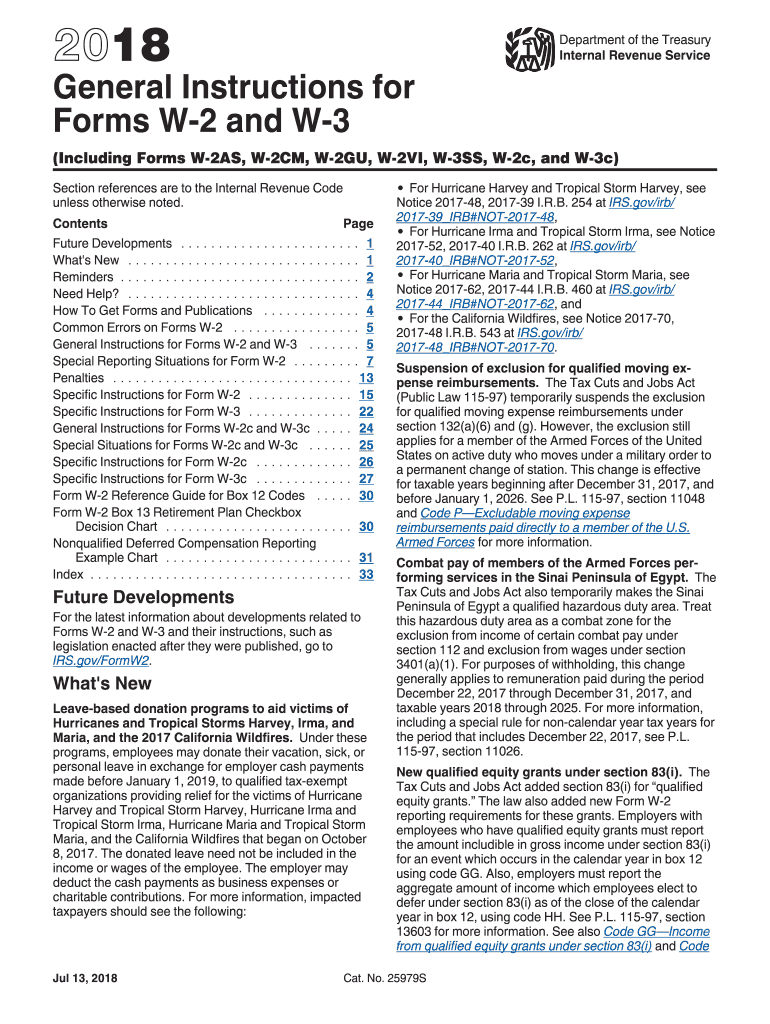

IRS Instruction W-2 & W-3 2018 free printable template

Show details

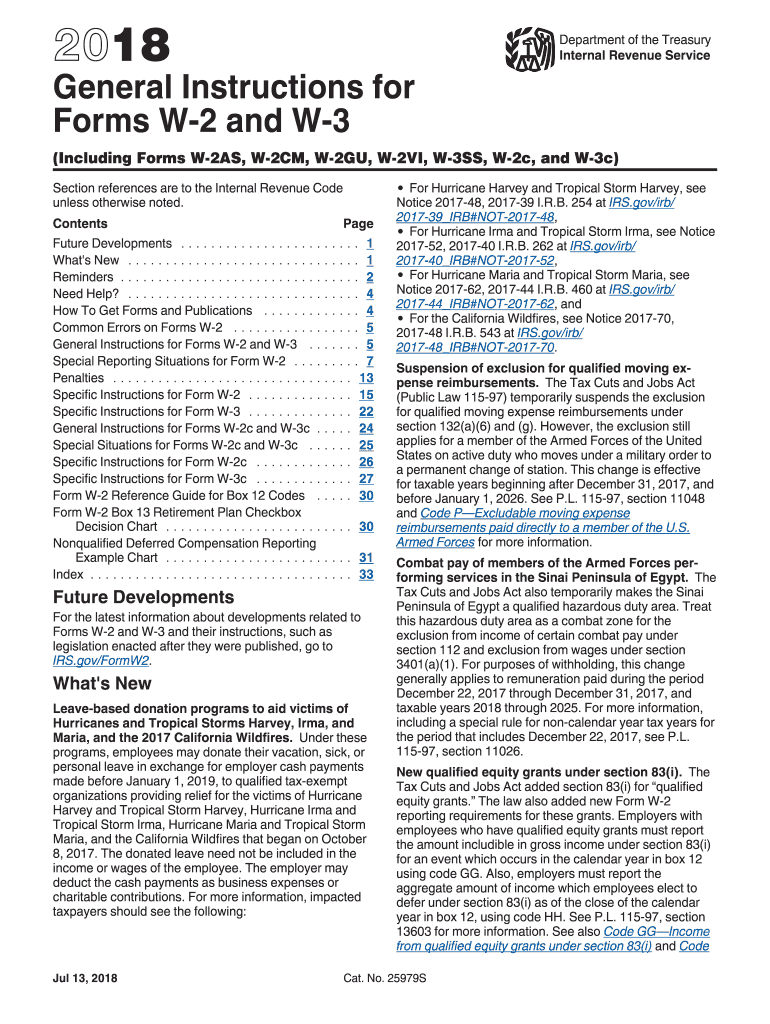

See the Form W-2 Reference Guide for Box 12 Codes. The detailed instructions for each code are next. CAUTION and a link to the BSO website visit the SSA s Employer W-2 Filing Instructions Information website at SSA. Penalties. Specific Instructions for Form W-2. Special Situations for Forms W-2c and W-3c. Form W-2 Reference Guide for Box 12 Codes. A of Form W-2. On Form W-3 check the Hshld. emp. checkbox in box b. For more information see Schedule H Form 1040 Household Employment Taxes and...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Instruction W-2 W-3

Edit your IRS Instruction W-2 W-3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Instruction W-2 W-3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS Instruction W-2 W-3 online

Follow the steps below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS Instruction W-2 W-3. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Instruction W-2 & W-3 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Instruction W-2 W-3

How to fill out IRS Instruction W-2 & W-3

01

Obtain the IRS W-2 and W-3 forms from the IRS website or your payroll software.

02

Fill out the W-2 form for each employee, including their Social Security number, total earnings, and withheld taxes.

03

Ensure to provide accurate information on the employer's details, including name, address, and Employer Identification Number (EIN).

04

Complete the appropriate boxes for state and local wages and taxes if applicable.

05

