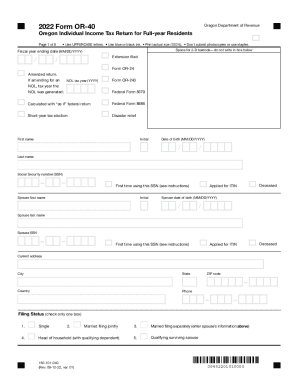

OR DoR OR-40 2017 free printable template

Show details

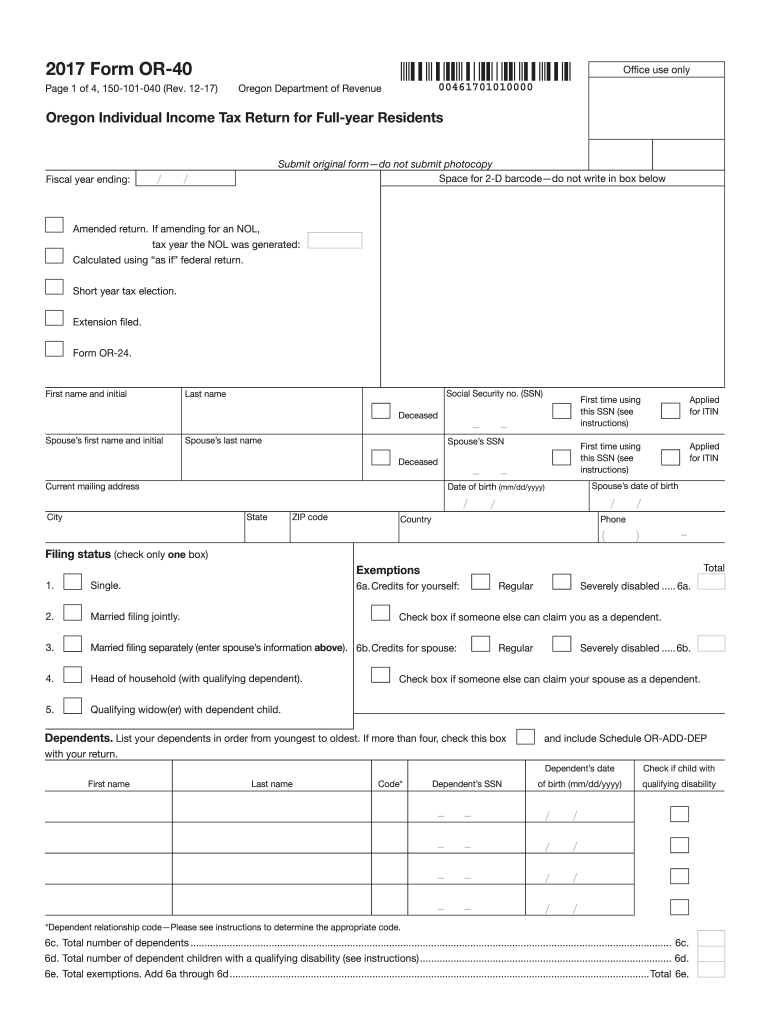

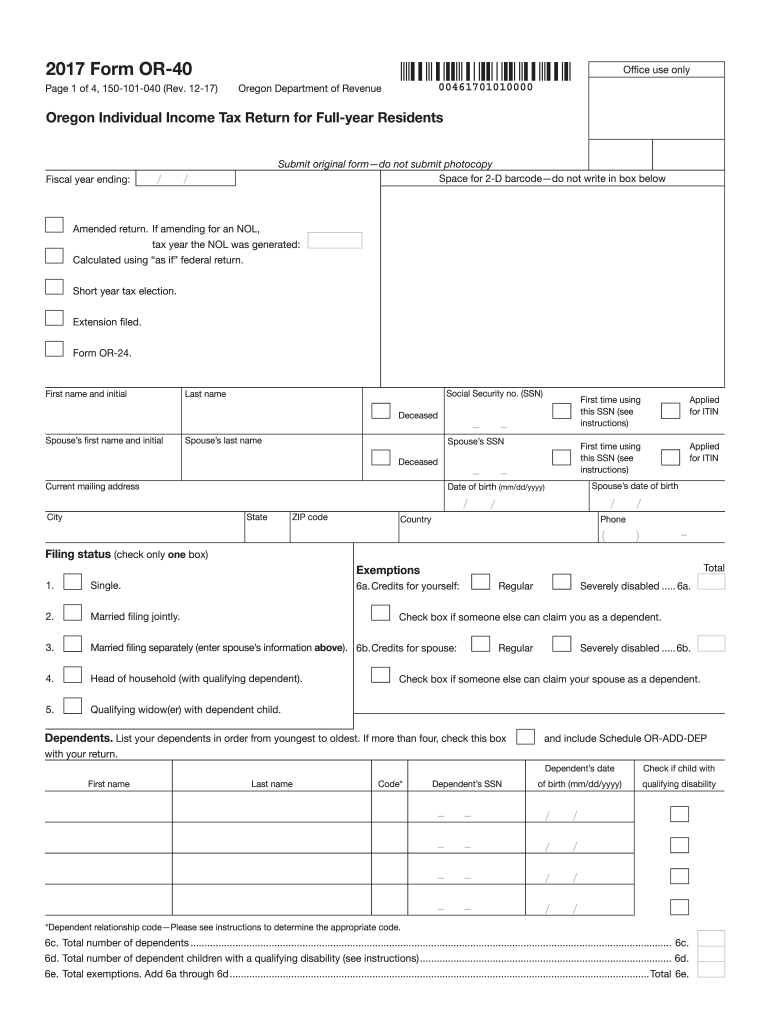

Clear form2017 Form OR40

Page 1 of 4, 150101040 (Rev. 1217)Office use only00461701010000Oregon Department of Revenue Oregon Individual Income Tax Return for Full year ResidentsFiscal year ending:/Submit

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your oregon 40 income tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oregon 40 income tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit oregon 40 income tax form online

Follow the guidelines below to use a professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit oregon 40 tax return form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

OR DoR OR-40 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out oregon 40 income tax

How to fill out Oregon 40 income tax:

01

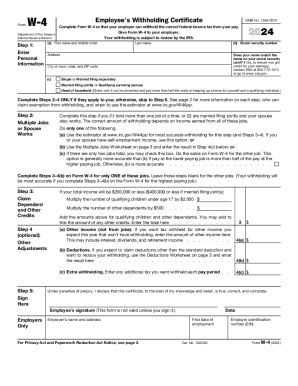

Gather all necessary documents such as W-2s, 1099s, and any other income forms received throughout the year.

02

Determine your filing status (single, married filing jointly, etc.) and gather relevant information such as Social Security numbers for yourself and any dependents.

03

Review the Oregon 40 income tax form instructions to ensure you understand the requirements and any specific instructions for your situation.

04

Begin filling out the form by providing personal information such as your name, address, and taxpayer identification number.

05

Proceed to report your income by entering the appropriate amounts in the designated sections, ensuring accuracy and completeness.

06

Deduct eligible expenses, such as education or business-related expenses, by following the instructions and guidelines provided on the form.

07

Calculate any applicable tax credits or deductions.

08

Complete the payment section if you owe taxes, or the refund section if you are expecting a refund. Include any necessary payment or banking information.

09

Review the completed form for any errors or omissions. Make amendments as needed.

10

Sign and date the form before submitting it to the Oregon Department of Revenue by mail or electronically.

Who needs Oregon 40 income tax?

01

Residents of Oregon who earned income during the tax year exceeding the minimum filing requirements set by the state.

02

Non-residents who earned income from Oregon sources and meet specific criteria outlined by the state.

