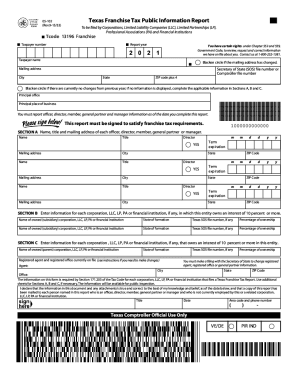

Who needs a 05-102 form?

This form is used by corporations, LCS, limited partnerships, professional associations, financial institutions and other business entities registered in Texas that are subject to franchise tax. The entities mentioned above must file the form to satisfy their tax obligations.

What is the 05-102 form for?

This form serves as a Texas Franchise Tax Public Information Report. The report is forwarded to the Secretary of State. The information provided is available on the Comptroller’s Franchise Account Status website so that anybody can see the required data of the business entity.

What documents must accompany the 05-102 form?

The report is accompanied by a franchise tax report and other tax forms if required.

When is the 05-102 form due?

This form is due on the date the franchise tax report is due. It won’t take long to fill out the report.

What information should be provided in the 05-102 form?

The report is completed by an officer, director or other authorized person of the business entity.

While completing the form, the filler must provide the following information:

- Taxpayer number

- Report year

- Taxpayer name, mailing address

- Principal office of the business entity

- Principal place of business

- Name, title and mailing address of each officer, director, member, general partner or manager (with the expiration date)

- Name of owned (subsidiary) corporation or financial institution in which the business entity owns an interest of 10% or more (including the state of formation, Texas SOS file number,

- Name of each corporation, LLC, LP, etc. that owns an interest of 10 % or more in your business entity (including state of formation, Texas SOS file number, percentage of ownership)

The filler also has to sign, date the report and type the phone number.

What do I do with the form after its completion?

The completed and signed form is forwarded to the Secretary of the State.