Review the filled W-2 forms for accuracy and sign the W-3 transmittal form.

06

Submit copies of W-2 forms to the Social Security Administration (SSA) along with the W-3 form before the deadline.

Who needs IRS Instruction W-2 & W-3?

01

Employers who pay wages to employees must fill out W-2 forms.

02

Employees receive W-2 forms to report their income on their tax returns.

03

Tax professionals may need these forms to assist clients in preparing their taxes.

04

Accountants and bookkeepers handling payroll for businesses also need them.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a W2c form?

To order official IRS forms, call 1-800-TAX-FORM (1-800-829-3676) or Order Information Returns and Employer Returns Online, and we'll mail you the scannable forms and other products. You may file Forms W-2 and W-3 electronically on the SSA's website at Employer Reporting Instructions & Information.

Can I file a W2c online?

This service offers fast, free, and secure online W-2 filing options to CPAs, accountants, enrolled agents, and individuals who process W-2s (the Wage and Tax Statement) and W-2Cs (Statement of Corrected Income and Tax Amounts).

What is a w3c tax form?

About Form W-3 C, Transmittal of Corrected Wage and Tax Statements | Internal Revenue Service.

How to print W2C?

Printing the W2C After reviewing or making the corrections, click Submit Form to continue printing. Click Print/E-file. Under the Select paper section, select between Blank / Perforated Paper and Preprinted Forms: May require alignment. Choose who you're printing for under the Select item to print section.

How do I submit my w2c to the IRS?