03

Part-year residents who earned income in Oregon or had income from Oregon sources during the time they were considered an Oregon resident.

04

Individuals who want to claim tax credits or deductions specific to Oregon taxpayers.

05

Business entities or corporations that have an Oregon income tax filing requirement.

Video instructions and help with filling out and completing oregon 40 income tax form

Instructions and Help about or or 40 tax form

Fill oregon 40 tax form printable : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is oregon 40 income tax?

Oregon has a progressive income tax system with four tax brackets. The tax rates for each bracket are as follows:

- 4.75% on the first $3,650 of taxable income

- 6.75% on taxable income between $3,651 and $8,900

- 8.75% on taxable income between $8,901 and $125,000

- 9.9% on taxable income over $125,000

The rate of 9.9% applies to income over $125,000 regardless of filing status (single, married filing jointly, etc.). These rates are for the 2021 tax year and are subject to change in future years.

Who is required to file oregon 40 income tax?

Individuals who are residents of Oregon and have income from various sources, including wages, self-employment, rental income, and other taxable income, are required to file Oregon Form 40. Non-residents of Oregon who have income from Oregon sources exceeding the filing threshold are also required to file Form 40. Additionally, part-year residents who had income earned during the period they were residents of Oregon must also file this form. The specific filing requirements and thresholds may vary, so it is recommended to consult the Oregon Department of Revenue or a tax professional for accurate and up-to-date information.

How to fill out oregon 40 income tax?

To fill out Form Oregon 40 for your state income tax, follow the steps below:

1. Gather your tax documents: Collect all the necessary documents, including your W-2 forms, 1099 forms, and any other income or deduction-related documents.

2. Download the form: Visit the Oregon Department of Revenue website or search online for "Oregon Form 40." Download and print a copy of the form to fill it out manually, or you may fill it out digitally if available.

3. Personal information: Enter your personal information at the top of the form, including your full name, Social Security number, and address.

