Get the free cash donation receipt

Show details

Cash Donation Receipt Date Description Amount $ Bolton Donation Donor Name & Address Bowler NOAH is a 501 (c) 3 nonprofit organization registered with the IRS. Cash Donation Receipt Date Description

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your cash donation receipt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cash donation receipt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

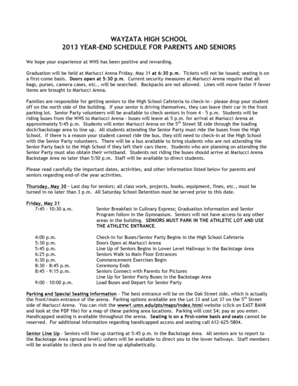

How to edit cash donation receipt online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit cash donation receipt. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

How to fill out cash donation receipt

How to fill out a cash donation receipt:

01

Start by including the date of the donation at the top of the receipt. This helps both the donor and the recipient keep track of when the donation was made.

02

Provide the donor's full name and contact information, including their address and phone number. This information is important for record-keeping purposes.

03

Specify the amount of the cash donation. Make sure to write the amount clearly and legibly so there is no confusion later on.

04

Include a clear and concise description of the purpose or cause for which the donation is being made. This helps ensure that the donation is allocated appropriately.

05

State whether the donation is being made with any conditions or restrictions. This ensures that the recipient is aware of any specific requirements the donor may have.

06

If applicable, include any additional information or documentation required by the donor or recipient organization. This may include tax identification numbers or specific instructions for tax purposes.

07

Sign and date the receipt. Both the donor and the recipient should sign the receipt as a confirmation of the donation.

Who needs a cash donation receipt?

01

Non-profit organizations: In order to comply with legal and accounting requirements, non-profit organizations often need to provide a receipt to donors for cash donations.

02

Donors for tax purposes: Cash donation receipts are often necessary for donors who want to claim tax deductions on their charitable contributions. These receipts serve as proof of the donation made.

03

Financial auditors: Donation receipts can be requested by auditors during financial reviews of both non-profit organizations and individual donors. These receipts help verify the accuracy and legitimacy of the recorded donations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is cash donation receipt?

Cash donation receipt is a document given to a donor by a charitable organization to acknowledge a cash donation made.

Who is required to file cash donation receipt?

Charitable organizations receiving cash donations are required to file cash donation receipts for tax purposes.

How to fill out cash donation receipt?

Cash donation receipts should include the donor's full name, amount donated, date of donation, and the charitable organization's information.

What is the purpose of cash donation receipt?

The purpose of a cash donation receipt is to provide proof of donation for tax deduction purposes.

What information must be reported on cash donation receipt?

Cash donation receipts must include the donor's information, donation amount, date of donation, and the charitable organization's information.

When is the deadline to file cash donation receipt in 2023?

The deadline to file cash donation receipts in 2023 is typically April 15th, unless extended by the IRS.

What is the penalty for the late filing of cash donation receipt?

The penalty for late filing of cash donation receipts can vary, but may include fines or loss of tax-exempt status for the charitable organization.

Can I create an electronic signature for the cash donation receipt in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your cash donation receipt in seconds.

How do I fill out cash donation receipt using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign cash donation receipt and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I complete cash donation receipt on an Android device?

On an Android device, use the pdfFiller mobile app to finish your cash donation receipt. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your cash donation receipt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.