TX Comptroller 01-924 2017 free printable template

Show details

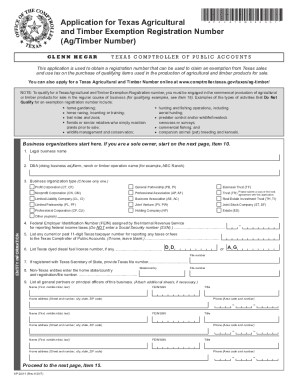

Do not send the completed certificate to the Comptroller of Public Accounts. Form 01-924 Back Rev.4-17/4 Always Exempt These items are always exempt and do not require an exemption certificate or an ag/timber number. PRINT FORM 01-924 Rev.4-17/4 CLEAR FORM Texas Agricultural Sales and Use Tax Exemption Certificate Commercial agricultural producers must use this form to claim exemption from Texas sales and use tax when buying leasing or renting qualifying agricultural items they will use...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your texas ag exemption requirements form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas ag exemption requirements form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit texas ag exemption requirements online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit texas ag tax exempt form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

TX Comptroller 01-924 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out texas ag exemption requirements

How to fill out Texas Ag Tax Exempt:

01

Obtain the Texas Agricultural and Timber Exempt Certificate (Form 01-924) from the Texas Comptroller's website or their office.

02

Fill out the top section of the form with your personal information such as name, address, and contact details.

03

Provide your Texas Taxpayer ID number or Social Security number in the designated field.

04

Indicate the type of farming or ranching activity you are engaged in, such as crop farming, livestock production, or timber operations.

05

Enter your agricultural or timber products' details, including their description, quantity, and estimated annual amount of sales.

06

If applicable, provide information on any agricultural or timber-related services you offer.

07

Sign and date the form, certifying that the information provided is accurate and complete.

08

Submit the completed form to the Texas Comptroller's office by mail or electronically through their website.

Who needs Texas Ag Tax Exempt:

01

Farmers and ranchers engaged in agricultural activities, such as crop farming, livestock production, or timber operations, may require a Texas Ag Tax Exempt certificate.

02

Businesses or individuals involved in selling agricultural or timber products, either in raw form or processed, may need this exemption certificate to avoid paying sales tax on qualifying sales.

03

It is essential for those who qualify for the exemption to obtain the Texas Ag Tax Exempt certificate to ensure compliance with state tax laws and to benefit from tax savings.

Video instructions and help with filling out and completing texas ag exemption requirements

Instructions and Help about exemption farm texas form

Hi farmer ranch customers we're here today to let you know about some new changes that are coming through the state of Texas any purchases made after January first 2012 will require a new agricultural permit or sales tax will be charged to find out more information about this you can visit word Texas org and find out more you

Fill ag exemption form : Try Risk Free

People Also Ask about texas ag exemption requirements

Can I get an ag exemption in Texas?

How many acres do you need to get ag exempt in Texas?

How many acres do you need for ag exemption in Texas?

How do I get ag sales tax exemption in Texas?

What qualifies for agricultural exemption in Texas?

How many animals do you need for an ag exemption in Texas?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is texas ag tax exempt?

Texas Agriculture Tax Exemption (Ag/Timber Exemption) is a state level exemption from certain taxes for certain activities related to agriculture and timber production. It exempts agricultural and timber producers from certain taxes, including sales and use taxes, motor vehicle taxes, and ad valorem taxes.

Who is required to file texas ag tax exempt?

Texas agricultural producers who produce and sell agricultural products are required to file for an agricultural tax exemption. The Texas Comptroller of Public Accounts handles the application and approval process for agricultural tax exemptions.

How to fill out texas ag tax exempt?

To fill out a Texas Agricultural Exemption Certificate, you will need to provide the following information:

• The name, address, and contact information of the agricultural business.

• The name and Social Security number of the owner, or the Federal Employer Identification Number (FEIN) of the business.

• The type of agricultural activity that is being conducted on the property.

• The address of the property where the agricultural activity is taking place.

• A description of the products or services that are being purchased with the exemption.

• The signature of the owner or authorized representative.

Once you have all of this information, you can submit your Texas Agricultural Exemption Certificate to the appropriate taxing authority in your county.

What is the purpose of texas ag tax exempt?

The Texas AG Tax Exempt program allows agricultural producers and land owners to receive an exemption from certain taxes, including sales tax, on the purchase of agricultural supplies and equipment used in the production of agricultural products. This exemption helps to reduce the cost of production and keeps Texas' agricultural industry competitive.

What information must be reported on texas ag tax exempt?

The Texas Agricultural Tax Exemption (ATAE) is a sales and use tax exemption available to qualified agricultural producers. To qualify for an ATAE, an agricultural producer must provide the following information to the Comptroller of Public Accounts:

1. Name of agricultural producer.

2. Business address.

3. Business telephone number.

4. Social Security or Federal Employer Identification Number.

5. Type of agricultural activity conducted.

6. Description of goods and services purchased.

7. Total amount of goods and services purchased.

8. Description of any improvements made to land or buildings used for agricultural production.

9. Total amount of improvements made to land or buildings used for agricultural production.

10. Description of any agricultural production equipment purchased.

11. Total amount of agricultural production equipment purchased.

12. Description of any agricultural products sold.

13. Total amount of agricultural products sold.

14. Total amount of sales and use taxes paid.

15. Any other information that may be requested by the Comptroller in order to determine eligibility for the ATAE.

What is the penalty for the late filing of texas ag tax exempt?

The penalty for late filing of a Texas Agricultural Tax Exemption (Ag/Timber) application is $50. It is important to note that this penalty is waived if it is the first time the applicant has failed to file the application on time.

How do I execute texas ag exemption requirements online?

With pdfFiller, you may easily complete and sign texas ag tax exempt form online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I complete exemption agricultural exempt on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your exemption texas by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

How do I edit texas agricultural tax exemption on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share exemption texas i form on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

Fill out your texas ag exemption requirements online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Exemption Agricultural Exempt is not the form you're looking for?Search for another form here.

Keywords relevant to texas agricultural form

Related to form 01 924

If you believe that this page should be taken down, please follow our DMCA take down process

here

.