4. Exemptions: If applicable, declare any exemptions you qualify for by checking the appropriate boxes provided.

5. Filing status: Select your filing status, such as single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

6. Income: Report your income from all sources, which may include wages, self-employment income, rental income, interest, dividends, and others. Enter the relevant amounts in the appropriate sections of the form.

7. Credits and deductions: Consider any available tax credits and deductions, such as education credits, dependent care expenses, retirement contributions, and others. Calculate the amounts and enter them in the corresponding sections.

8. Tax liability: Use the tax tables provided by the Oregon Department of Revenue to determine your taxable income and resulting tax liability. Enter the amount in the designated field on the form.

9. Withholdings and payments: Report any tax withholdings from your paychecks, estimated tax payments, or any other tax credits applied towards your liability.

10. Refund or balance due: If your total tax withholdings and payments exceed your tax liability, you may be eligible for a refund. Conversely, if you owe additional tax, calculate the balance due and include the payment with your completed form.

11. Sign and date: Sign and date your completed Form Oregon 40. If filing jointly, both spouses must sign the form.

12. Retain a copy: Before submitting your tax return, make sure to make a copy for your records.

13. Submitting your return: Mail your completed Form Oregon 40 to the address provided on the form. Alternatively, if e-filing is available, you may electronically submit your return through the Oregon Department of Revenue's website or using approved tax software.

Remember to double-check all the information entered on the form to ensure accuracy and avoid processing delays or penalties. If you have complex tax situations or questions, it is recommended to consult with a tax professional or utilize tax software for further guidance.

What is the purpose of oregon 40 income tax?

The Oregon 40 income tax is imposed by the state of Oregon to fund various governmental programs and services. The purpose of this tax is to generate revenue that is used to finance public infrastructure, education, healthcare, public safety, transportation, environmental protection, and other essential functions of the state government. The funds collected through the Oregon 40 income tax are allocated towards improving the quality of life for residents and supporting the overall development of the state.

What information must be reported on oregon 40 income tax?

When filing an Oregon Form 40 income tax return, you must report the following information:

1. Personal Information: Include your name, Social Security number, mailing address, and filing status (single, married filing jointly, etc.).

2. Oregon Wages: Report your total wages earned in Oregon during the tax year.

3. Federal Income Tax: Report the amount of federal income tax you paid during the tax year.

4. Oregon Adjustments: Enter any additional income adjustments that are specific to Oregon, such as Oregon-specific deductions or exemptions.

5. Tax Credits: Report any tax credits you are eligible for, such as the Oregon Earned Income Credit or the Residential Energy Credit.

6. Other Income: Include any additional income sources not already reported, such as rental income or self-employment earnings.

7. Oregon Withholding: Report any Oregon state income tax that was withheld from your wages or other income.

8. Oregon Estimated Tax: If applicable, report any estimated tax payments you made throughout the tax year.

9. Oregon Use Tax: If you made any out-of-state purchases or acquired any property subject to Oregon use tax, report the amount.

10. Total Tax Liability: Calculate your total Oregon income tax liability based on the information provided.

11. Payment or Refund: If you owe additional tax, include payment with your return. If you overpaid throughout the year, you may be eligible for a refund.

Note: This list does not cover every possible detail that must be reported on an Oregon 40 income tax return. It is important to review the instructions and any applicable tax guidelines provided by the Oregon Department of Revenue when preparing your return.

When is the deadline to file oregon 40 income tax in 2023?

The specific deadline for filing Oregon Form 40 for income tax in 2023 has not been released yet, as tax filing deadlines are typically announced closer to the tax year-end. In most cases, the deadline for filing individual income tax returns falls on April 15th each year. However, it's always recommended to verify the exact deadline for a specific tax year with the Oregon Department of Revenue or consult a tax professional for the most accurate information.

What is the penalty for the late filing of oregon 40 income tax?

According to the Oregon Department of Revenue, if you file your Oregon Form 40 income tax return late, you may be subject to a penalty. The penalty for late filing in Oregon is generally 5% of the tax due for each month or part of a month the return is late, up to a maximum penalty of 25% of the tax due. If there is no tax due, the late filing penalty is typically $25 per month, up to a maximum of $150. However, if you have a reasonable cause for filing late, you may be able to request a waiver of the penalty. It is always recommended to file your return on time to avoid penalties and interest.

How do I make edits in oregon 40 income tax form without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing oregon 40 tax return form and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I edit 2019 oregon form 40 instructions straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing or or tax form.

How do I fill out oregon return on an Android device?

Use the pdfFiller mobile app and complete your oregon tax form 40 2019 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

Fill out your oregon 40 income tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2019 Oregon Form 40 Instructions is not the form you're looking for?Search for another form here.

Keywords relevant to 2019 form or 40

Related to or or 40 form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.