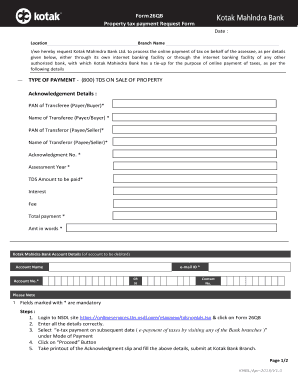

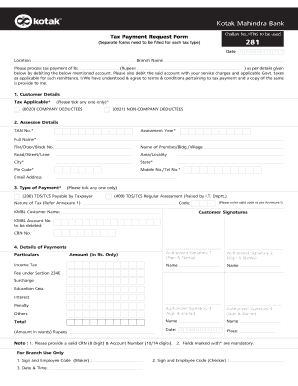

India Kotak Mahindra Bank Form 26QB 2016-2024 free printable template

Show details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your kotak form tax 2016-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kotak form tax 2016-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing kotak form tax online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit income tax challan 280 online payment kotak mahindra bank form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

India Kotak Mahindra Bank Form 26QB Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out kotak form tax 2016-2024

How to fill out kotak form tax:

01

Start by gathering all the necessary documents such as your income statements, investment details, and any other relevant financial information.

02

Ensure that you have a clear understanding of the different sections and fields in the kotak form tax. Familiarize yourself with the instructions provided.

03

Begin filling out the form by entering your personal details, such as your name, address, and contact information.

04

Move on to the income section and accurately report your income from various sources. Include details of salary, business income, rental income, and any other applicable income.

05

Deduct any eligible expenses or deductions from your income in the appropriate section. This could include expenses related to education, healthcare, home loans, or investments.

06

If you have made any investments or have been paying insurance premiums, provide the necessary details in the investment section of the form.

07

Cross-check all the information entered to ensure accuracy. Any errors or discrepancies can lead to complications later on.

08

Sign and date the form once you have completed all the required fields.

09

Submit the form to the appropriate authority or follow any specific instructions provided.

Who needs kotak form tax:

01

Individuals who have earned taxable income during a financial year are required to fill out the kotak form tax.

02

Salaried employees, self-employed individuals, and business owners are among those who may need to fill out this form.

03

Individuals who have made investments, have rental income, or receive income from other sources may also need to fill out this form to report their taxable income accurately.

04

It is important to note that the requirements for filling out this form may vary from country to country, so it is essential to consult the relevant tax authority or seek professional advice to determine if you need to fill out the kotak form tax.

Fill kotak mahindra 26qb : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is kotak form tax?

Kotak Form Tax is not a widely recognized term or concept. It is possible that you are referring to Kotak Mahindra Bank, an Indian financial institution, which may have its own tax-related forms or services. However, without further information or context, it is challenging to provide a specific answer.

Who is required to file kotak form tax?

It is not clear what you are referring to when you mention "kotak form tax." If you are referring to the income tax returns in India, then every individual or entity that meets certain criteria is required to file the income tax return. The specific criteria vary based on factors such as income level, age, and source of income. It is advisable to consult a tax professional or refer to the official guidelines provided by the Income Tax Department in India for specific information on who needs to file tax returns.

How to fill out kotak form tax?

To fill out a Kotak tax form, follow these steps:

1. Obtain a physical copy of the Kotak tax form, either by downloading it from their website or picking it up from a Kotak branch.

2. Read the instructions on the form carefully to understand the requirements and sections to be filled.

3. Collect and organize all the necessary documents and information required to complete the form, such as your PAN card, bank statements, salary slips, investment details, and any other relevant documents.

4. Start by providing your personal details, such as your name, address, contact information, and PAN number, in the dedicated spaces.

5. Move on to the income details section. Include information about your salary, dividends, interest income, rental income, and any other sources of income. Ensure that you provide accurate information and include supporting documents if required.

6. Declare your deductions, exemptions, and rebates, if applicable. This may include deductions for life insurance premiums, Provident Fund contributions, medical insurance premiums, and others. Make sure to attach the necessary documents to support your claims.

7. If you are filing the tax form for someone else or if you have an authorized representative, provide their details in the appropriate sections.

8. Double-check all the information you have provided before proceeding further to avoid any errors or mistakes.

9. Sign and date the form at the designated space. If you are filing the form electronically, follow the guidelines provided for digital signatures.

10. Submit the completed form along with the required supporting documents to the appropriate tax authorities. You may submit it physically at a designated branch or submit it online, depending on the guidelines provided by Kotak and the tax department.

It is always advisable to consult with a tax professional or accountant to ensure accurate and proper completion of your tax form.

What is the purpose of kotak form tax?

The purpose of the Kotak form for tax is to report and document tax-related information to the appropriate tax authorities. It helps individuals and businesses accurately report their income, deductions, credits, and other relevant details for the purpose of calculating their tax liability and ensuring compliance with tax laws. The Kotak form simplifies the tax filing process by providing a structured format to collect necessary information and ensures that taxpayers provide all the required details to the tax authorities.

What information must be reported on kotak form tax?

The specific information that must be reported on the Kotak tax form may vary depending on the jurisdiction and the type of income being reported. In general, some common information that may need to be reported on the form includes:

1. Personal Information: This includes details such as name, address, taxpayer identification number, and contact information.

2. Income Details: The form may require the reporting of various types of income, such as salary, interest, dividends, capital gains, rental income, and any other sources of income.

3. Deductions and Exemptions: Taxpayers may need to provide details about any deductions or exemptions they are claiming, such as mortgage interest, medical expenses, or educational expenses.

4. Tax Credits: If eligible, taxpayers may need to report any tax credits they are claiming, such as foreign tax credits or credits for specific investments or activities.

5. Foreign Assets and Income: If applicable, taxpayers may need to disclose information about any foreign assets or income, such as foreign bank accounts, offshore investments, or foreign rental properties.

6. Filing Status: The form may require taxpayers to specify their filing status, such as single, married filing jointly, married filing separately, or head of household.

7. Tax Payments: Taxpayers may need to report any tax payments made during the tax year, such as tax withheld from their salary, estimated tax payments, or any tax paid in a foreign country.

8. Signature and Date: The form may require the taxpayer's signature and the date of filing.

It is important to consult the specific instructions provided with the Kotak tax form or seek professional advice to ensure accurate reporting of the required information.

How can I edit kotak form tax on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing income tax challan 280 online payment kotak mahindra bank form.

How do I edit form 26qb property payment on an iOS device?

Use the pdfFiller mobile app to create, edit, and share kotak form 26qb from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How can I fill out bank 26qb payment on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your bank 26qb fill form. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your kotak form tax 2016-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 26qb Property Payment is not the form you're looking for?Search for another form here.

Keywords relevant to kotak bank form tax

Related to kotak bank tax request form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.