To submit Forms W-2c on magnetic media or electronically, contact the Social Security Magnetic Media Coordinator for your state. Call 1-800-772-6270 for your coordinator's phone number. Employers in the U.S. Virgin Islands may call 787-766-5574. Employers in American Samoa and Guam may call 510-970-8247.

How do you handle W2C?

Form W-2c: Corrected Wage and Tax Statement is a corrected version of your W-2. If you already imported or entered your W-2 and you haven't yet filed, go back and edit your W-2 with the corrected info from your W-2c. And if you already mailed your return, or it was accepted, you may need to amend.

How to order W-2c and W 3c forms?

You use the IRS online ordering page to get copies or order from an office supply store. Make sure you are ordering the correct form for the tax year. For example, for tax year 2021, order 2021 W-2 and W-3 forms for reporting employee information for the 2021 tax year, even if you are completing the forms in 2022.

Where can I get 2017 W-2 forms?

In the event you lose your Form W–2, or require a duplicate copy you can download a copy from Cal Employee Connect under the "W-2" tab. You also can request one from the State Controller's Office. To do so you must obtain a Standard Form 436: Request for Duplicate Wage and Tax Statement: As a fill and print PDF form.

How do I submit a corrected w3?

File the W-2c and W-3c with the Social Security Administration promptly after discovering the error. If filing by mail, send the W-2c and W-3c to the SSA address stated in the IRS “Instructions for Forms W-2c and W-3c” publication. If filing electronically, submit the forms via the SSA Business Services Online.

How do I fill out a W-2c?

0:00 1:56 How to Correct a W-2 Form | IRS Form W-2c Instructions - YouTube YouTube Start of suggested clip End of suggested clip This page collects information about what needs to be corrected. And reported to the irs verifyMoreThis page collects information about what needs to be corrected. And reported to the irs verify employer and employee details and begin making the necessary. Corrections.

How do I submit my W2c to the IRS?

To submit Forms W-2c on magnetic media or electronically, contact the Social Security Magnetic Media Coordinator for your state. Call 1-800-772-6270 for your coordinator's phone number. Employers in the U.S. Virgin Islands may call 787-766-5574. Employers in American Samoa and Guam may call 510-970-8247.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS Instruction W-2 W-3 to be eSigned by others?

IRS Instruction W-2 W-3 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit IRS Instruction W-2 W-3 straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing IRS Instruction W-2 W-3, you need to install and log in to the app.

How do I fill out IRS Instruction W-2 W-3 using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign IRS Instruction W-2 W-3 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is IRS Instruction W-2 & W-3?

IRS Instruction W-2 & W-3 are forms used by employers to report wages and taxes withheld from employees to the Internal Revenue Service (IRS). Form W-2 is used to report the annual wages paid to employees and the taxes withheld, while Form W-3 serves as a summary of the information contained in all W-2 forms issued by an employer.

Who is required to file IRS Instruction W-2 & W-3?

Employers are required to file IRS Instruction W-2 & W-3 if they pay wages to employees. This includes businesses, non-profits, and government entities that compensate staff members and must report annual earnings and withholdings to the IRS.

How to fill out IRS Instruction W-2 & W-3?

To fill out IRS Instruction W-2, employers need to provide information such as the employee's wages, federal income tax withheld, Social Security wages, and other necessary withholdings in the appropriate boxes. For W-3, employers summarize the total amounts reported on all W-2 forms, including total wages, total taxes withheld, and the number of W-2 forms submitted.

What is the purpose of IRS Instruction W-2 & W-3?

The purpose of IRS Instruction W-2 & W-3 is to ensure accurate reporting of employee compensation and tax withholdings to the IRS. These forms help the IRS track tax obligations and ensure compliance with tax laws for both employers and employees.

What information must be reported on IRS Instruction W-2 & W-3?

On Form W-2, employers must report the employee's name, Social Security number, wages, tips, other compensation, and the federal and state taxes withheld. Form W-3 requires a summary of total wages, total Social Security wages, total Medicare wages, and total taxes withheld for all W-2 forms submitted by the employer.

Fill out your IRS Instruction W-2 W-3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Instruction W-2 W-3 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.