Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

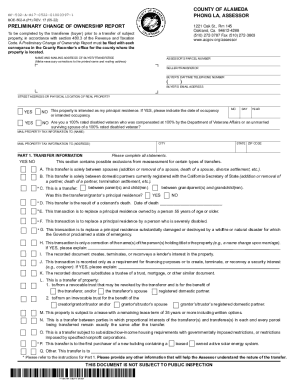

BOE 502-A refers to Form BOE-502-A, which is a document used in the state of California for filing a claim for reassessment exclusion for transfer between parents and children. This form is used to claim an exclusion from property tax reassessment when real property is transferred from a parent to their child. It helps to prevent a sudden increase in property taxes for the child who inherits the property.

Who is required to file boe 502 a?

The BOE 502-A form, also known as the California Out-of-State Use Tax Return, is typically filed by individuals or businesses in California who have made purchases from out-of-state retailers that did not charge them California sales tax. This form is used to report and pay the use tax owed on those purchases.

How to fill out boe 502 a?

To fill out Form BOE 502-A, follow these steps:

1. Obtain the form: You can download Form BOE 502-A from the official website of the California Department of Tax and Fee Administration (CDTFA) or obtain a copy from the nearest CDTFA office.

2. Provide your business information: Fill in your business name, address, and telephone number in the designated section at the top of the form.

3. Fill in seller's permit information: If you have a seller's permit, provide your permit number and effective date. If you do not have a seller's permit, leave this section blank.

4. Reporting period: Determine the reporting period for sales and use tax collection. In the "Reporting Period" area, write the month, day, and year of the period you are reporting.

5. Total gross receipts: Enter the total gross receipts for the reporting period in the corresponding fields provided.

6. Tax computation: Use the tax rate chart provided by the CDTFA to calculate the sales tax amount owed based on the total gross receipts. Write the calculated amount in the designated field.

7. Other deductions: If you have any allowable deductions, such as returns and allowances, write the total amount in the corresponding field provided.

8. Calculate the total tax due: Subtract the deductions (if any) from the tax amount calculated in step 6. Write the resulting amount in the designated field.

9. Late payment penalty: If the payment is late, calculate the penalty based on the instructions provided on the form. Write the amount of the late payment penalty in the corresponding field.

10. Calculate the total amount due: Add the total tax due from step 8 and the late payment penalty from step 9. Write the final amount owed in the designated field.

11. Payment information: Provide your name, telephone number, and email address in the payment information section.

12. Sign and date the form: Sign and date the form to certify that the information provided is accurate and complete.

13. Submit the form: Mail the completed Form BOE 502-A along with your payment or electronic funds transfer (if applicable) to the address mentioned on the form or submit it electronically, if applicable.

14. Retain a copy: Make a copy of the completed form for your records.

Note: It is recommended to consult the Instructions for Form BOE 502-A provided by the CDTFA to ensure accurate completion of the form, as there may be specific details or exceptions based on your business situation.

What is the purpose of boe 502 a?

BOE-502-A is a form used by individuals and businesses in California to report and remit their sales and use taxes to the California Department of Tax and Fee Administration (CDTFA). The purpose of this form is to record the sales made and the corresponding taxes collected and to calculate the amount owed to the CDTFA. This form helps taxpayers comply with their tax obligations and provide accurate information for tax administration purposes.

What information must be reported on boe 502 a?

BOE 502-A is a form used in California for reporting local district taxes owed to the Board of Equalization. The information that must be reported on BOE 502-A includes:

1. Business information: Name, address, and contact details of the business.

2. Reporting period: The month or quarter for which the taxes are being reported.

3. Tax identification number: The business's California sales and use tax account number.

4. Gross receipts: The total sales or gross receipts from retail sales made during the reporting period.

5. Non-taxable sales: The amount of non-taxable sales made during the reporting period.

6. Taxable sales: The amount of taxable sales made during the reporting period.

7. Tax rate(s): The applicable tax rate(s) for the reporting period. This may vary depending on the location and type of goods or services sold.

8. Sales tax due: The calculated amount of sales tax due based on the taxable sales and applicable tax rates.

9. Credits and adjustments: Any credits or adjustments to be applied against the sales tax due, such as refunds or returned items.

10. Penalty and interest: Any penalty or interest charges incurred, if applicable.

11. Total due: The total amount of sales tax, including penalty and interest, if applicable.

It is important to note that the specific requirements and detailed instructions for completing BOE 502-A can vary, so it is advisable to consult the official form and any provided guidelines or instructions for accurate reporting.

What is the penalty for the late filing of boe 502 a?

The penalty for late filing of BOE (Board of Equalization) 502 A can vary depending on the jurisdiction and specific circumstances. It is recommended to consult the official guidelines of the taxation authority in your area to determine the exact penalty. However, common penalties for late filing of tax forms may include monetary fines, interest on unpaid taxes, and other potential consequences such as late payment penalties or potential audits.

How do I execute boe 502 a online?

pdfFiller has made it easy to fill out and sign boe 502 form. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit form preliminary change ownership report in Chrome?

alameda county form can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How can I edit alameda county pcor on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing a boe 502 form right away.