Who needs Form 8965?

Form 8965 is the Health Coverage Exemptions Form that is filed by everyone who hasn’t had health insurance during the year. In other words, these are taxpayers who weren’t covered by a qualified insurance plan. If a person gets their coverage through an employer, they don’t need to file the form. Instead, the individual must buy insurance through an insurance marketplace or make use of private insurance.

What is Form 8965 for?

Form 8965 aims to get exemptions to avoid the penalty for not having health insurance coverage during the year. If an individual doesn’t have coverage, he or she isn’t entitled to exemptions. In this case, there is no need to submit Form 8965. The worksheet of the form is used to calculate the amount of the penalty.

Is Form 8965 accompanied by other forms?

Form 8965 is filed together with the tax return unless an individual is already approved for exemption through the health insurance marketplace. If the person doesn’t file a tax return because of low annual income, they don’t have to file Form 8965 either.

When is Form 8965 due?

The due date for the form is the same as the due date for the tax return. In 2017 the deadline for submitting income tax returns is April 17th.

How do I fill out Form 8965?

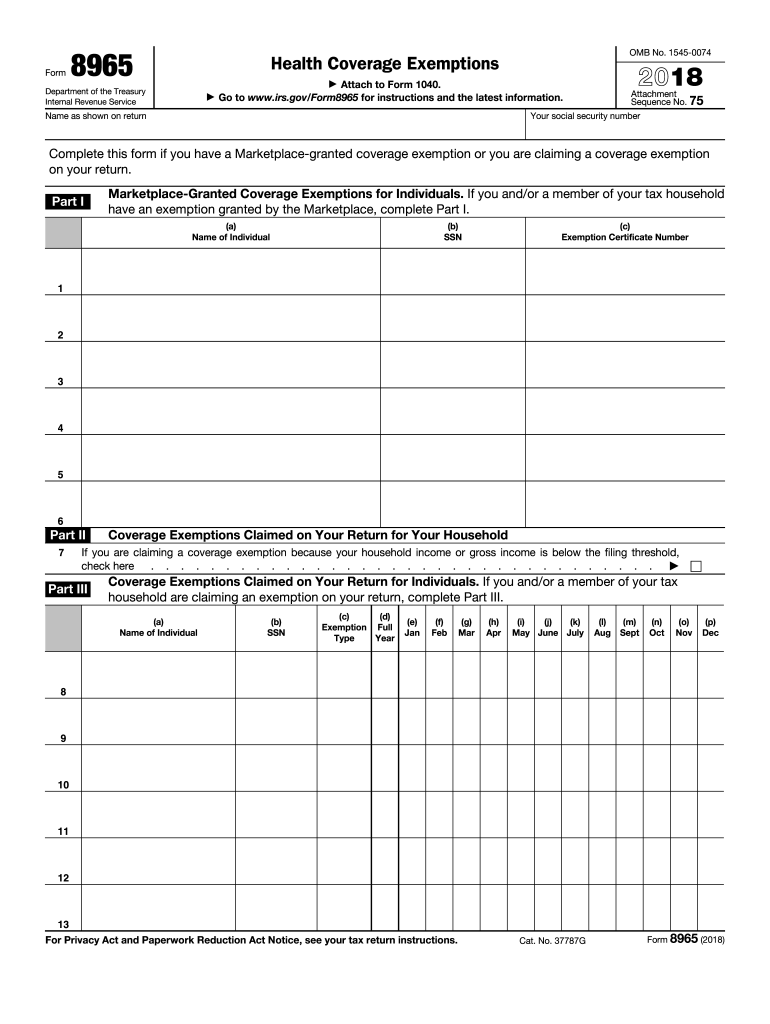

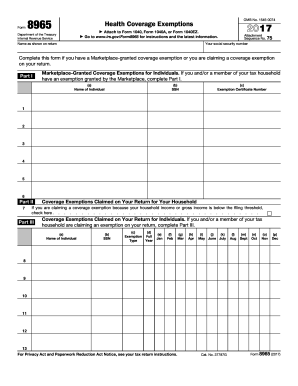

For the most part Form 8965 is easy to complete. It is only one-page long and comprises three parts:

- Part 1 is designed for individuals with marketplace granted coverage exemptions. In this part one must provide their name, SSN and exemption certificate number.

- Part 2 is created for individual household returns. It must be completed if the household income is lower than the required threshold.

- Part 3 is for covered exemptions claimed on a return for other individuals. It requires the name of the individual, SSN and type of the exemption.

Where do I send Form 8965?

Form is attached to the 1040, 1040A, 1040EZ and submitted to the IRS.