name, upload a QR code, an image of your handwritten signature, or draw it to eSign your 8879 form.

- Click the Done button above when finished.

Next, choose whether to print out your eSigned form 8879 from the editor or send it to the ERO - via email or with a direct USPS option available in the editor.

Do other forms accompany form 8879?

The 8879 form is a self-contained document and is not accompanied by other IRS forms. However, you need to complete it when e-filing your IRS Form 1040NR.

When is the 8879 form due?

Before submitting their income tax return documents, taxpayers must complete and file their form 8879 to the ERO in advance.

Where do I send IRS 8879 form?

It's important not to send the 8879 form to the IRS until requested. After filling out this document, you should keep it for at least three years to confirm your e-file signature. If you get a request to provide the IRS form 8879, you should retain a copy of it.