TX TAD 50-771 (formerly TARB 6600 & 6106) 2012 free printable template

Show details

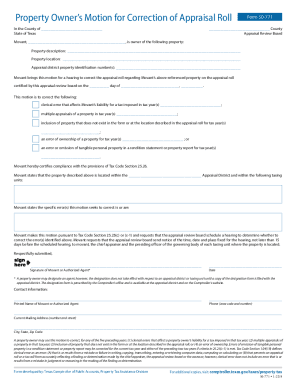

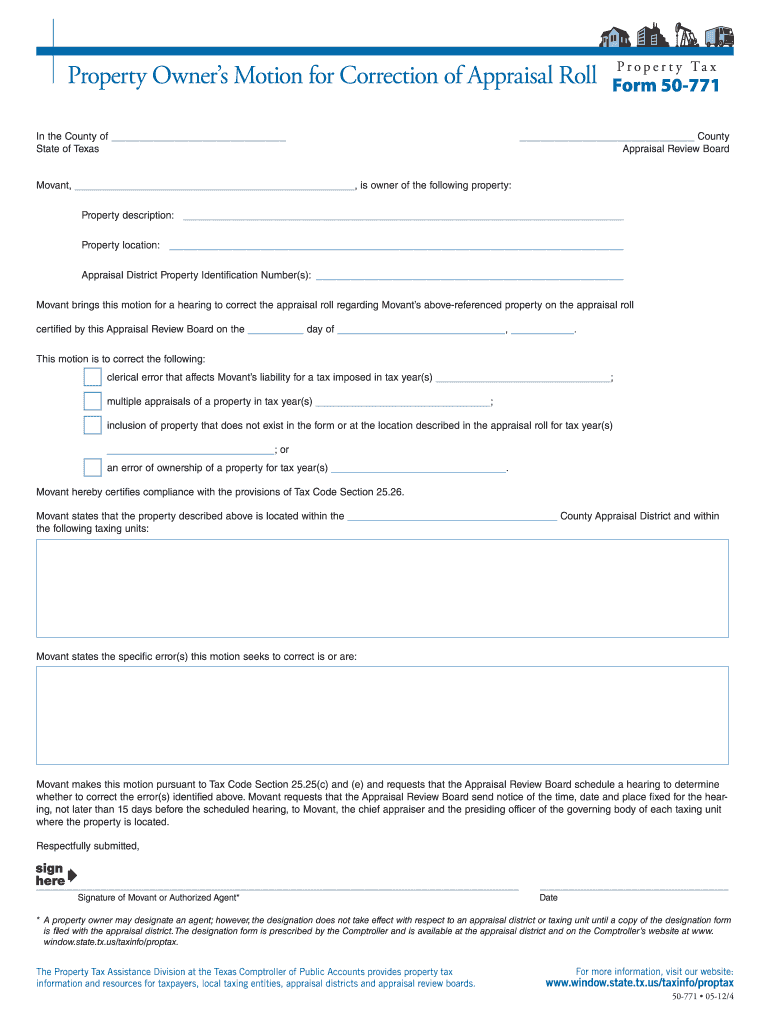

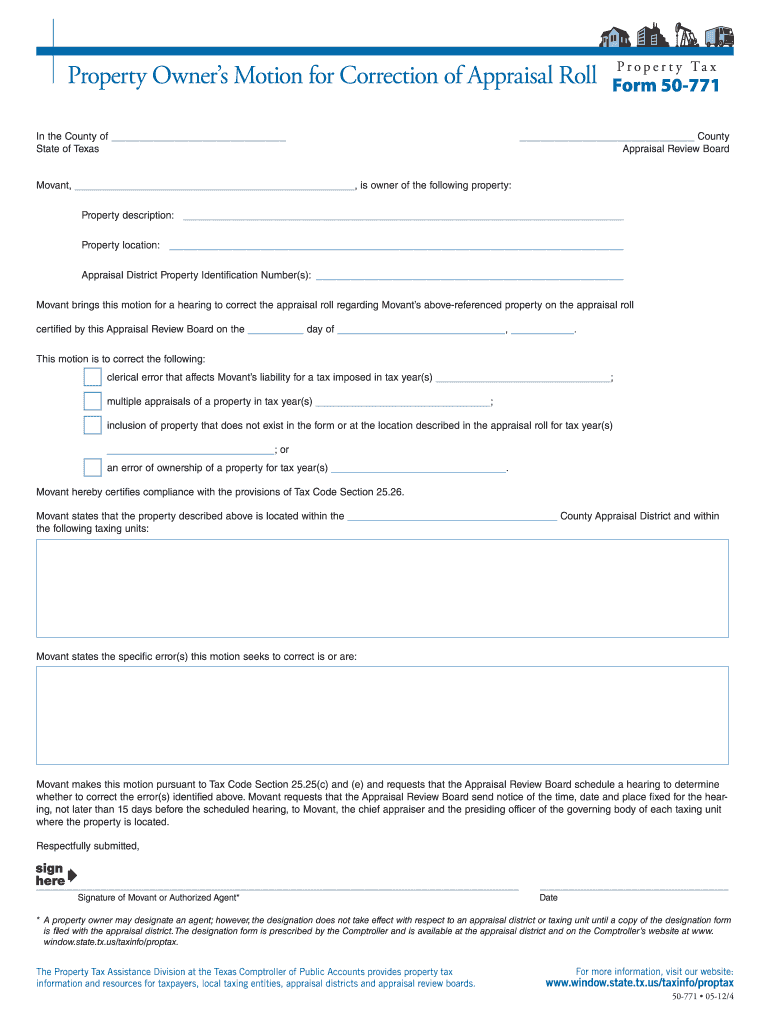

Property Owner s Motion for Correction of Appraisal Roll In the County of State of Texas Movant P r o p e r t y Ta x Form 50-771 Appraisal Review Board Property description Property location Appraisal District Property Identification Number s Movant brings this motion for a hearing to correct the appraisal roll regarding Movant s above-referenced property on the appraisal roll certified by this Appraisal Review Board on the day of. This motion is to correct the following clerical error that...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your property tax form 50 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property tax form 50 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing property tax form 50 online

To use the professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit property tax form 50. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

TX TAD 50-771 (formerly TARB 6600 & 6106) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out property tax form 50

How to fill out property tax form 50:

01

Start by gathering all the necessary documents such as your property address, ownership details, and any supporting documents required by your local tax authority.

02

Carefully read the instructions provided with the property tax form 50 to ensure you understand all the requirements and information needed.

03

Begin filling out the form by entering your personal information, including your name, address, and contact details. Make sure to double-check the accuracy of this information.

04

Provide the details of your property, including its address, legal description, and any additional information requested, such as the property's use or classification.

05

Report your ownership details, including the names and contact information of all property owners. If there are multiple owners, indicate their respective ownership percentages.

06

Proceed to the next section of the form, which may require you to declare any changes in ownership during the tax year or any transfers of property.

07

If applicable, provide any relevant financial information required by the form, such as the property's market value, assessed value, or any exemptions or deductions you may be eligible for.

08

Review all the information entered on the form to ensure its accuracy and completeness. Double-check for any errors or omissions before submitting.

09

Sign and date the form as required, acknowledging that the information provided is true and accurate to the best of your knowledge.

10

Finally, submit the completed property tax form 50 to your local tax authority by the specified deadline.

Who needs property tax form 50:

01

Property owners: Anyone who owns a property, whether it is residential, commercial, or vacant land, may need to fill out property tax form 50. This form allows you to report important details about your property and fulfill your obligations regarding property taxes.

02

Local tax authorities: Property tax form 50 is typically required by local tax authorities to assess and collect property taxes accurately. These forms help authorities maintain records, determine property valuations, and calculate the appropriate tax amount owed by property owners.

03

Property managers or agents: In some cases, property managers or agents may be responsible for completing property tax forms on behalf of property owners. This can occur if the property owner has delegated these tasks to a professional or if the property is part of a larger real estate portfolio managed by a company or individual.

Fill form : Try Risk Free

People Also Ask about property tax form 50

How to protest property taxes and win Texas?

How do you win a property tax protest in Texas?

Is it worth protesting property taxes in Texas?

How much does Texas tax protest cost?

Should I protest my property taxes in Texas?

What evidence do I need to protest property taxes in Texas?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is property tax form 50?

Property tax form 50 is a document used to report information about the value of a property and calculate property taxes.

Who is required to file property tax form 50?

Property owners are required to file property tax form 50.

How to fill out property tax form 50?

Property tax form 50 can be filled out by providing information about the property's value, location, and ownership details.

What is the purpose of property tax form 50?

The purpose of property tax form 50 is to assess the property's value for tax calculation purposes.

What information must be reported on property tax form 50?

Information such as property value, location, ownership details, and any improvements made to the property must be reported on property tax form 50.

When is the deadline to file property tax form 50 in 2023?

The deadline to file property tax form 50 in 2023 is typically on or before April 15th.

What is the penalty for the late filing of property tax form 50?

The penalty for the late filing of property tax form 50 can vary but may result in additional fees or interest charges.

How can I modify property tax form 50 without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your property tax form 50 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I make changes in property tax form 50?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your property tax form 50 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out property tax form 50 using my mobile device?

Use the pdfFiller mobile app to fill out and sign property tax form 50 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Fill out your property tax form 50 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.